Region:Middle East

Author(s):Shubham

Product Code:KRAA8933

Pages:86

Published On:November 2025

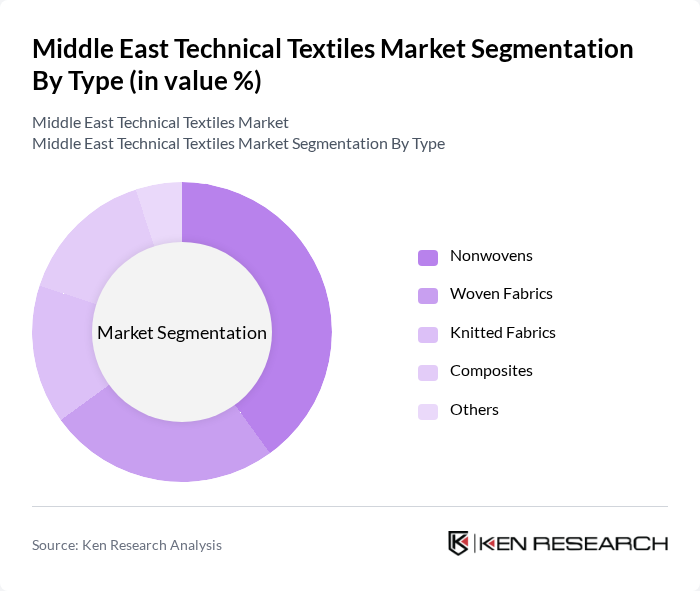

By Type:The technical textiles market is segmented into Nonwovens, Woven Fabrics, Knitted Fabrics, Composites, and Others. Nonwovens lead the market due to their versatility and wide range of applications, particularly in hygiene products, medical textiles, and geotextiles. The demand for Nonwovens is driven by their cost-effectiveness and the growing need for disposable products in healthcare and personal care sectors. Woven Fabrics and Composites are also gaining traction, especially in automotive and construction applications, where strength and durability are paramount .

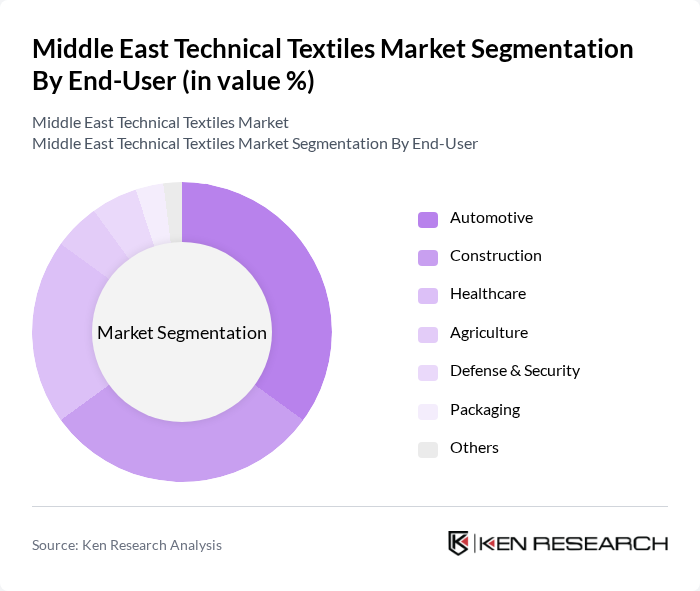

By End-User:The end-user segmentation includes Automotive, Construction, Healthcare, Agriculture, Defense & Security, Packaging, and Others. The Automotive sector is the largest consumer of technical textiles, driven by the increasing demand for lightweight materials that enhance fuel efficiency and safety. The Construction industry follows closely, utilizing technical textiles for geotextiles and reinforcement materials. Healthcare is also a significant segment, with rising demand for medical textiles, including surgical gowns and wound dressings, further propelling market growth .

The Middle East Technical Textiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ahlstrom-Munksjö, Freudenberg Group, DuPont, Berry Global, TenCate, Johns Manville, Herculite Products, Sioen Industries, Tencate Geosynthetics, Asahi Kasei, Solvay, Toray Industries, Mitsubishi Chemical, BASF, Al Abdullatif Industrial Investment Company, Ghadir Petrochemical Company, Advanced Fabrics (SAAF), Saudi German Nonwovens Company (SGN), National Petrochemical Industrial Company (NATPET), Egypt Nonwoven Fabrics Company (ENF) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East technical textiles market appears promising, driven by increasing investments in sustainable practices and technological innovations. As industries prioritize eco-friendly solutions, the demand for advanced textiles is expected to rise significantly. Furthermore, collaborations between manufacturers and research institutions are likely to foster innovation, leading to the development of new applications. The healthcare and automotive sectors will continue to be key drivers, with a focus on enhancing product performance and sustainability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Nonwovens Woven Fabrics Knitted Fabrics Composites Others |

| By End-User | Automotive Construction Healthcare Agriculture Defense & Security Packaging Others |

| By Application | Geotextiles Protective Textiles (ProTech) Industrial Textiles (InduTech) Medical Textiles (MediTech) Agro Textiles (AgroTech) Construction Textiles (BuildTech) Transport Textiles (MobilTech) Packaging Textiles (PackTech) Others |

| By Material | Natural Fibers Synthetic Fibers Mineral Fibers Regenerated Fibers Biodegradable Materials Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Israel, Palestine, Syria, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Iran & Turkey Others |

| By Technology | Spinning Weaving Knitting Finishing Coating and Laminating Nanotechnology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Technical Textiles | 100 | Product Managers, R&D Engineers |

| Medical Textiles Applications | 80 | Healthcare Product Developers, Quality Assurance Managers |

| Construction and Geotextiles | 70 | Project Managers, Civil Engineers |

| Protective Clothing and Fabrics | 50 | Safety Officers, Procurement Managers |

| Smart Textiles and Wearables | 60 | Innovation Managers, Technology Developers |

The Middle East Technical Textiles Market is valued at approximately USD 8.6 billion, reflecting a robust growth trajectory driven by increasing demand for advanced materials across various sectors, including automotive, healthcare, and construction.