Region:Asia

Author(s):Geetanshi

Product Code:KRAD7336

Pages:94

Published On:December 2025

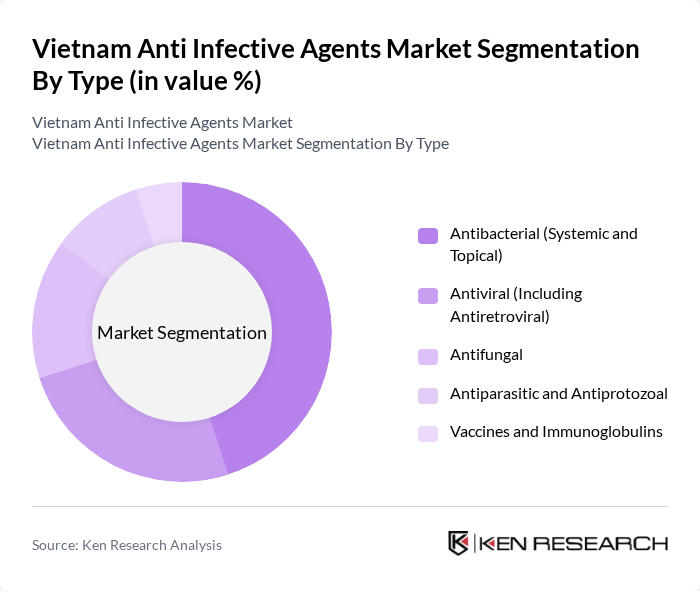

By Type:The anti-infective agents market can be segmented into various types, including antibacterial, antiviral, antifungal, antiparasitic, and vaccines. Among these, antibacterial agents, both systemic and topical, dominate the market due to their widespread use in treating bacterial infections, which are prevalent in the region. The increasing incidence of antibiotic-resistant bacteria has also led to a surge in demand for innovative antibacterial solutions.

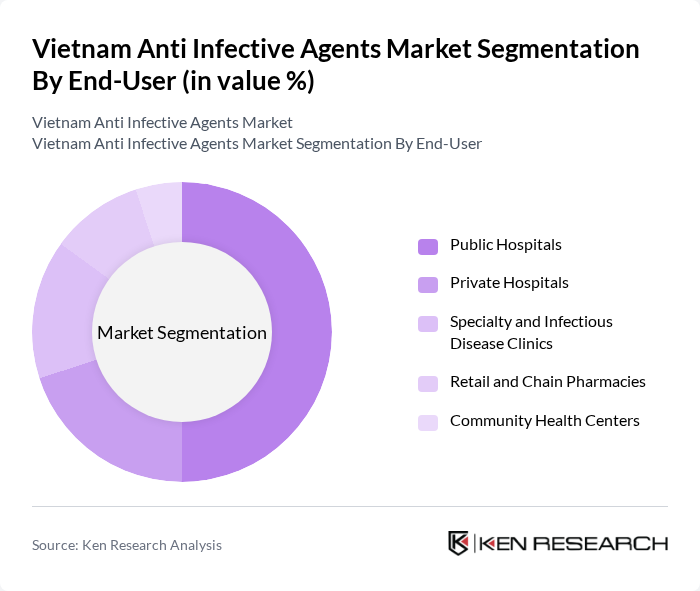

By End-User:The end-user segmentation includes public hospitals, private hospitals, specialty and infectious disease clinics, retail and chain pharmacies, and community health centers. Public hospitals are the leading end-users, primarily due to their role in providing comprehensive healthcare services to a large segment of the population. The increasing patient load and the need for effective treatment options in these facilities drive the demand for anti-infective agents.

The Vietnam Anti Infective Agents Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHG Pharmaceutical Joint Stock Company (Hau Giang Pharmaceutical), Traphaco Joint Stock Company, Imexpharm Corporation, Domesco Medical Import-Export Joint Stock Corporation, Mekophar Chemical Pharmaceutical Joint Stock Company, Bidiphar Joint Stock Company (Binh Dinh Pharmaceutical), Pymepharco Joint Stock Company, OPC Pharmaceutical Joint Stock Company, SPM Corporation, Sanofi Vietnam Co., Ltd., Pfizer (Vietnam) Limited, Novartis Pharma Services (Vietnam) Co., Ltd., Merck Sharp & Dohme (Vietnam) Company Limited, GlaxoSmithKline (GSK) Vietnam Co., Ltd., AstraZeneca Vietnam Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam anti-infective agents market is poised for significant transformation as it adapts to the evolving landscape of healthcare needs. With a focus on innovative treatments and the integration of advanced technologies, the market is expected to witness a surge in the development of novel anti-infective agents. Additionally, the increasing collaboration between local and international pharmaceutical companies will enhance research capabilities, leading to more effective solutions for combating infectious diseases. The emphasis on antimicrobial stewardship will further shape the market dynamics, ensuring sustainable practices in drug usage.

| Segment | Sub-Segments |

|---|---|

| By Type | Antibacterial (Systemic and Topical) Antiviral (Including Antiretroviral) Antifungal Antiparasitic and Antiprotozoal Vaccines and Immunoglobulins |

| By End-User | Public Hospitals Private Hospitals Specialty and Infectious Disease Clinics Retail and Chain Pharmacies Community Health Centers |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies and Drug Stores Government Tender / Centralized Procurement E-Pharmacies Wholesalers and Distributors |

| By Formulation | Oral Solid (Tablets, Capsules) Oral Liquid (Syrups, Suspensions) Parenteral (Intravenous, Intramuscular) Topical (Creams, Ointments, Gels) Inhalation and Other Specialized Forms |

| By Route of Administration | Oral Parenteral Topical Inhalation Others |

| By Patient Demographics | Pediatric Adult Geriatric Immunocompromised and High-Risk Groups |

| By Geography | Northern Vietnam (including Hanoi) Central Vietnam Southern Vietnam (including Ho Chi Minh City) Rural and Remote Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Managers | 120 | Pharmacy Directors, Supply Chain Managers |

| Pharmaceutical Sales Representatives | 100 | Sales Managers, Territory Representatives |

| Healthcare Professionals | 150 | Doctors, Clinical Pharmacists |

| Regulatory Affairs Specialists | 80 | Compliance Officers, Regulatory Managers |

| Market Research Analysts | 90 | Market Analysts, Business Development Managers |

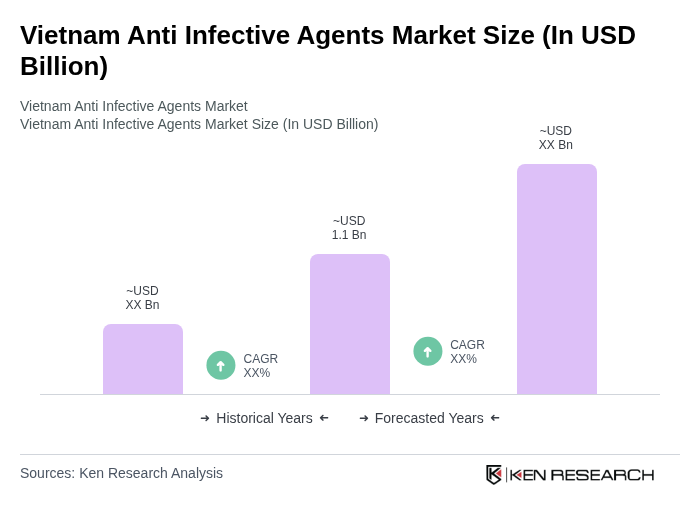

The Vietnam Anti Infective Agents Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the rising prevalence of infectious diseases and increased healthcare expenditure over the past five years.