Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KRAB1787

Pages:96

Published On:October 2025

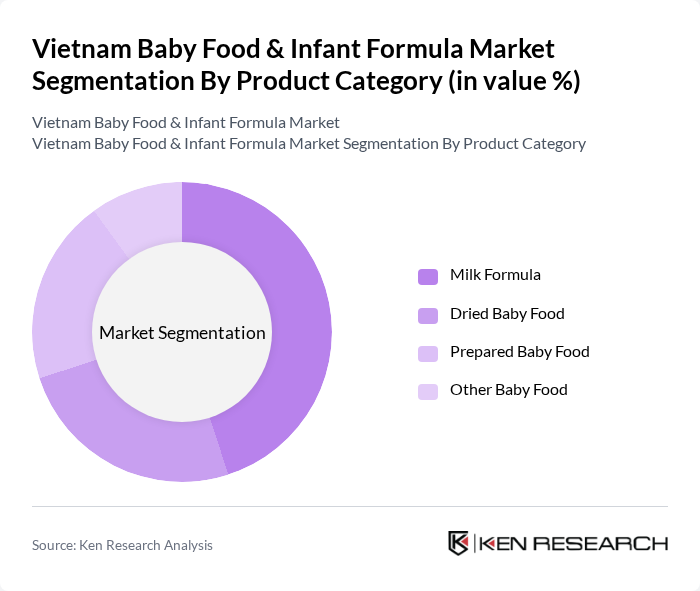

By Product Category:The product category segmentation includes various types of baby food products, each catering to different consumer preferences and nutritional needs. The dominant sub-segment in this category is Milk Formula, which is favored for its convenience and nutritional value. Dried Baby Food and Prepared Baby Food also hold significant market shares, appealing to parents looking for quick and easy meal options for their infants. The Other Baby Food segment, while smaller, includes niche products that cater to specific dietary needs, such as organic or hypoallergenic options, which are gaining traction through online channels.

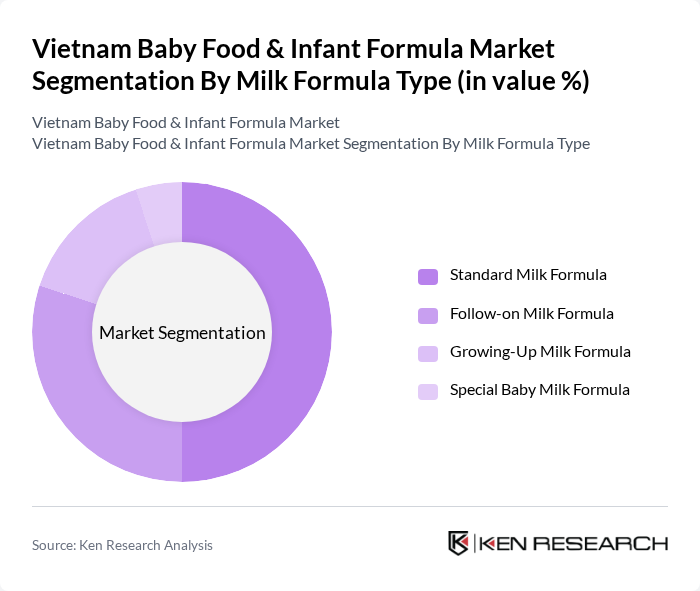

By Milk Formula Type:The milk formula type segmentation includes various formulations designed to meet the nutritional needs of infants at different stages. The Standard Milk Formula is the most widely used, as it provides essential nutrients for infants. Follow-on Milk Formula and Growing-Up Milk Formula are also popular among parents transitioning their children to solid foods. Special Baby Milk Formula caters to infants with specific dietary requirements, although it represents a smaller segment of the market. International brands such as Abbott and Johnson & Johnson enjoy strong consumer trust, while domestic players also compete effectively, especially in value segments.

The Vietnam Baby Food & Infant Formula Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Vietnam Co Ltd, Nestlé Vietnam Co Ltd, Danone Dumex Vietnam Co Ltd, FrieslandCampina Vietnam Co Ltd, Mead Johnson Nutrition (Vietnam) Co Ltd, Meiji Holdings Co Ltd, Glico Dairy Products Co Ltd, Hipp GmbH & Co Vertrieb KG, The Kraft Heinz Company, Nutifood Nutrition Food Joint Stock Company, TH True Milk, Vinamilk, Dutch Lady Vietnam, Gerber Products Company, Wakodo Co Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam baby food and infant formula market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for convenient, nutritious products will rise. Additionally, the increasing penetration of e-commerce platforms will facilitate access to a wider range of products. Brands that adapt to these trends by offering innovative, health-focused solutions and leveraging digital marketing strategies are likely to thrive in this dynamic landscape, ensuring sustained growth and market relevance.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Milk Formula Dried Baby Food Prepared Baby Food Other Baby Food |

| By Milk Formula Type | Standard Milk Formula Follow-on Milk Formula Growing-Up Milk Formula Special Baby Milk Formula |

| By Age Group | Up to 6 Months to 12 Months to 36 Months |

| By Form Type | Solid Liquid |

| By Distribution Channel | Retail Offline Retail E-Commerce |

| By Cities | Ho Chi Minh City Hanoi Hai Phong Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parent Consumer Insights | 100 | Parents of infants aged 0-12 months |

| Pediatric Healthcare Professionals | 50 | Pediatricians, Nutritionists, and Dietitians |

| Retail Sector Feedback | 60 | Store Managers and Baby Product Retailers |

| Online Shopping Behavior | 50 | Parents who purchase baby food online |

| Market Trend Analysts | 40 | Market Researchers and Industry Analysts |

The Vietnam Baby Food & Infant Formula Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by rising disposable incomes, urbanization, and increased awareness of infant nutrition among parents.