Vietnam Artisanal Bakery Products Market Overview

- The Vietnam Artisanal Bakery Products Market is valued at USD 2.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for high-quality, handcrafted baked goods, a rising trend towards healthier eating habits, and the growing popularity of premium, organic, and gluten-free bakery items. The market has seen a significant shift towards artisanal products, which are perceived as fresher and more authentic compared to mass-produced alternatives. Urban millennials and Gen Z consumers, in particular, are willing to pay a premium for products made with natural ingredients and lower sugar content .

- Key cities such as Ho Chi Minh City and Hanoi dominate the market due to their large urban populations and vibrant food culture. These cities are home to a plethora of artisanal bakeries that cater to the growing middle class, which is increasingly willing to spend on premium bakery products. The presence of a diverse culinary scene, the influence of Western dining habits, and the rapid expansion of café culture foster innovation and competition among local bakers. The adoption of digital platforms and social media marketing has further amplified the reach and popularity of artisanal bakeries in these urban centers .

- In 2023, the Vietnamese government implemented regulations aimed at enhancing food safety standards in the bakery sector. The Circular No. 24/2019/TT-BYT issued by the Ministry of Health sets forth mandatory compliance requirements for hygiene practices, ingredient sourcing, and food safety management systems for bakery producers. These regulations are designed to protect consumer health, promote the use of local ingredients, and ensure traceability throughout the supply chain. Compliance with these standards is expected to elevate the quality of artisanal bakery products and boost consumer confidence in the market .

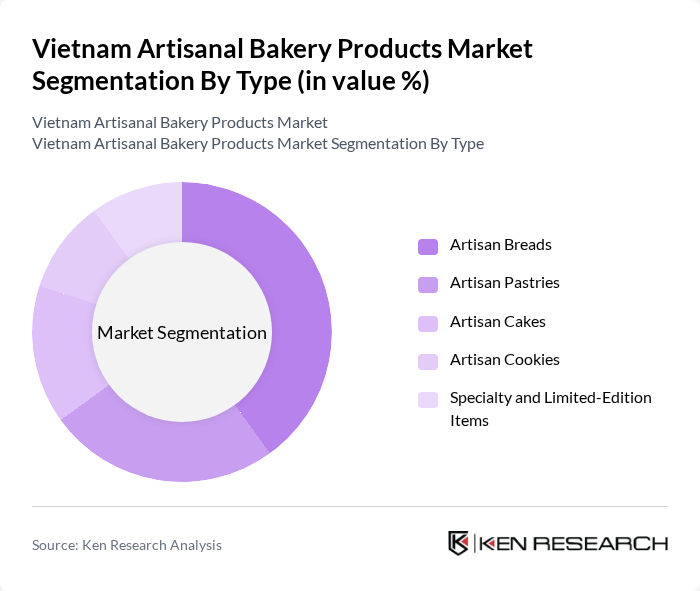

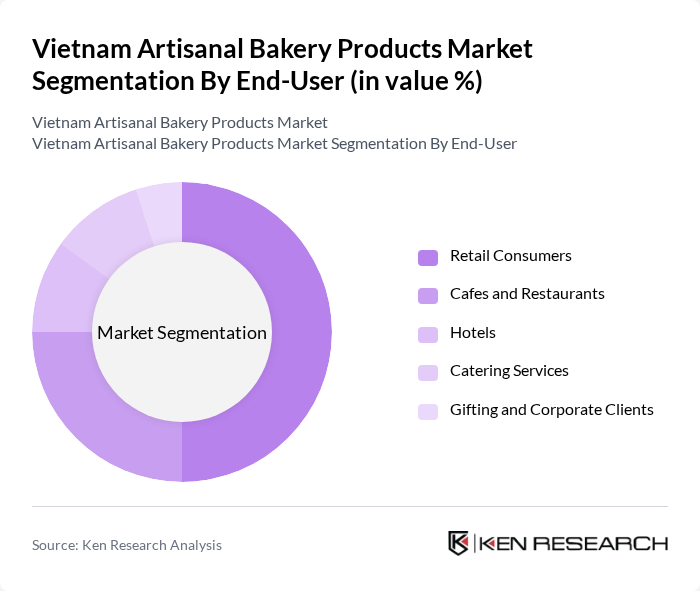

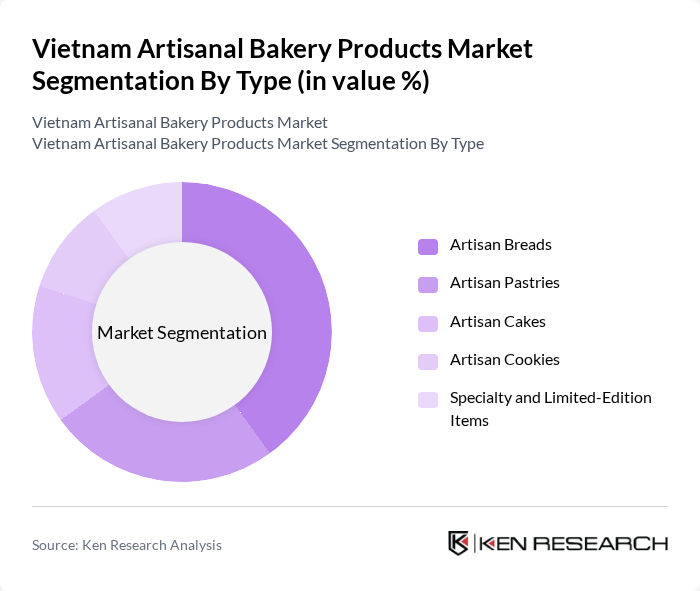

Vietnam Artisanal Bakery Products Market Segmentation

By Type:The market is segmented into various types of artisanal bakery products, including artisan breads, artisan pastries, artisan cakes, artisan cookies, and specialty and limited-edition items. Among these, artisan breads have gained significant popularity due to their perceived health benefits, unique flavors, and use of whole grains or natural ingredients. Artisan pastries and cakes continue to attract consumers seeking indulgent treats, while specialty and limited-edition items cater to niche markets, often leveraging local flavors and seasonal ingredients to drive demand .

By End-User:The end-user segmentation includes retail consumers, cafes and restaurants, hotels, catering services, and gifting and corporate clients. Retail consumers represent the largest segment, driven by the increasing demand for convenient and ready-to-eat products, as well as the trend of home baking and the desire for high-quality baked goods. Cafes and restaurants also play a significant role, as they increasingly incorporate artisanal products into their menus to attract discerning customers. The food service sector, including hotels and catering services, requires a steady supply of premium baked goods, while gifting and corporate clients drive demand for customized and specialty items .

Vietnam Artisanal Bakery Products Market Competitive Landscape

The Vietnam Artisanal Bakery Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bánh Mì ABC, BreadTalk Vietnam, Maison Marou, The Baker’s Wife, Ph??c Thành Bakery, Kinh ?ô Bakery, Givral Bakery, Tous Les Jours Vietnam, Paris Baguette Vietnam, Highland Coffee Bakery, Bread & Butter, Sweet Bakery, Bánh Mì Ph??ng, An Phú Bakery, Bánh Mì Hòa Mã contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Artisanal Bakery Products Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Fresh and Organic Products:The Vietnamese market has seen a significant rise in consumer preference for fresh and organic bakery products, with a reported increase of 30% in organic food sales from 2022 to 2023. This trend is driven by heightened awareness of health benefits, as 65% of consumers now prioritize organic ingredients. The World Bank projects that the organic food market in Vietnam will reach $1.7 billion in future, further fueling demand for artisanal bakery products.

- Growth of the Health-Conscious Consumer Segment:The health-conscious segment in Vietnam is expanding rapidly, with 45% of consumers actively seeking healthier food options. This shift is reflected in the bakery sector, where sales of whole grain and low-calorie products have surged by 30% in the past year. The Ministry of Health reports that 75% of urban consumers are now more aware of nutritional information, driving artisanal bakeries to innovate and cater to this growing demographic.

- Rise in Local Artisanal Brands:The emergence of local artisanal brands has transformed the Vietnamese bakery landscape, with over 250 new brands launched in the last two years. This growth is supported by a 20% increase in consumer spending on premium bakery products, as reported by the Vietnam Retail Association. Local brands emphasize quality and unique flavors, appealing to a market that values authenticity and craftsmanship, thus enhancing the artisanal bakery segment's visibility and sales.

Market Challenges

- High Competition from Industrial Bakery Products:The artisanal bakery market faces intense competition from industrial bakery products, which dominate approximately 70% of the market share. These products benefit from economies of scale, allowing them to offer lower prices. The Vietnam Food Industry Association indicates that industrial bakeries are investing heavily in marketing and distribution, making it challenging for smaller artisanal brands to compete effectively in terms of pricing and market reach.

- Fluctuating Raw Material Prices:The artisanal bakery sector is significantly impacted by fluctuating raw material prices, particularly for key ingredients like flour and sugar. In future, wheat prices rose by 25% due to global supply chain disruptions, affecting production costs for bakeries. The Vietnam General Department of Customs reported that sugar prices increased by 20% in the same period, putting additional pressure on artisanal bakers to maintain profitability while ensuring product quality.

Vietnam Artisanal Bakery Products Market Future Outlook

The future of the Vietnam artisanal bakery products market appears promising, driven by evolving consumer preferences and increasing health awareness. As more consumers seek unique and high-quality products, artisanal bakeries are likely to expand their offerings, including gluten-free and vegan options. Additionally, the rise of e-commerce platforms will facilitate greater access to these products, allowing bakeries to reach a broader audience. This trend is expected to enhance market growth and innovation in the coming years.

Market Opportunities

- Expansion into Rural Markets:There is a significant opportunity for artisanal bakeries to expand into rural markets, where demand for quality baked goods is rising. With rural household incomes increasing by 12% annually, bakeries can tap into this growing consumer base, offering fresh and organic products that cater to local tastes and preferences.

- Development of Gluten-Free and Vegan Options:The growing trend towards gluten-free and vegan diets presents a lucrative opportunity for artisanal bakeries. With an estimated 20% of the population actively seeking gluten-free products, bakeries that innovate in this space can capture a dedicated customer segment, enhancing their market presence and profitability.