Region:North America

Author(s):Shubham

Product Code:KRAB5633

Pages:82

Published On:October 2025

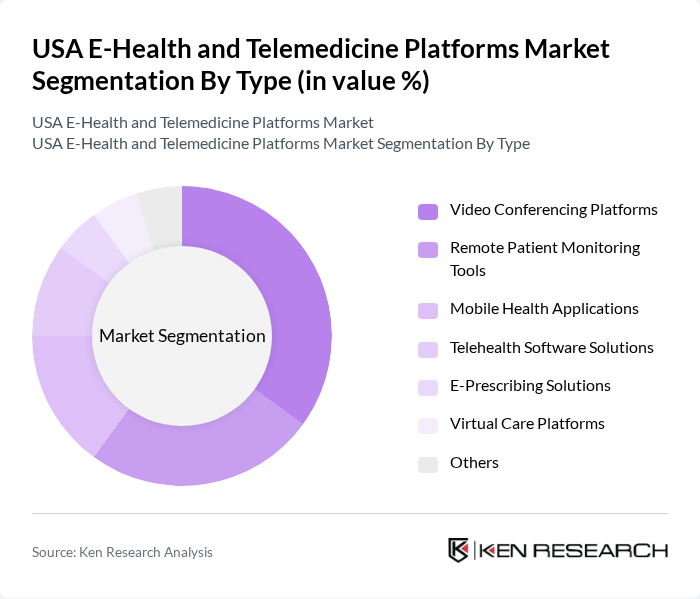

By Type:The market is segmented into various types of platforms that cater to different healthcare needs. The subsegments include Video Conferencing Platforms, Remote Patient Monitoring Tools, Mobile Health Applications, Telehealth Software Solutions, E-Prescribing Solutions, Virtual Care Platforms, and Others. Among these, Video Conferencing Platforms are leading due to their widespread use in virtual consultations, which have become essential during the pandemic. The demand for Remote Patient Monitoring Tools is also increasing as healthcare providers seek to manage chronic conditions effectively from a distance.

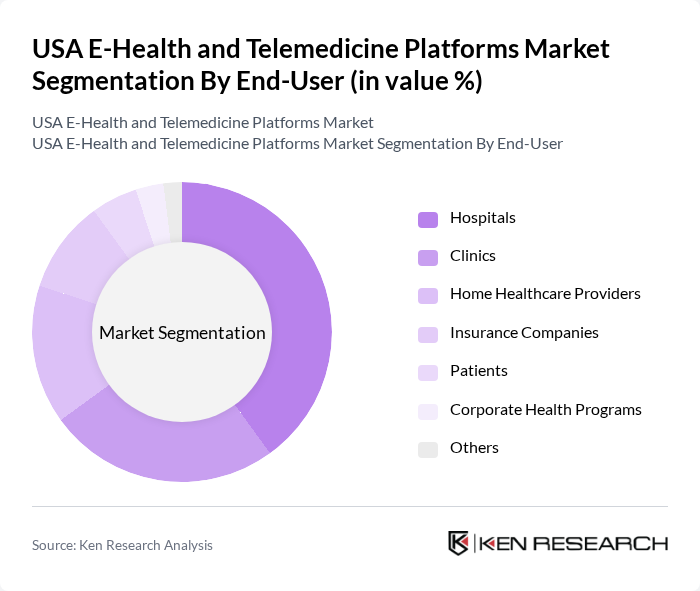

By End-User:This segmentation includes Hospitals, Clinics, Home Healthcare Providers, Insurance Companies, Patients, Corporate Health Programs, and Others. Hospitals are the leading end-users due to their need for comprehensive telehealth solutions to manage patient care efficiently. Clinics are also increasingly adopting these platforms to enhance patient engagement and streamline operations. The rise of Home Healthcare Providers is notable as more patients prefer receiving care in their homes.

The USA E-Health and Telemedicine Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Inc., Amwell, MDLIVE, Inc., Doxy.me, Doctor on Demand, Zocdoc, HealthTap, PlushCare, eVisit, SimplePractice, Luma Health, MyTelemedicine, Talkspace, WellVia, Medici contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA E-Health and Telemedicine Platforms market appears promising, driven by technological advancements and changing patient preferences. In the future, the integration of artificial intelligence in telemedicine is expected to enhance diagnostic accuracy and patient engagement. Additionally, the increasing acceptance of telehealth services among patients, particularly in mental health, will likely lead to broader adoption. As healthcare continues to evolve, telemedicine will play a pivotal role in delivering accessible and efficient care across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Conferencing Platforms Remote Patient Monitoring Tools Mobile Health Applications Telehealth Software Solutions E-Prescribing Solutions Virtual Care Platforms Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Insurance Companies Patients Corporate Health Programs Others |

| By Application | Primary Care Specialty Care Mental Health Services Chronic Disease Management Preventive Care Emergency Services Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Third-Party Distributors Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Bundled Services Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Mobile Technologies Others |

| By User Demographics | Age Groups Income Levels Geographic Locations Health Conditions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using Telemedicine | 150 | Doctors, Clinic Administrators |

| Patients Engaging with E-Health Services | 120 | Patients, Caregivers |

| Technology Vendors in Telemedicine | 80 | Product Managers, Business Development Executives |

| Healthcare Policy Makers | 60 | Health Policy Analysts, Regulatory Affairs Specialists |

| Insurance Providers Offering Telehealth Coverage | 70 | Underwriters, Claims Managers |

The USA E-Health and Telemedicine Platforms Market is valued at approximately USD 30 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and the demand for remote healthcare services, particularly accelerated by the COVID-19 pandemic.