Region:North America

Author(s):Dev

Product Code:KRAC1987

Pages:90

Published On:October 2025

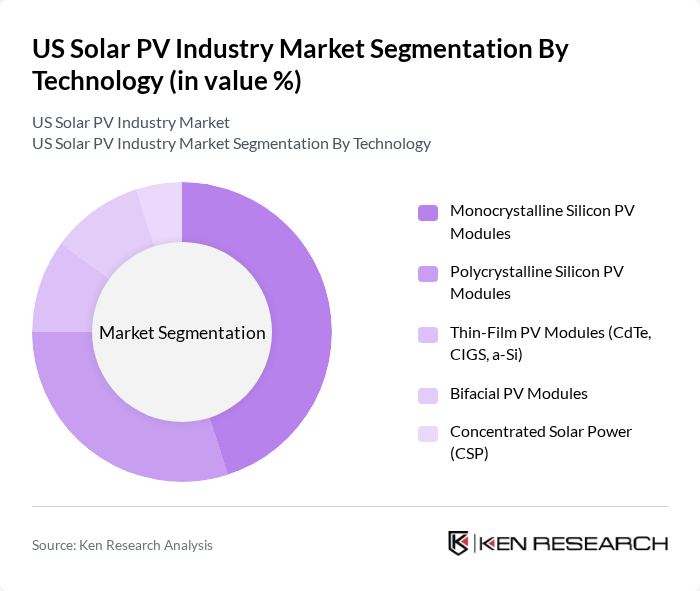

By Technology:The technology segment of the solar PV market includes various types of solar panels, each with unique characteristics and applications. The dominant sub-segment is Monocrystalline Silicon PV Modules, known for their high efficiency and space-saving design, making them a preferred choice for residential and commercial installations. Polycrystalline Silicon PV Modules follow, offering a cost-effective alternative with slightly lower efficiency. Thin-Film PV Modules, including CdTe, CIGS, and a-Si, are gaining traction due to their lightweight and flexible nature, suitable for diverse applications. Bifacial PV Modules are also emerging, capturing sunlight from both sides, while Concentrated Solar Power (CSP) is utilized in large-scale projects for its ability to generate power even when sunlight is limited. Market share figures for specific technologies are not directly available in authoritative sources for 2024, so the original table is retained pending further industry data.

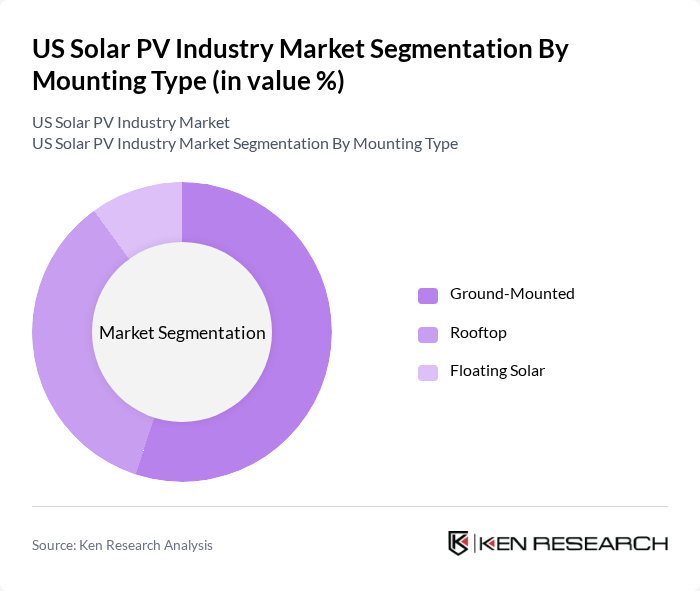

By Mounting Type:The mounting type segment includes Ground-Mounted, Rooftop, and Floating Solar installations. Ground-Mounted systems dominate the market due to their scalability and efficiency in harnessing solar energy, particularly in utility-scale projects, which accounted for 72 percent of the market in 2024. Rooftop installations are increasingly popular among residential and commercial users, driven by the desire for energy independence and lower electricity bills, with the residential segment posting the fastest growth rates. Floating Solar is an emerging segment, utilizing water bodies for installations, which helps in conserving land and reducing evaporation. The choice of mounting type often depends on site conditions, available space, and specific energy needs. Market share figures for specific mounting types are not directly available in authoritative sources for 2024, so the original table is retained pending further industry data.

The US Solar PV Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Inc., SunPower Corporation, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., Trina Solar Co., Ltd., Enphase Energy, Inc., Hanwha Q CELLS USA Inc., NextEra Energy, Inc., Tesla, Inc. (Tesla Energy), REC Group, SMA Solar Technology AG, Sunrun Inc., Array Technologies, Inc., LONGi Green Energy Technology Co., Ltd., 8minute Solar Energy contribute to innovation, geographic expansion, and service delivery in this space.

The US solar PV industry is poised for significant growth, driven by increasing investments in renewable energy and technological advancements. As energy storage solutions become more prevalent, the integration of solar with battery systems will enhance reliability and efficiency. Additionally, the shift towards decentralized energy production will empower consumers to generate their own electricity, further driving adoption. With a strong focus on sustainability and carbon neutrality, the solar sector is expected to play a crucial role in the US energy landscape over the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technology | Monocrystalline Silicon PV Modules Polycrystalline Silicon PV Modules Thin-Film PV Modules (CdTe, CIGS, a-Si) Bifacial PV Modules Concentrated Solar Power (CSP) |

| By Mounting Type | Ground-Mounted Rooftop Floating Solar |

| By End-Use | Utility-Scale Commercial and Industrial Residential Community Solar |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 120 | Homeowners, Solar System Installers |

| Commercial Solar Projects | 100 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 80 | Project Managers, Renewable Energy Analysts |

| Solar Technology Manufacturers | 60 | Product Development Managers, Sales Directors |

| Policy and Regulatory Insights | 50 | Regulatory Affairs Specialists, Energy Policy Experts |

The US Solar PV Industry Market is valued at approximately USD 30 billion, reflecting significant growth driven by increasing demand for renewable energy, technological advancements, and supportive government policies aimed at reducing carbon emissions.