Region:North America

Author(s):Shubham

Product Code:KRAD6769

Pages:86

Published On:December 2025

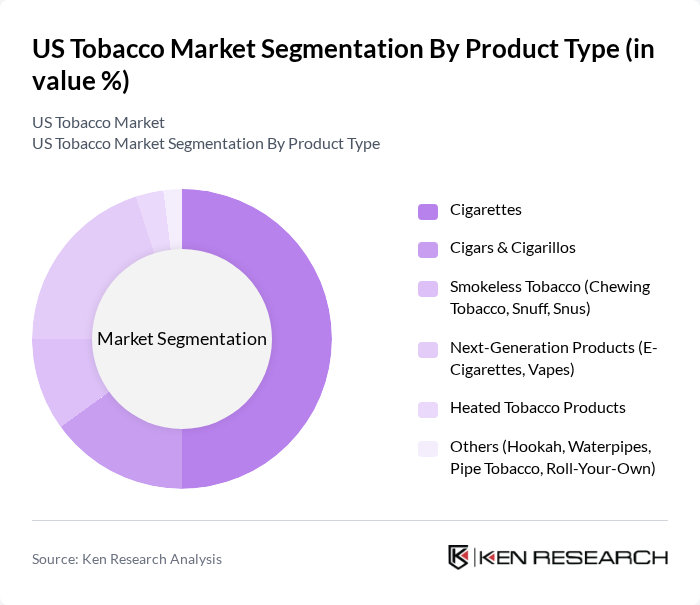

By Product Type:The product type segmentation of the US Tobacco Market includes various categories such as Cigarettes, Cigars & Cigarillos, Smokeless Tobacco (Chewing Tobacco, Snuff, Snus), Next-Generation Products (E?Cigarettes, Vapes), Heated Tobacco Products, and Others (Hookah, Waterpipes, Pipe Tobacco, Roll?Your?Own). This structure aligns with common industry classifications that distinguish between combustible, smokeless, and nicotine delivery products. Among these, Cigarettes remain the dominant segment by revenue due to their long?standing popularity and established consumer base, although unit volumes are gradually declining. The rise of Next?Generation Products is notable, as younger adult consumers increasingly experiment with e?cigarettes, vapes, and nicotine pouches perceived as less harmful or more convenient than traditional combustible products.

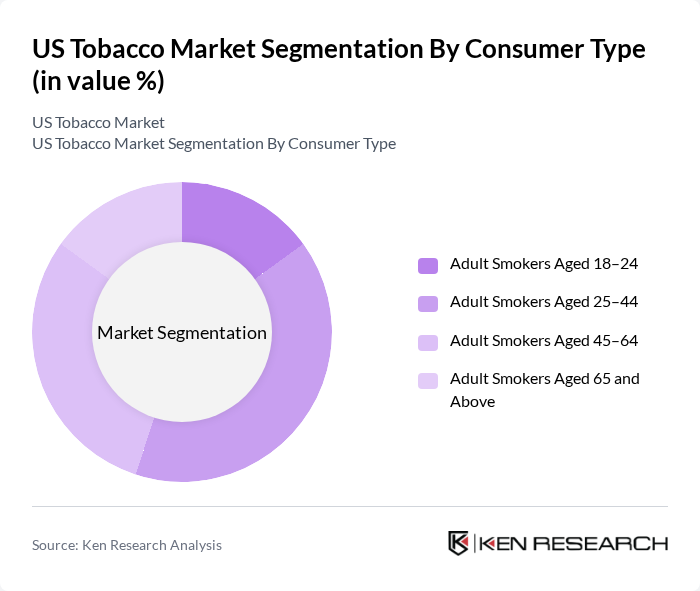

By Consumer Type:This segmentation includes Adult Smokers Aged 18–24, Adult Smokers Aged 25–44, Adult Smokers Aged 45–64, and Adult Smokers Aged 65 and Above. The segment of Adult Smokers Aged 25–44 is currently the largest in terms of tobacco use, reflecting higher daily and non?daily smoking prevalence compared with younger adults, who have shown sharper declines in combustible cigarette use. This demographic is also more inclined to experiment with new products, such as e?cigarettes and nicotine pouches, which are gaining traction among younger and middle?aged adults and contributing to a gradual shift in consumption from combustible to alternative products.

The US Tobacco Market is characterized by a dynamic mix of regional and international players. Leading participants such as Altria Group, Inc., Philip Morris USA Inc. (PM USA), Reynolds American Inc. (RAI), ITG Brands, LLC, Swedish Match North America LLC, Japan Tobacco International U.S.A., Inc., Imperial Brands PLC (Imperial Tobacco U.S. Operations), British American Tobacco p.l.c. (BAT U.S. Operations), Turning Point Brands, Inc., Vector Group Ltd. (Liggett Vector Brands), National Tobacco Company, L.P., PT Djarum (Djarum USA), Kretek International, Inc., R.J. Reynolds Vapor Company (Vuse), NJOY, LLC (an Altria Company) contribute to innovation, geographic expansion, and service delivery in this space.

The US tobacco market is poised for transformation as consumer preferences shift towards reduced-risk products and innovative offerings. With the rise of e-cigarettes and vaping, manufacturers are likely to invest heavily in product development and marketing strategies that align with health-conscious trends. Additionally, the expansion of online sales channels will enhance accessibility, catering to a broader audience. As regulatory pressures persist, companies will need to navigate compliance while exploring new market segments to ensure sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cigarettes Cigars & Cigarillos Smokeless Tobacco (Chewing Tobacco, Snuff, Snus) Next-Generation Products (E-Cigarettes, Vapes) Heated Tobacco Products Others (Hookah, Waterpipes, Pipe Tobacco, Roll-Your-Own) |

| By Consumer Type | Adult Smokers Aged 18–24 Adult Smokers Aged 25–44 Adult Smokers Aged 45–64 Adult Smokers Aged 65 and Above |

| By Distribution Channel | Tobacco Shops Convenience Stores Supermarkets & Hypermarkets Online Retail Others (Gas Stations, Duty-Free, Vape Shops) |

| By Price Tier | Premium Products Mid-Range Products Value/Discount Products Private Label and Generic Products |

| By Consumer Demographics | Age Group Gender Income Level Urban vs Rural Consumers |

| By Packaging Type | Soft Packs Hard Packs Cans, Pouches & Tins Others (Cartons, Refill Pods, Disposable Devices) |

| By Geographic Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cigarette Consumption Patterns | 150 | Adult Smokers, Retail Store Owners |

| Smokeless Tobacco Usage | 100 | Smokeless Tobacco Users, Health Professionals |

| Regulatory Impact Assessment | 80 | Policy Makers, Public Health Officials |

| Consumer Attitudes Towards Smoking Cessation | 120 | Former Smokers, Health Coaches |

| Tobacco Product Innovations | 90 | Product Development Managers, Marketing Executives |

The US Tobacco Market is valued at approximately USD 110 billion, driven by consumer demand for traditional tobacco products and the growing popularity of next-generation alternatives like e-cigarettes and heated tobacco products.