Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9210

Pages:87

Published On:November 2025

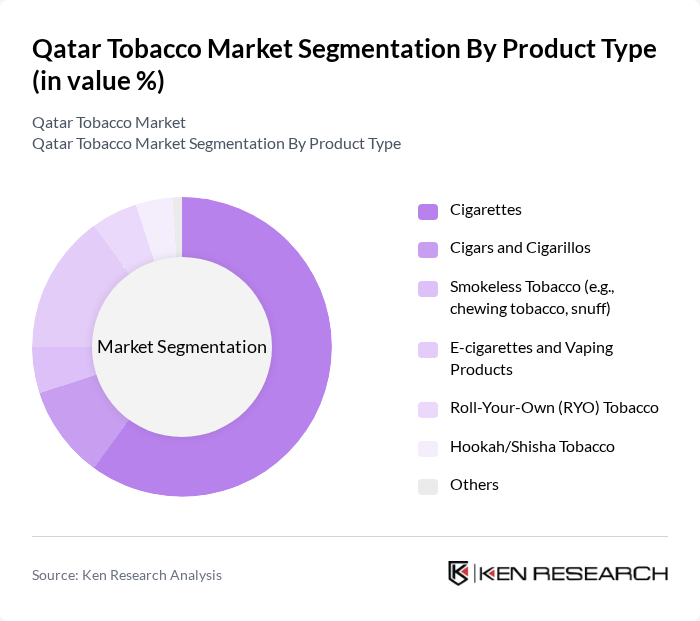

By Product Type:The product type segmentation of the market includes various categories such as cigarettes, cigars and cigarillos, smokeless tobacco, e-cigarettes and vaping products, roll-your-own (RYO) tobacco, hookah/shisha tobacco, and others. Among these, cigarettes dominate the market due to their widespread availability and consumer preference. The increasing trend of smoking among younger demographics has further solidified the position of cigarettes as the leading product type.

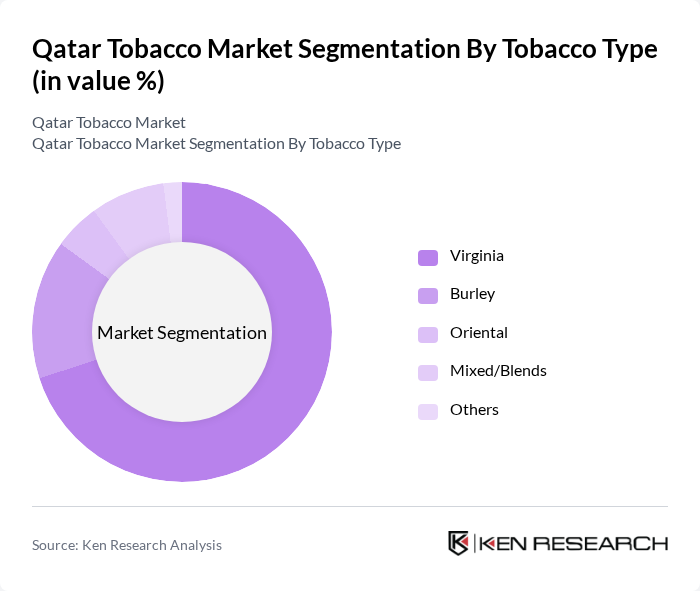

By Tobacco Type:This segmentation includes Virginia, Burley, Oriental, Mixed/Blends, and others. Virginia tobacco is the most popular type in the market, favored for its mild flavor and high-quality characteristics. The preference for Virginia tobacco is driven by its widespread use in cigarette production, making it a staple in the tobacco industry.

The Qatar Tobacco Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Tobacco Company, Qatar Distribution Company, Philip Morris International, British American Tobacco, Japan Tobacco International, Imperial Brands, Al-Faisal Holding, Al-Mana Group, Al-Ahli Tobacco Trading, and Doha Marketing Services Company (Domasco) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar tobacco market is poised for transformation, driven by evolving consumer preferences and regulatory landscapes. As the demand for reduced-risk products increases, manufacturers are likely to innovate and diversify their offerings. Additionally, the expansion of online sales channels will facilitate greater accessibility for consumers. However, the market must navigate ongoing health campaigns and regulatory pressures, which will shape product development and marketing strategies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cigarettes Cigars and Cigarillos Smokeless Tobacco (e.g., chewing tobacco, snuff) E-cigarettes and Vaping Products Roll-Your-Own (RYO) Tobacco Hookah/Shisha Tobacco Others |

| By Tobacco Type | Virginia Burley Oriental Mixed/Blends Others |

| By End User | Men Women Unisex |

| By Distribution Channel | Store-Based Retailers (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores) Non-Store Retailers (Online Retail, Vending Machines) Others |

| By Price Range | Premium Mid-Range Economy |

| By Age Group | Generation X (41–56 Years) Millennials (25–40 Years) Baby Boomers (57–75 Years) Others |

| By Packaging Type | Soft Packs Hard Packs Cartons Others |

| By Flavor | Regular Flavored Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cigarette Retailers | 100 | Store Owners, Retail Managers |

| Shisha Lounge Operators | 75 | Business Owners, Operations Managers |

| Health Professionals | 50 | Public Health Officials, Doctors |

| Consumers of Tobacco Products | 120 | Adult Smokers, Shisha Users |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Qatar Tobacco Market is valued at approximately USD 1.7 billion, reflecting a steady growth driven by increasing consumer demand, rising disposable income, and cultural acceptance of tobacco products in the region.