Region:North America

Author(s):Geetanshi

Product Code:KRAC7864

Pages:94

Published On:December 2025

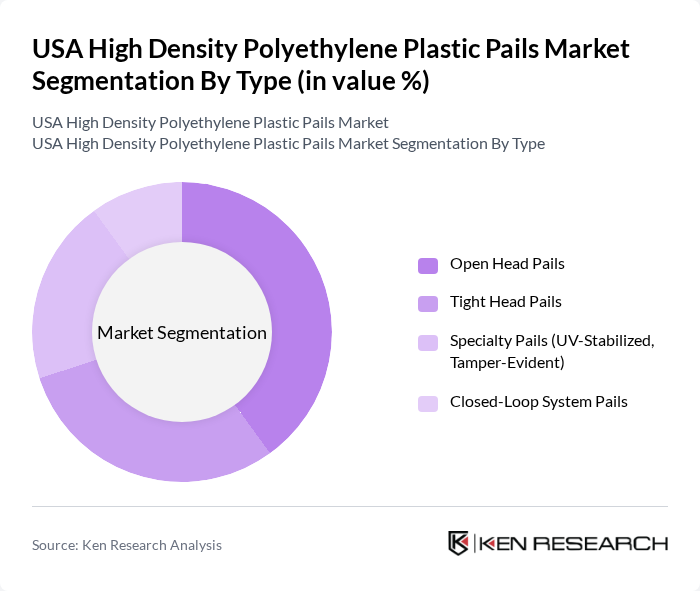

By Type:The market is segmented into various types of pails, including Open Head Pails, Tight Head Pails, Specialty Pails (UV-Stabilized, Food-Grade, Marine Grade), and Closed-Loop Recycling System Pails. Among these, Tight Head Pails are gaining traction due to their secure sealing and suitability for hazardous materials, making them a preferred choice in industrial applications.

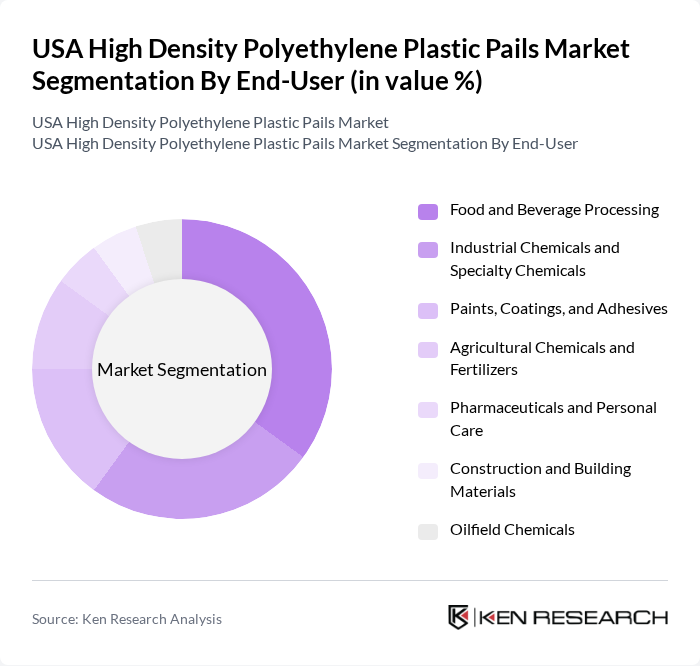

By End-User:The end-user segmentation includes Food and Beverage Processing, Industrial Chemicals and Specialty Chemicals, Paints, Coatings, and Adhesives, Agricultural Chemicals and Fertilizers, Oilfield Chemicals, Building Materials and Construction, and Lubricants and Metal Treatment Chemicals. The Paints & Coatings segment dominated the market in recent periods, driven by increasing demand for paints and coatings in the construction and automotive industries, where HDPE plastic pails are particularly valued for their strength, resistance to chemical interactions, and ability to preserve product integrity. The Food and Beverage Processing segment remains significant due to the increasing demand for safe and hygienic packaging solutions in the food industry.

The USA High Density Polyethylene Plastic Pails Market is characterized by a dynamic mix of regional and international players. Leading participants such as Berry Global, Inc., Mauser Packaging Solutions, Polyethylene Containers, Inc., Siena Plastics, Sonoco Products Company, Greif, Inc., Container Supply, M&M Industries, Labelmaster, The Cary Company, Kaufman Container, Pail and Container, Inc., United States Plastic Corporation, Welch Plastics (Custom HDPE Fabrication), Alpha Packaging contribute to innovation, geographic expansion, and service delivery in this space.

The USA High Density Polyethylene Plastic Pails Market is poised for significant evolution, driven by increasing consumer demand for sustainable packaging solutions. As environmental regulations tighten, manufacturers are likely to invest in innovative designs that enhance recyclability and reduce waste. Additionally, the growth of online retail channels will further propel the demand for HDPE pails, as businesses seek efficient and reliable packaging options to meet consumer expectations. Collaboration with e-commerce platforms will also play a crucial role in shaping market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Open Head Pails Tight Head Pails Specialty Pails (UV-Stabilized, Food-Grade, Marine Grade) Closed-Loop Recycling System Pails |

| By End-User | Food and Beverage Processing Industrial Chemicals and Specialty Chemicals Paints, Coatings, and Adhesives Agricultural Chemicals and Fertilizers Oilfield Chemicals Building Materials and Construction Lubricants and Metal Treatment Chemicals |

| By Size | Gallon Gallon Gallon (Primary Market Driver) Above 5 Gallon (Bulk Handling) |

| By Color | Natural/Translucent Black (UV-Protected) Custom Colors Others |

| By Closure Type | Screw Cap Snap-On Lid Lever Lock Closure Leak-Proof Sealed Lids |

| By Distribution Channel | Direct Sales to Industrial End-Users Online Retail and E-commerce Distributors and Wholesalers Packaging Hubs and Regional Suppliers |

| By Application | Storage and Containment Transportation and Logistics Mixing and Blending Automated Dispensing Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Quality Assurance Specialists |

| Chemical Industry Applications | 80 | Procurement Managers, Safety Compliance Officers |

| Pharmaceutical Packaging Solutions | 70 | Regulatory Affairs Managers, Production Supervisors |

| Consumer Goods Packaging | 90 | Product Development Managers, Marketing Directors |

| Industrial Applications | 60 | Operations Managers, Supply Chain Analysts |

The USA High Density Polyethylene Plastic Pails Market is valued at approximately USD 215 million, reflecting a robust demand driven by various industries such as food and beverage, chemicals, and construction, which favor durable and lightweight packaging solutions.