Region:North America

Author(s):Shubham

Product Code:KRAD5425

Pages:95

Published On:December 2025

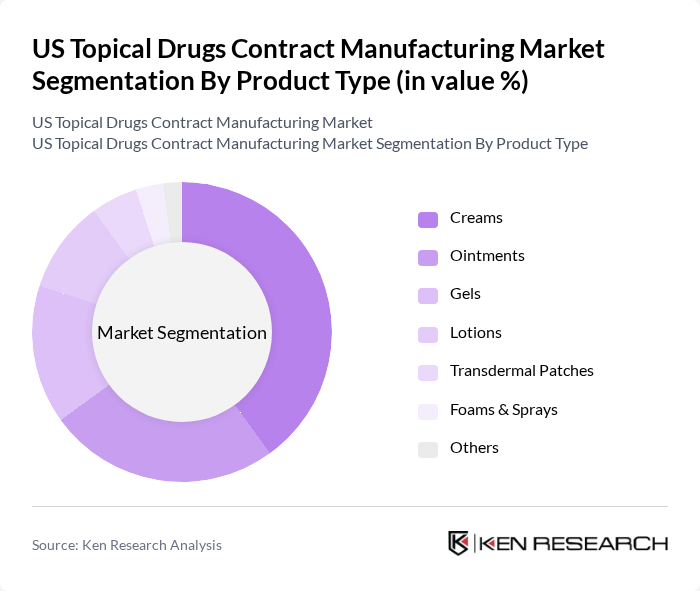

By Product Type:The product type segmentation includes various forms of topical drugs, each catering to specific therapeutic needs and consumer preferences. The dominant sub-segment in this category is creams and other semi?solid formulations, which are widely used due to their versatility, patient acceptability, and effectiveness in delivering active ingredients across a broad range of dermatological indications. Ointments and gels also hold significant market shares, particularly in dermatological and pain?management applications, where higher occlusivity or faster absorption is required, while transdermal patches are gaining traction for their convenience, controlled and sustained release properties, and ability to improve adherence in chronic conditions such as pain and hormone therapy.

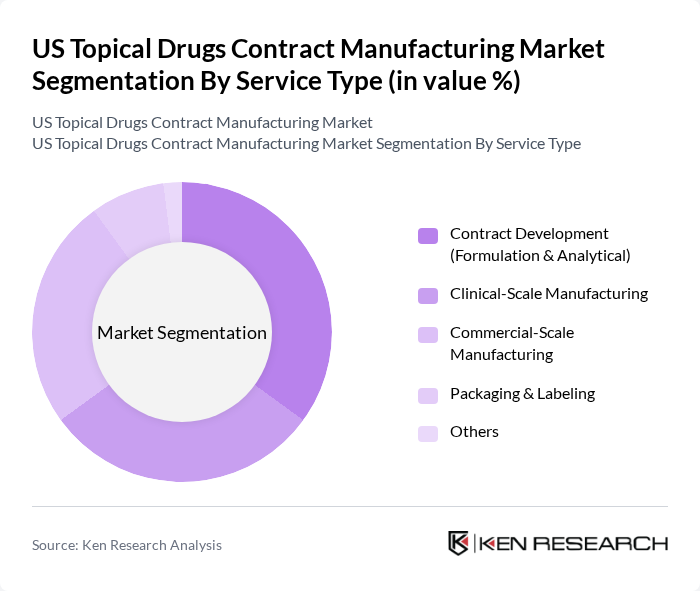

By Service Type:The service type segmentation encompasses various manufacturing services offered to pharmaceutical companies. Contract development services, including formulation, analytical, and stability services, are crucial for companies looking to innovate and bring new products to market, especially as topical drug delivery becomes more complex and incorporates technologies such as nano?formulations and advanced permeation enhancers. Clinical-scale manufacturing is also significant, as it supports the transition from development to commercial production and ensures supply for clinical trials under cGMP conditions. Packaging and labeling services are essential for compliance with FDA requirements, serialization, tamper?evidence, and brand differentiation, making them vital components of the contract manufacturing process for topical and transdermal products.

The US Topical Drugs Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Catalent, Inc., Lonza Group AG, Recipharm AB, Aenova Group, Fareva Group, Piramal Pharma Solutions, Alcami Corporation, Thermo Fisher Scientific (Patheon), Viatris Inc., Tedor Pharma, Inc., BioDerm Laboratories, Inc. (Topical CDMO), Edge Pharma, LLC, Crown Laboratories, Inc., Bora Pharmaceuticals Co., Ltd., Teligent, Inc. (Topical Generics & Contract Manufacturing) contribute to innovation, geographic expansion, specialization in semi?solid and transdermal dosage forms, and end?to?end service delivery in this space.

The future of the US topical drugs contract manufacturing market appears promising, driven by ongoing advancements in technology and increasing consumer demand for personalized medicine. As the market evolves, manufacturers are likely to invest in innovative drug delivery systems and expand their capabilities to meet the growing needs of dermatological treatments. Additionally, the rise of e-commerce in pharmaceutical sales will further enhance market accessibility, allowing companies to reach a broader customer base and adapt to changing consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Creams Ointments Gels Lotions Transdermal Patches Foams & Sprays Others |

| By Service Type | Contract Development (Formulation & Analytical) Clinical-Scale Manufacturing Commercial-Scale Manufacturing Packaging & Labeling Others |

| By Client Type | Large Pharmaceutical Companies Specialty & Mid?size Pharmaceutical Companies Generic Drug Manufacturers Biotech & Emerging Pharma Others |

| By Therapeutic Area | Dermatology (Acne, Psoriasis, Eczema, etc.) Pain Management & Anesthetics Hormonal & Women’s Health Anti?infective & Antifungal Treatments Ophthalmic & Other Topical Uses Others |

| By Scale of Operation | Pilot & Small?Scale Batches Commercial Large?Scale Production High?Potency / Containment Manufacturing Others |

| By Formulation Technology | Conventional Topical Formulations Advanced / Novel Delivery Systems (e.g., Liposomes, Nanoemulsions) Transdermal Drug Delivery Systems Others |

| By Market Segment | Prescription (Rx) Drugs Over?the?Counter (OTC) Drugs Medical Aesthetics & Cosmeceuticals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Topical Drug Manufacturers | 100 | Production Managers, Quality Assurance Leads |

| Pharmaceutical R&D Departments | 80 | Research Scientists, Product Development Managers |

| Regulatory Affairs Specialists | 60 | Regulatory Compliance Officers, Legal Advisors |

| Market Access and Pricing Analysts | 70 | Market Access Managers, Pricing Strategy Analysts |

| Healthcare Professionals and Pharmacists | 90 | Pharmacists, Dermatologists, General Practitioners |

The US Topical Drugs Contract Manufacturing Market is valued at approximately USD 7.1 billion, reflecting a significant growth driven by the rising prevalence of skin disorders and increasing demand for dermatological products.