Region:North America

Author(s):Dev

Product Code:KRAB4245

Pages:88

Published On:October 2025

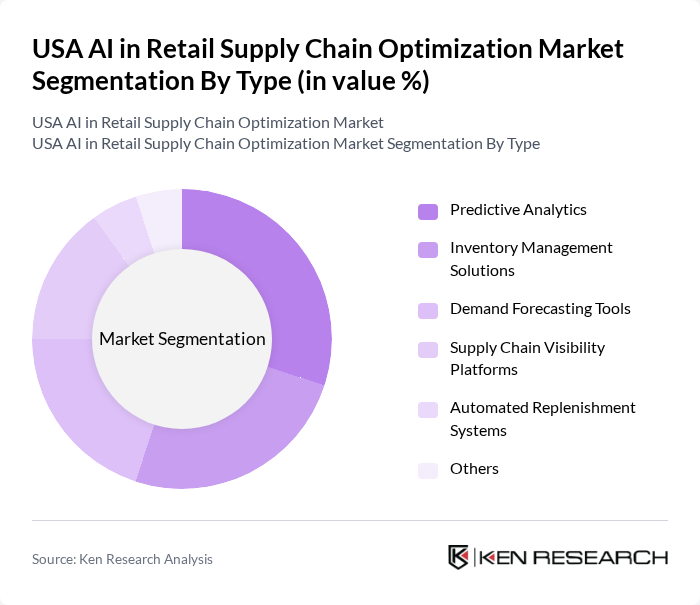

By Type:The market is segmented into various types, including Predictive Analytics, Inventory Management Solutions, Demand Forecasting Tools, Supply Chain Visibility Platforms, Automated Replenishment Systems, and Others. Each of these sub-segments plays a crucial role in enhancing the efficiency and effectiveness of retail supply chains.

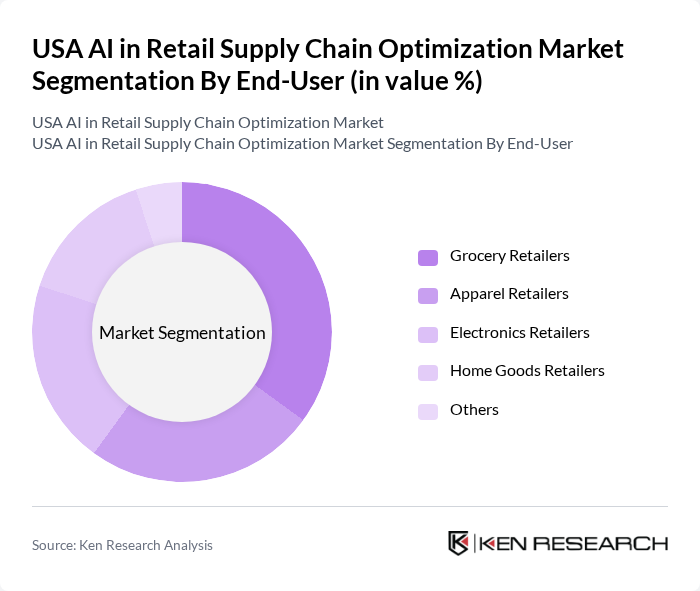

By End-User:The end-user segmentation includes Grocery Retailers, Apparel Retailers, Electronics Retailers, Home Goods Retailers, and Others. Each segment has unique requirements and challenges that AI solutions aim to address, leading to tailored applications across the retail landscape.

The USA AI in Retail Supply Chain Optimization Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Blue Yonder, JDA Software Group, Inc., Kinaxis Inc., Infor, Manhattan Associates, Inc., Llamasoft, Inc., ClearMetal, C3.ai, Zebra Technologies Corporation, Coupa Software Incorporated, TIBCO Software Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in retail supply chain optimization appears promising, driven by technological advancements and evolving consumer expectations. As retailers increasingly focus on personalization and sustainability, AI solutions will play a pivotal role in enhancing operational efficiency. The integration of machine learning for demand forecasting and automation in logistics will likely become standard practices. Additionally, the growing emphasis on ethical AI and data protection will shape regulatory frameworks, ensuring that innovation aligns with consumer trust and societal values.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Inventory Management Solutions Demand Forecasting Tools Supply Chain Visibility Platforms Automated Replenishment Systems Others |

| By End-User | Grocery Retailers Apparel Retailers Electronics Retailers Home Goods Retailers Others |

| By Application | Inventory Optimization Order Fulfillment Supplier Management Logistics Management Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Distribution Mode | B2B Distribution B2C Distribution E-commerce Platforms Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Customer Segment | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| AI in Inventory Management | 150 | Supply Chain Managers, Inventory Analysts |

| AI-Driven Demand Forecasting | 100 | Data Scientists, Demand Planners |

| Logistics Optimization through AI | 120 | Logistics Coordinators, Operations Directors |

| Customer Experience Enhancement via AI | 80 | Customer Experience Managers, Marketing Directors |

| AI in Supply Chain Risk Management | 90 | Risk Managers, Compliance Officers |

The USA AI in Retail Supply Chain Optimization Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by the adoption of AI technologies aimed at enhancing operational efficiency and customer satisfaction in the retail sector.