Region:North America

Author(s):Shubham

Product Code:KRAE0357

Pages:80

Published On:December 2025

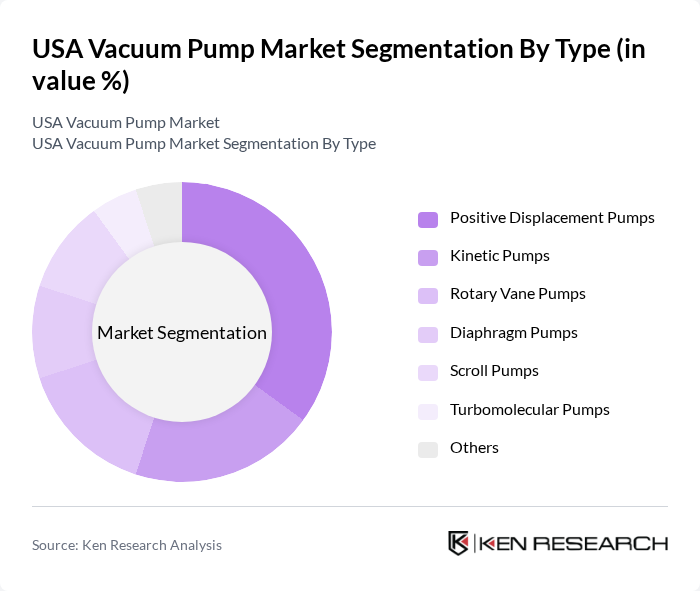

By Type:The vacuum pump market is segmented into various types, including Positive Displacement Pumps, Kinetic Pumps, Rotary Vane Pumps, Diaphragm Pumps, Scroll Pumps, Turbomolecular Pumps, and Others. Among these, Positive Displacement Pumps are leading due to their efficiency and reliability in various industrial applications. The increasing demand for these pumps in sectors like healthcare and semiconductor manufacturing is driving their market share.

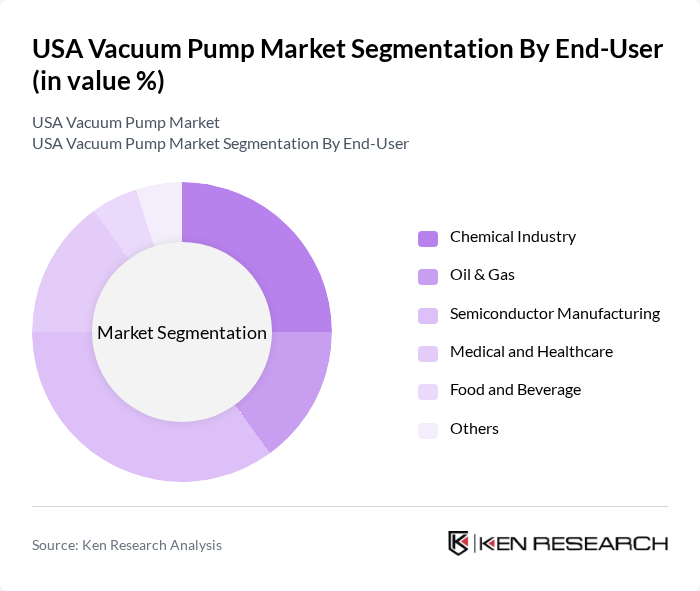

By End-User:The end-user segmentation includes industries such as Chemical, Oil & Gas, Semiconductor Manufacturing, Medical and Healthcare, Food and Beverage, and Others. The Semiconductor Manufacturing sector is the dominant end-user, driven by the increasing demand for vacuum systems in chip production processes. This sector's growth is fueled by advancements in technology and the rising need for efficient manufacturing processes.

The USA Vacuum Pump Market is characterized by a dynamic mix of regional and international players. Leading participants such as Busch Vacuum Solutions, Edwards Vacuum, Gardner Denver, Pfeiffer Vacuum, Leybold, Atlas Copco, Ametek, Inc., Ingersoll Rand, Tuthill Vacuum & Blower Systems, SMC Corporation, KSB SE & Co. KGaA, ULVAC Technologies, Celeros Flow Technology, Hibar Systems Ltd., and Vacuum Pump Services, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA vacuum pump market appears promising, driven by ongoing technological advancements and increasing industrial automation. As industries strive for greater efficiency and sustainability, the demand for energy-efficient vacuum pumps is expected to rise. Furthermore, the integration of IoT technologies into vacuum systems will enhance operational efficiency and predictive maintenance, allowing for better resource management and reduced downtime, ultimately shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Positive Displacement Pumps Kinetic Pumps Rotary Vane Pumps Diaphragm Pumps Scroll Pumps Turbomolecular Pumps Others |

| By End-User | Chemical Industry Oil & Gas Semiconductor Manufacturing Medical and Healthcare Food and Beverage Others |

| By Application | Packaging Vacuum Drying Vacuum Filtration Vacuum Distillation Others |

| By Material | Stainless Steel Plastic Aluminum Others |

| By Size | Small Vacuum Pumps Medium Vacuum Pumps Large Vacuum Pumps Others |

| By Technology | Electric Vacuum Pumps Pneumatic Vacuum Pumps Hydraulic Vacuum Pumps Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing | 100 | Production Managers, Quality Control Supervisors |

| Food Processing Industry | 80 | Operations Directors, Equipment Maintenance Heads |

| Semiconductor Fabrication | 70 | Process Engineers, Facility Managers |

| Research Laboratories | 60 | Lab Managers, Research Scientists |

| Industrial Manufacturing | 90 | Plant Managers, Engineering Directors |

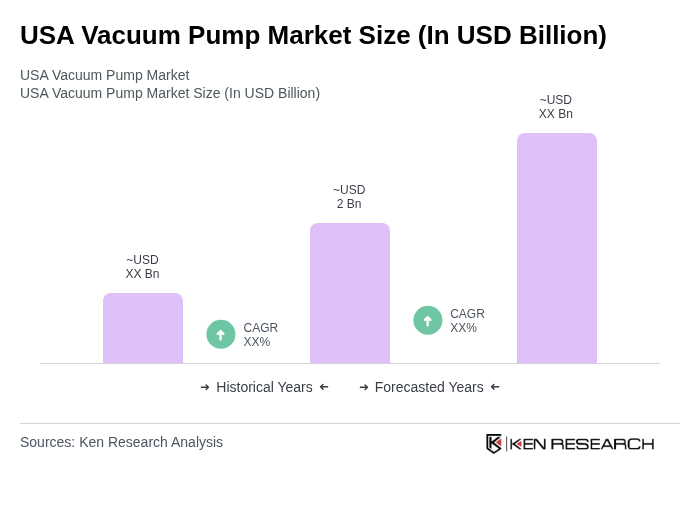

The USA Vacuum Pump Market is valued at approximately USD 2 billion, driven by increasing demand in sectors such as semiconductor fabrication, biotechnology, and healthcare, which require precision-controlled environments and energy-efficient vacuum systems.