Region:Asia

Author(s):Rebecca

Product Code:KRAD7393

Pages:99

Published On:December 2025

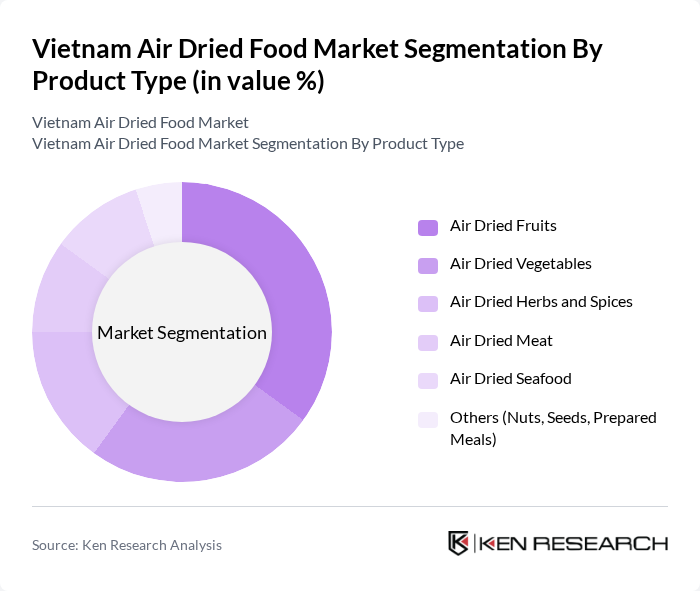

By Product Type:The air-dried food market is segmented into various product types, including air-dried fruits, air-dried vegetables, air-dried herbs and spices, air-dried meat, air-dried seafood, and others such as nuts, seeds, and prepared meals. Among these, air-dried fruits are currently the leading subsegment, driven by increasing health awareness, demand for minimally processed snacks, and the growing use of fruit chips in retail snack lines and foodservice applications. Consumers are increasingly opting for air-dried fruits as a convenient and healthy alternative to traditional indulgent snacks, which has significantly boosted their market share and shelf presence in supermarkets, convenience stores, and online channels.

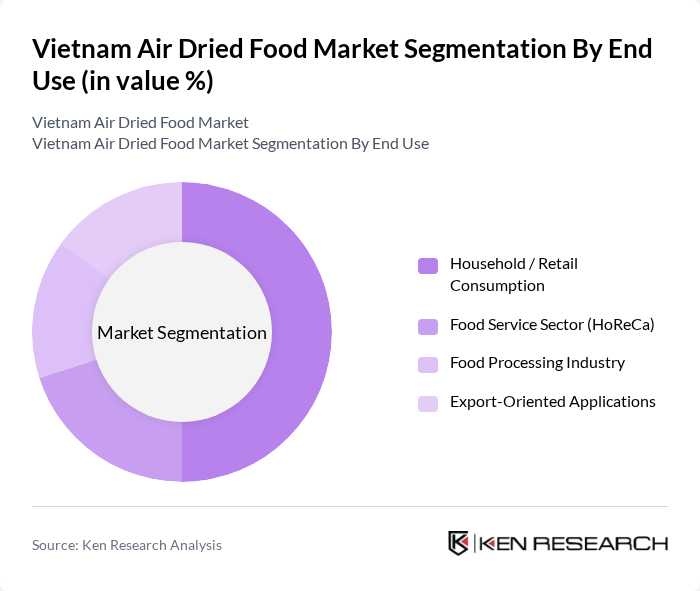

By End Use:The market is also segmented by end use, which includes household/retail consumption, the food service sector (HoReCa), the food processing industry, and export-oriented applications. The household/retail consumption segment is the most significant, as more consumers are purchasing air-dried foods for personal use via supermarkets, minimarts, specialty stores, and online platforms. This trend is driven by the increasing popularity of healthy snacking, demand for long-shelf-life pantry items, and the convenience of air-dried products, which are easy to store, transport, and consume without refrigeration.

The Vietnam Air Dried Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinamit Joint Stock Company (Vinamit JSC), Vinamilk (Vietnam Dairy Products JSC – dried yogurt and snack lines), Nafoods Group JSC, L'ang Farm, Dalat Hasfarm Co., Ltd. (dried fruits and vegetables), Viet Spice Co., Ltd. (Vietspice – dried herbs and spices), Asia Food Technology Joint Stock Company (AFOTECH), Bidifisco – Binh Dinh Fishery Joint Stock Company (dried seafood), Vissan Joint Stock Company (VISSAN – dried meat products), Huu Nghi Food Joint Stock Company (Huu Nghi Food JSC), Saigon Food Joint Stock Company (Saigon Food JSC), Hoang Anh Dried Fruit Co., Ltd. (Hoang Anh Fruits), Duy Anh Foods Co., Ltd. (dried rice products and snacks), Ong Bau Dried Fruit and Agricultural Products Co., Ltd., VinFruit Vietnam Co., Ltd. (premium dried fruit exporter) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam air-dried food market is poised for significant growth, driven by evolving consumer preferences towards healthier and convenient food options. As urbanization continues, the demand for ready-to-eat meals will likely increase, further boosting the air-dried food segment. Additionally, the rise of e-commerce will enhance product accessibility, allowing brands to reach a wider audience. Companies that innovate and adapt to these trends will be well-positioned to capitalize on the expanding market opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Air Dried Fruits Air Dried Vegetables Air Dried Herbs and Spices Air Dried Meat Air Dried Seafood Others (Nuts, Seeds, Prepared Meals) |

| By End Use | Household / Retail Consumption Food Service Sector (HoReCa) Food Processing Industry Export-Oriented Applications |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Specialty and Health Food Stores Online Retail and E-commerce Platforms Direct and B2B Sales |

| By Form | Powder and Granules Chunks / Pieces Flakes Whole / Slices |

| By Price Range | Economy Mid-Range Premium Private Label / Bulk |

| By Region | Northern Vietnam (including Hanoi and Red River Delta) Central Vietnam Southern Vietnam (including Ho Chi Minh City and Mekong Delta) Other Provinces and Emerging Production Clusters |

| By Consumer Demographics | Age Group Income Level Lifestyle and Health Orientation Urban vs Rural Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Air-Dried Fruits | 100 | Store Managers, Product Buyers |

| Wholesale Distribution of Dried Vegetables | 80 | Wholesale Distributors, Supply Chain Managers |

| Export Market for Dried Seafood | 70 | Export Managers, Quality Assurance Officers |

| Consumer Preferences for Dried Meat Products | 90 | End Consumers, Food Enthusiasts |

| Market Trends in Organic Dried Foods | 60 | Health Food Store Owners, Nutritionists |

The Vietnam Air Dried Food Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing consumer demand for convenient and healthy food options, particularly among health-conscious individuals.