Region:Middle East

Author(s):Dev

Product Code:KRAD1715

Pages:85

Published On:November 2025

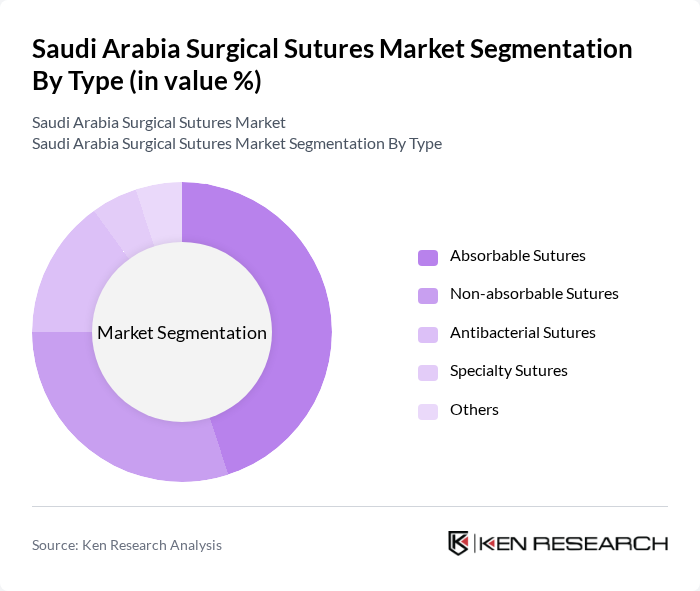

By Type:The market is segmented into various types of sutures, including absorbable sutures, non-absorbable sutures, antibacterial sutures, specialty sutures, and others. Among these, absorbable sutures are gaining significant traction due to their convenience and reduced need for suture removal, making them a preferred choice in many surgical procedures. The adoption of advanced absorbable materials and antimicrobial coatings is further supporting this segment’s growth .

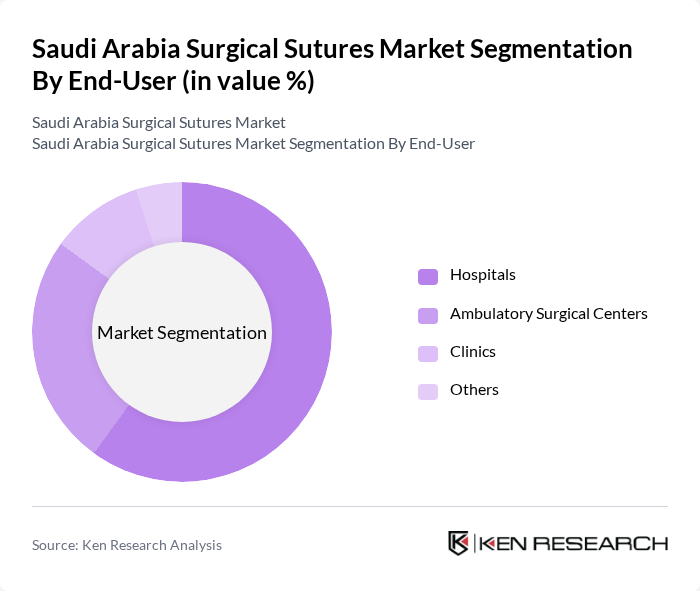

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers, clinics, and others. Hospitals are the leading end-users of surgical sutures, driven by the high volume of surgical procedures performed in these facilities, along with the availability of advanced surgical technologies and skilled healthcare professionals. The expansion of ambulatory surgical centers and increased adoption of outpatient procedures are also contributing to market growth in these segments .

The Saudi Arabia Surgical Sutures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ethicon (Johnson & Johnson), Medtronic, B. Braun Melsungen AG, Smith & Nephew, Conmed Corporation, Teleflex Incorporated, Surgical Specialties Corporation, Aesculap (B. Braun), Peters Surgical, Lotus Surgicals, Dolphin Sutures, Sutures India Pvt Ltd (Healthium Medtech), Medline Industries, DemeTECH Corporation, Samyang Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surgical sutures market in Saudi Arabia appears promising, driven by ongoing advancements in healthcare technology and an increasing focus on patient-centered care. As the healthcare infrastructure expands, particularly in underserved regions, the demand for innovative suturing solutions is expected to rise. Additionally, the integration of smart technologies and biodegradable materials will likely enhance surgical outcomes, making sutures more effective and sustainable, thus attracting more investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Absorbable Sutures Non-absorbable Sutures Antibacterial Sutures Specialty Sutures Others |

| By End-User | Hospitals Ambulatory Surgical Centers Clinics Others |

| By Application | General Surgery Orthopedic Surgery Cardiovascular Surgery Gynecological Surgery Ophthalmic Surgery Cosmetic Surgery Others |

| By Material | Monofilament Sutures Multifilament Sutures Silk Sutures Nylon Sutures Polyester Sutures Polypropylene Sutures Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Model | Premium Pricing Competitive Pricing Value-based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Surgeons Specializing in General Surgery | 50 | General Surgeons, Surgical Residents |

| Healthcare Supply Distributors | 40 | Sales Representatives, Product Managers |

| Clinical Research Organizations | 40 | Clinical Researchers, Medical Affairs Managers |

| Regulatory Bodies and Associations | 40 | Regulatory Affairs Specialists, Policy Makers |

The Saudi Arabia Surgical Sutures Market is valued at approximately USD 105 million, reflecting a significant growth driven by an increase in surgical procedures, advancements in surgical techniques, and a focus on wound care management.