Region:Middle East

Author(s):Shubham

Product Code:KRAD3503

Pages:86

Published On:November 2025

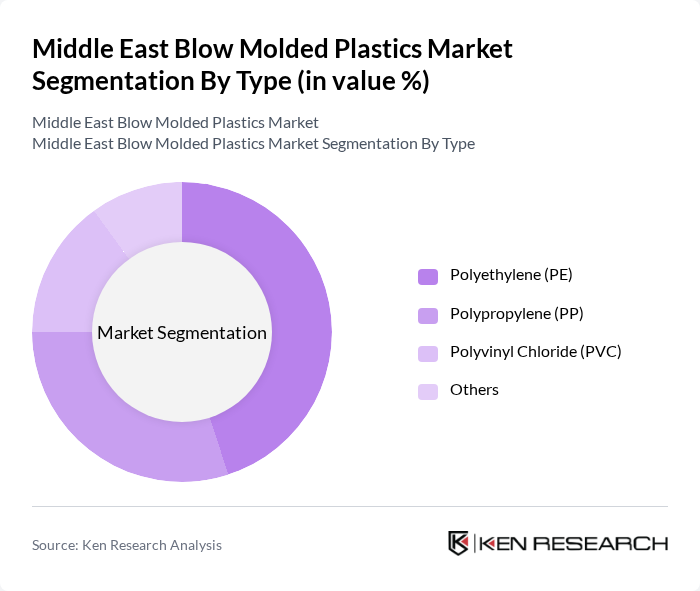

By Type:The blow molded plastics market can be segmented into various types, including Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), and others. Each type serves different applications and industries, with varying properties that cater to specific consumer needs. Polyethylene (PE) is widely used for bottles and containers due to its flexibility and barrier properties, while Polypropylene (PP) is preferred for automotive and industrial parts for its heat resistance and strength. Polyvinyl Chloride (PVC) finds applications in packaging, construction, and medical products owing to its chemical resistance and clarity.

The dominant subsegment in the blow molded plastics market is Polyethylene (PE), which accounts for a significant portion of the market share. This is largely due to its versatility, cost-effectiveness, and excellent barrier properties, making it ideal for packaging applications in the food and beverage sector. The increasing consumer preference for lightweight and durable packaging solutions has further solidified PE's position as the leading material in this market.

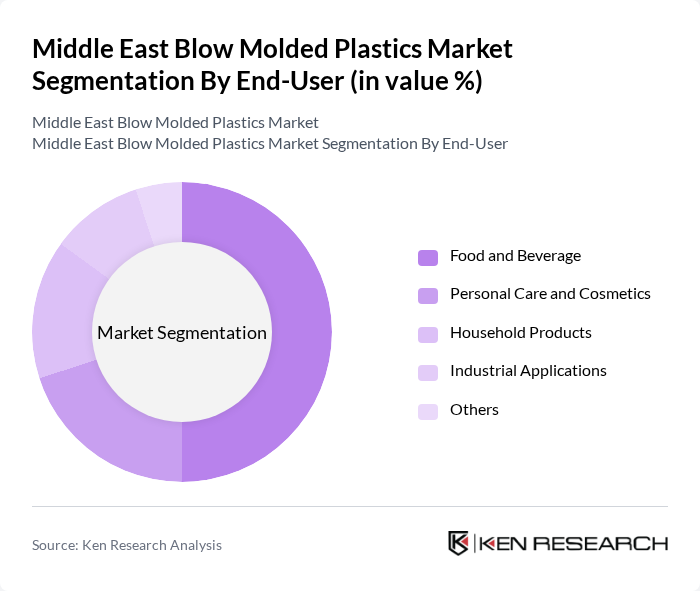

By End-User:The market can also be segmented based on end-users, including Food and Beverage, Personal Care and Cosmetics, Household Products, Industrial Applications, and others. Each end-user category has unique requirements that influence the demand for blow molded plastics. The food and beverage segment relies on blow molded plastics for bottles and containers that ensure product safety and shelf life, while personal care and cosmetics utilize custom packaging for branding and protection. Industrial applications demand robust containers for chemicals and lubricants, and household products benefit from lightweight, durable packaging.

The Food and Beverage sector is the leading end-user of blow molded plastics, driven by the growing demand for packaged food and beverages. The convenience of ready-to-drink products and the need for safe, hygienic packaging solutions have led to increased consumption of blow molded containers. This trend is further supported by the rise in e-commerce and home delivery services, which require efficient packaging solutions.

The Middle East Blow Molded Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpla Middle East, Plastipak Packaging Middle East, Berry Global Middle East, Greiner Packaging Middle East, RPC Group (now part of Berry Global), Amcor Middle East, Resilux Middle East, Sidel Middle East, KHS Middle East, AEP Industries (now part of Berry Global), CKS Packaging Middle East, Klöckner Pentaplast Middle East, Graham Packaging (now part of Berry Global), Inline Plastics Middle East, Silgan Holdings Middle East, Saudi Basic Industries Corporation (SABIC), National Packaging Company (NPC), Saudi Arabia, Gulf Plastic Industries, UAE, Al Ghurair Packaging, UAE, Al Jaber Packaging, UAE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East blow molded plastics market appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt smart packaging technologies, the integration of IoT and RFID in packaging solutions is expected to enhance supply chain efficiency. Furthermore, the shift towards biodegradable plastics is anticipated to gain momentum, aligning with consumer preferences for eco-friendly products. This evolution will likely create new avenues for growth and innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Others |

| By End-User | Food and Beverage Personal Care and Cosmetics Household Products Industrial Applications Others |

| By Application | Bottles Containers Jars Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Manufacturing Process | Extrusion Blow Molding Injection Blow Molding Stretch Blow Molding Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Sustainability Initiatives | Recyclable Products Biodegradable Options Eco-friendly Manufacturing Processes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Blow Molded Components | 60 | Product Managers, Design Engineers |

| Packaging Solutions for Food & Beverage | 70 | Packaging Engineers, Quality Assurance Managers |

| Consumer Goods Manufacturing | 50 | Operations Managers, Supply Chain Analysts |

| Construction Materials Sector | 40 | Procurement Managers, Project Engineers |

| Medical Device Packaging | 40 | Regulatory Affairs Specialists, Production Supervisors |

The Middle East Blow Molded Plastics Market is valued at approximately USD 3.4 billion, driven by the increasing demand for lightweight and durable packaging solutions across various industries, including food and beverage, personal care, and automotive.