Region:North America

Author(s):Shubham

Product Code:KRAC4352

Pages:92

Published On:October 2025

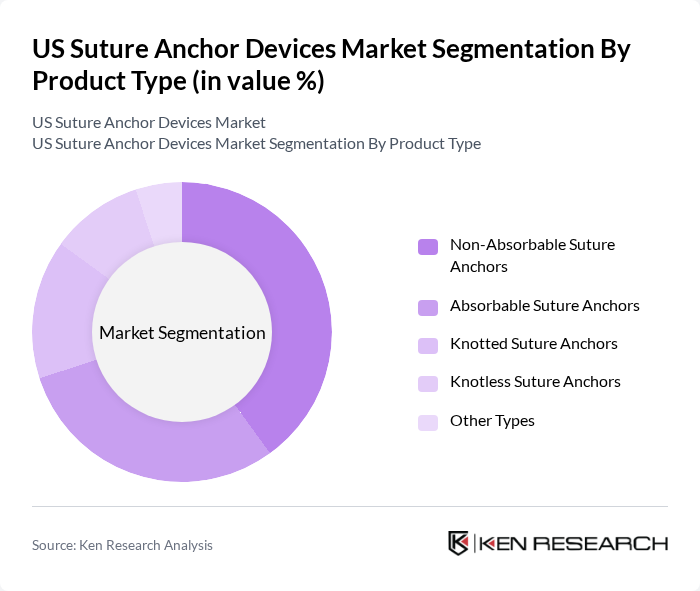

By Product Type:The product type segmentation includes various categories of suture anchors, each catering to specific surgical needs. Non-absorbable suture anchors are widely used due to their durability and strength, making them suitable for long-term applications. Absorbable suture anchors are gaining traction for their ability to dissolve over time, reducing the need for additional surgeries. Knotless suture anchors are preferred for their ease of use and reduced surgical time, while knotted anchors remain popular for their reliability in securing tissues. Other types include specialized anchors designed for unique surgical requirements .

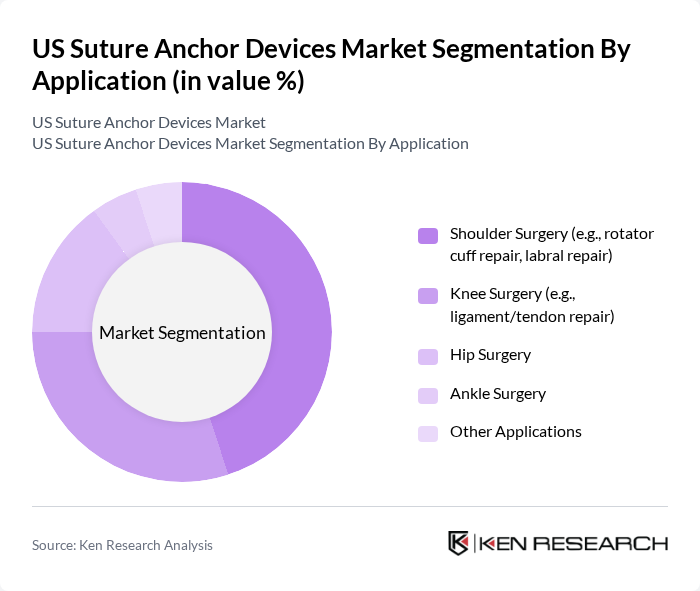

By Application:The application segmentation encompasses various surgical procedures where suture anchors are utilized. Shoulder surgery, particularly for rotator cuff and labral repairs, represents a significant portion of the market due to the high incidence of shoulder injuries. Knee surgery, including ligament and tendon repairs, is another major application area, driven by the increasing number of sports-related injuries. Hip and ankle surgeries are also notable applications, with growing demand for effective fixation solutions in these regions. Other applications include various orthopedic and sports medicine procedures .

The US Suture Anchor Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arthrex, Inc., Smith & Nephew plc, Stryker Corporation, DePuy Synthes (Johnson & Johnson), Medtronic plc, Zimmer Biomet Holdings, Inc., ConMed Corporation, B. Braun Melsungen AG, NuVasive, Inc., Orthofix Medical Inc., Aesculap, Inc., RTI Surgical Holdings, Inc., KFx Medical Corporation, Tenex Health, Inc., Biorez, Inc., Anika Therapeutics, Inc., Enovis Corporation, Orthomed contribute to innovation, geographic expansion, and service delivery in this space .

The future of the US suture anchor devices market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric care. The integration of digital technologies in surgical practices is expected to enhance procedural efficiency and outcomes. Additionally, the shift towards outpatient surgical procedures is likely to expand the market, as healthcare providers seek to reduce costs while improving patient experiences and recovery times.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Non-Absorbable Suture Anchors Absorbable Suture Anchors Knotted Suture Anchors Knotless Suture Anchors Other Types |

| By Application | Shoulder Surgery (e.g., rotator cuff repair, labral repair) Knee Surgery (e.g., ligament/tendon repair) Hip Surgery Ankle Surgery Other Applications |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Other End-Users |

| By Material | Metallic (e.g., titanium, stainless steel) Bioabsorbable (e.g., polylactic acid, polyglycolic acid) Polyethylene Other Materials |

| By Region | Northeast Midwest South West |

| By Others | Niche Products Custom Solutions Emerging Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 45 | Orthopedic Surgeons, Sports Medicine Specialists |

| Hospital Procurement Managers | 35 | Procurement Managers, Supply Chain Directors |

| Medical Device Distributors | 30 | Sales Representatives, Distribution Managers |

| Clinical Researchers | 25 | Clinical Researchers, Medical Device Analysts |

| Healthcare Policy Makers | 20 | Healthcare Policy Analysts, Regulatory Affairs Specialists |

The US Suture Anchor Devices Market is valued at approximately USD 257 million, reflecting a significant growth driven by the increasing prevalence of orthopedic surgeries and advancements in surgical techniques.