Region:Global

Author(s):Geetanshi

Product Code:KRAA4031

Pages:89

Published On:January 2026

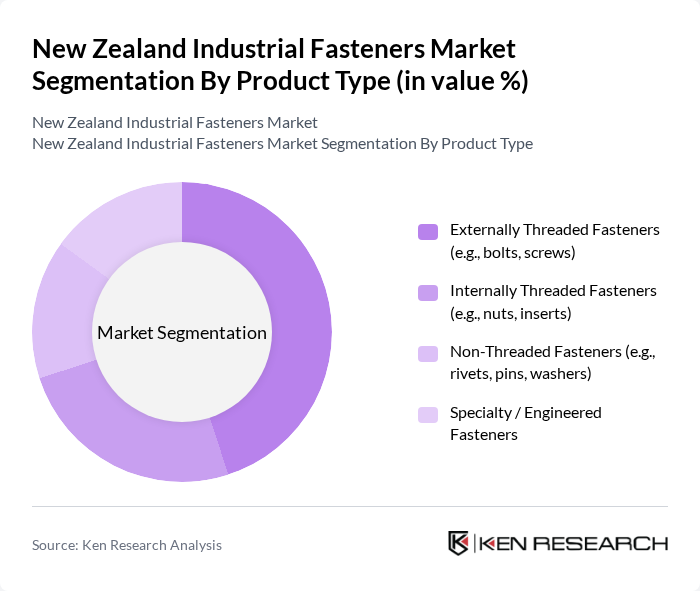

By Product Type:The market is segmented into various product types, including externally threaded fasteners, internally threaded fasteners, non-threaded fasteners, and specialty/engineered fasteners. Among these, externally threaded fasteners, such as bolts and screws, dominate the market due to their widespread application in construction and manufacturing, in line with regional trends where externally threaded fasteners account for the largest share of industrial fastener demand. The demand for these fasteners is driven by their versatility, load-bearing capability, and reliability in structural connections, machinery assembly, transportation equipment, and infrastructure projects.

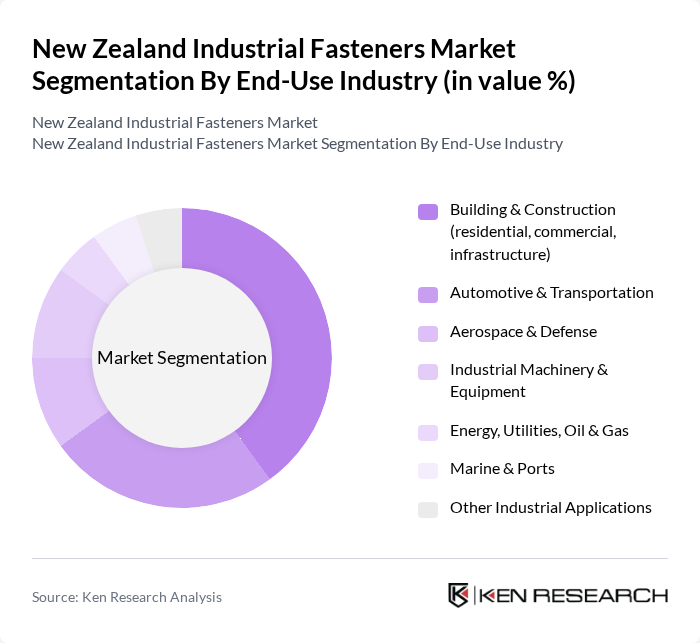

By End-Use Industry:The industrial fasteners market is significantly influenced by various end-use industries, including building and construction, automotive and transportation, aerospace and defense, industrial machinery and equipment, energy, utilities, oil and gas, marine and ports, and other industrial applications. The building and construction sector is the largest consumer of fasteners, driven by ongoing residential construction, commercial developments, and infrastructure projects such as bridges, rail, and utilities, where metal fasteners are preferred for their high mechanical strength and corrosion resistance.

The New Zealand Industrial Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Steel & Tube Holdings Limited, Ekspres Fasteners NZ Ltd, Anzor Fasteners, Fortress Fasteners, EDL Fasteners, Konnect Fastening Systems (NZ), Macsim Fastenings New Zealand, ITW Proline / Ramset New Zealand, Bolt Shop (NZ) Ltd, Bay Engineers Supplies, Blackwoods Protector, Bunnings Trade (Industrial Fasteners Range), NZ Safety Blackwoods, United Fasteners (New Zealand), and other emerging local players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand industrial fasteners market appears promising, driven by ongoing investments in infrastructure and technological advancements. As the construction sector continues to expand, the demand for innovative and sustainable fasteners will likely increase. Additionally, the adoption of automation in manufacturing processes will enhance efficiency and reduce costs, positioning local manufacturers favorably in a competitive landscape. Companies that embrace these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Externally Threaded Fasteners (e.g., bolts, screws) Internally Threaded Fasteners (e.g., nuts, inserts) Non-Threaded Fasteners (e.g., rivets, pins, washers) Specialty / Engineered Fasteners |

| By End-Use Industry | Building & Construction (residential, commercial, infrastructure) Automotive & Transportation Aerospace & Defense Industrial Machinery & Equipment Energy, Utilities, Oil & Gas Marine & Ports Other Industrial Applications |

| By Material | Carbon Steel Stainless Steel Alloy Steel & Special Alloys Aluminum & Other Metals Plastic / Composite |

| By Performance / Grade | Standard Industrial Grade High-Strength Structural Grade Corrosion-Resistant / Marine Grade Aerospace Grade |

| By Coating / Plating | Zinc Plated / Electroplated Hot-Dip Galvanized Stainless / Passivated Specialty Coatings (e.g., PTFE, phosphate) Uncoated |

| By Sales Channel | Direct Sales to OEMs / Projects Industrial Distributors / Wholesalers Retail & Trade Stores Online & E-commerce |

| By Region | North Island – Auckland & Upper North North Island – Central & Lower North (incl. Wellington) South Island – Canterbury & Otago South Island – Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Fastener Usage | 100 | Project Managers, Site Supervisors |

| Automotive Fastener Supply Chain | 80 | Procurement Managers, Quality Control Inspectors |

| Manufacturing Sector Fastener Demand | 90 | Operations Managers, Production Planners |

| Retail Fastener Distribution | 70 | Retail Managers, Inventory Control Specialists |

| Fastener Innovation and R&D | 60 | R&D Managers, Product Development Engineers |

The New Zealand Industrial Fasteners Market is valued at approximately USD 320 million, based on a five-year historical analysis and its share within the combined Australia and New Zealand industrial fasteners market, which totals around USD 950 million.