Region:North America

Author(s):Geetanshi

Product Code:KRAC7885

Pages:82

Published On:December 2025

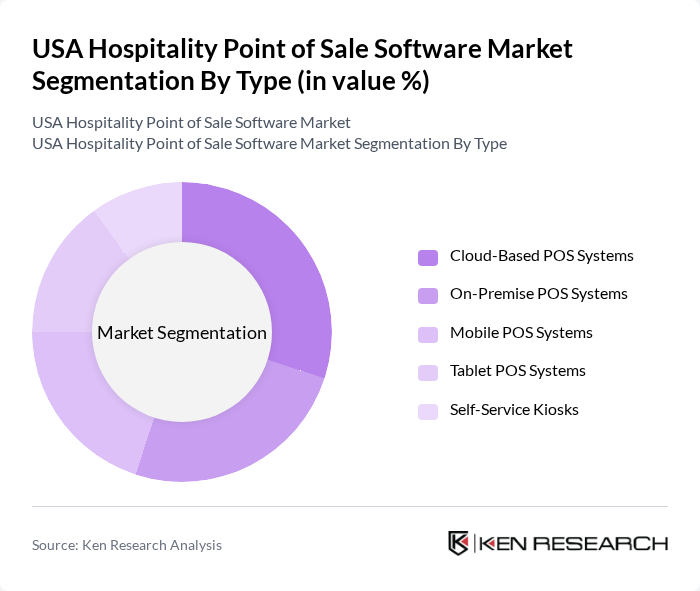

By Type:The market is segmented into various types of POS systems, including Cloud-Based POS Systems, On-Premise POS Systems, Mobile POS Systems, Tablet POS Systems, and Self-Service Kiosks. Each of these sub-segments caters to different operational needs and preferences of businesses in the hospitality sector.

The Cloud-Based POS Systems segment is currently dominating the market due to their flexibility, scalability, and ease of integration with other digital tools. Businesses are increasingly opting for cloud solutions to reduce hardware costs and enhance operational efficiency. The ability to access data remotely and the growing trend of mobile payments further bolster the demand for cloud-based systems. As a result, this segment is expected to maintain its leadership position in the market.

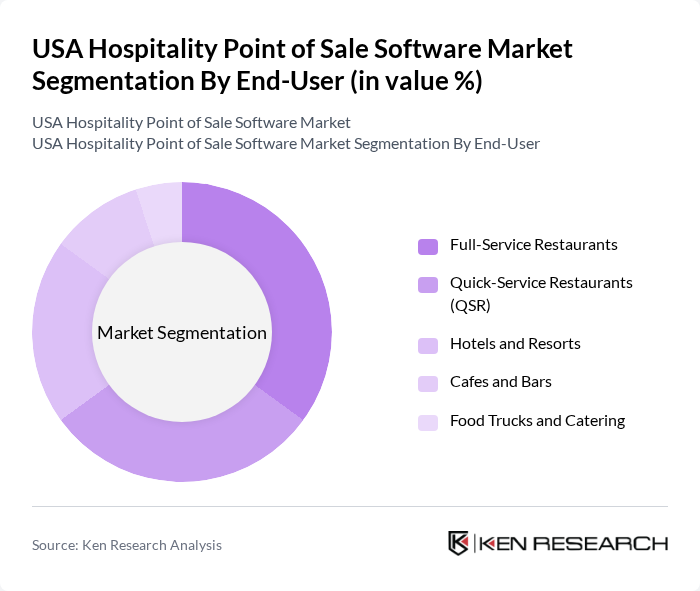

By End-User:The market is segmented based on end-users, including Full-Service Restaurants, Quick-Service Restaurants (QSR), Hotels and Resorts, Cafes and Bars, and Food Trucks and Catering. Each segment has unique requirements and preferences for POS solutions.

Full-Service Restaurants are leading the market segment due to their complex operational needs, which require advanced POS functionalities such as table management, customer relationship management, and integrated payment solutions. The increasing focus on enhancing customer experience and operational efficiency drives the demand for sophisticated POS systems in this segment. As a result, Full-Service Restaurants are expected to continue leading the market.

The USA Hospitality Point of Sale Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Square, Inc., Toast, Inc., Lightspeed POS Inc., Clover (Block, Inc.), TouchBistro, Revel Systems, NCR Corporation, Oracle Hospitality (Oracle Corporation), Agilysys, Inc., Micros Systems (Oracle MICROS), Global Payments Inc., Fiserv, Inc., Vend (Lightspeed subsidiary), ShopKeep (Lightspeed subsidiary), Flexi Software contribute to innovation, geographic expansion, and service delivery in this space.

The USA hospitality POS software market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As businesses increasingly adopt integrated payment solutions and leverage AI for operational efficiency, the market will likely see a shift towards more user-friendly interfaces. Additionally, the growing emphasis on sustainability will encourage the development of eco-friendly POS systems, aligning with consumer demand for responsible business practices. This dynamic landscape presents both challenges and opportunities for stakeholders in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based POS Systems On-Premise POS Systems Mobile POS Systems Tablet POS Systems Self-Service Kiosks |

| By End-User | Full-Service Restaurants Quick-Service Restaurants (QSR) Hotels and Resorts Cafes and Bars Food Trucks and Catering |

| By Deployment Model | Cloud Deployment On-Premise Deployment Hybrid Deployment |

| By Payment Method | Credit/Debit Cards Mobile Wallets Contactless Payments Cash Transactions Buy Now Pay Later (BNPL) |

| By Region | Northeast Midwest South West |

| By Customer Size | Small Enterprises (1-50 locations) Medium Enterprises (51-500 locations) Large Enterprises (500+ locations) |

| By Feature Set | Inventory Management and Tracking Customer Relationship Management (CRM) Reporting and Advanced Analytics Employee Management and Scheduling Kitchen Display Systems (KDS) Third-Party Delivery Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hotel Chains POS Software Usage | 120 | IT Managers, Operations Directors |

| Restaurant POS System Adoption | 100 | Restaurant Owners, General Managers |

| Bar and Nightclub POS Solutions | 80 | Bar Managers, Financial Controllers |

| Resort and Spa Management Systems | 70 | Resort Managers, IT Directors |

| Event Venue POS Software | 60 | Event Coordinators, Venue Managers |

The USA Hospitality Point of Sale Software Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by the adoption of digital payment solutions and the integration of advanced features like mobile ordering and AI-driven tools.