Region:North America

Author(s):Rebecca

Product Code:KRAC3250

Pages:100

Published On:October 2025

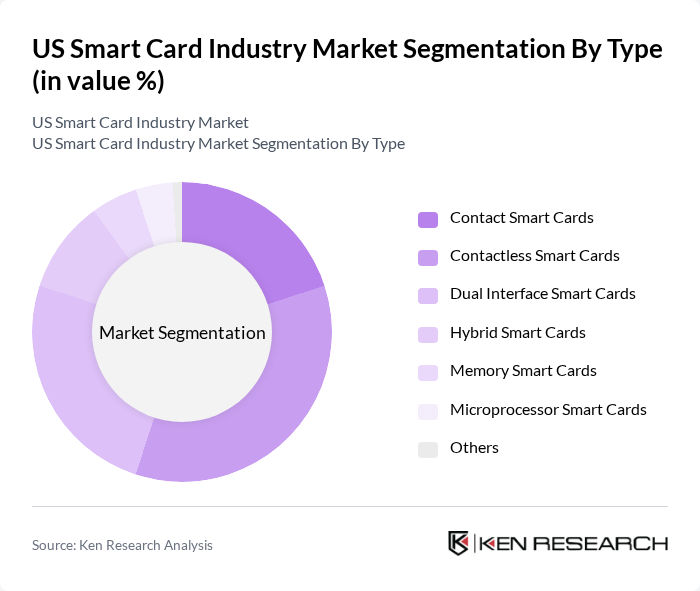

By Type:The segmentation by type includes various forms of smart cards tailored to specific functionalities and user needs. The primary subsegments are Contact Smart Cards, Contactless Smart Cards, Dual Interface Smart Cards, Hybrid Smart Cards, Memory Smart Cards, Microprocessor Smart Cards, and Others. Contactless and dual interface smart cards are increasingly preferred for secure payments and transit applications, while microprocessor smart cards dominate in banking and government ID due to advanced security features .

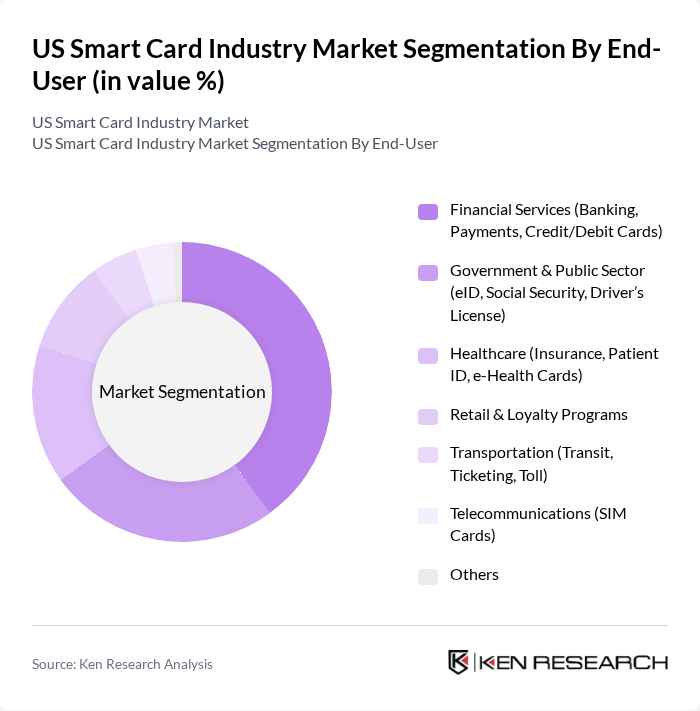

By End-User:The end-user segmentation reflects the diverse sectors utilizing smart card technology, including Financial Services, Government & Public Sector, Healthcare, Retail & Loyalty Programs, Transportation, Telecommunications, and Others. Financial services remain the largest segment, driven by widespread adoption of EMV cards and secure payment solutions. Government and healthcare sectors increasingly deploy smart cards for secure identification, patient management, and digital access control .

The US Smart Card Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thales DIS (formerly Gemalto N.V.), HID Global Corporation, NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., Giesecke+Devrient GmbH, CPI Card Group Inc., Identiv, Inc., CardLogix Corporation, Valid USA, Inc., Watchdata Technologies Ltd., Eastcompeace Technology Co., Ltd., IDEMIA, Entrust Corporation, XTec Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US smart card industry appears promising, driven by technological advancements and evolving consumer preferences. As mobile wallets gain traction, the integration of smart cards with mobile payment systems is expected to enhance user experience. Additionally, the increasing focus on biometric authentication will likely lead to the development of more secure smart card solutions. These trends indicate a shift towards more innovative and user-friendly payment methods, positioning the industry for sustained growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Contact Smart Cards Contactless Smart Cards Dual Interface Smart Cards Hybrid Smart Cards Memory Smart Cards Microprocessor Smart Cards Others |

| By End-User | Financial Services (Banking, Payments, Credit/Debit Cards) Government & Public Sector (eID, Social Security, Driver’s License) Healthcare (Insurance, Patient ID, e-Health Cards) Retail & Loyalty Programs Transportation (Transit, Ticketing, Toll) Telecommunications (SIM Cards) Others |

| By Application | Payment Processing Identity Verification & Authentication Access Control (Physical & Logical) Loyalty & Gift Programs Ticketing & Transit Healthcare Records Management Others |

| By Distribution Channel | Direct Sales Online Retail Distributors System Integrators Resellers Others |

| By Region | Northeast Midwest South West Others |

| By Price Range | Low-End Mid-Range High-End Others |

| By Security Features | Basic Security (PIN, Password) Advanced Encryption (AES, RSA, ECC) Biometric Security (Fingerprint, Face, Iris) Multi-Factor Authentication Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Smart Card Usage | 100 | Banking Executives, IT Security Managers |

| Healthcare Smart Card Applications | 80 | Healthcare Administrators, IT Directors |

| Transportation Smart Card Systems | 60 | Transport Authority Officials, Operations Managers |

| Government ID Smart Card Programs | 50 | Policy Makers, Program Managers |

| Retail Payment Solutions | 60 | Retail Managers, Payment System Analysts |

The US Smart Card Industry Market is valued at approximately USD 3.4 billion, reflecting a significant growth driven by the demand for secure payment solutions and the rise in contactless transactions across various sectors, including healthcare and financial services.