Netherlands Baby Food & Infant Formula Market Overview

- The Netherlands Baby Food & Infant Formula Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of infant nutrition, rising disposable incomes, and a growing population of young families. The demand for high-quality and safe baby food products has surged, leading to a competitive landscape among manufacturers.

- Key cities such as Amsterdam, Rotterdam, and The Hague dominate the market due to their high population density and concentration of young families. These urban areas also benefit from better access to retail outlets and online shopping platforms, making it easier for parents to purchase baby food and infant formula products.

- In 2023, the Dutch government implemented regulations requiring stricter labeling and safety standards for baby food products. This regulation aims to ensure that all baby food and infant formula meet high nutritional standards and are free from harmful additives, thereby enhancing consumer trust and safety in the market.

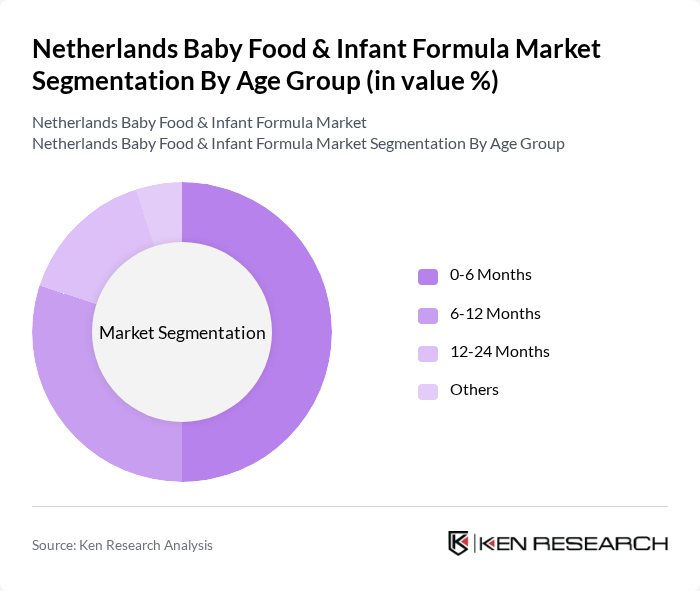

Netherlands Baby Food & Infant Formula Market Segmentation

By Type:The market is segmented into various types of baby food and infant formula products, including Infant Formula, Baby Cereals, Baby Snacks, Baby Purees, Organic Baby Food, Gluten-Free Baby Food, and Others. Among these, Infant Formula is the leading subsegment, driven by the increasing preference for formula feeding among new parents. The demand for organic and gluten-free options is also rising, reflecting a trend towards healthier and more natural food choices for infants.

By Age Group:The age group segmentation includes 0-6 Months, 6-12 Months, 12-24 Months, and Others. The 0-6 Months age group dominates the market, as this is the critical period for infant nutrition and development. Parents are increasingly opting for specialized formulas and baby foods tailored to the nutritional needs of infants in this age range, contributing to the growth of this segment.

Netherlands Baby Food & Infant Formula Market Competitive Landscape

The Netherlands Baby Food & Infant Formula Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone S.A., Nestlé S.A., FrieslandCampina N.V., Hero Group, Hain Celestial Group, Inc., Mead Johnson Nutrition Company, Abbott Laboratories, Perrigo Company plc, Bledina (part of Danone), Holle Baby Food, Organix Brands, Inc., Plum Organics, Baby Gourmet Foods, Inc., Little Spoon, Yumi contribute to innovation, geographic expansion, and service delivery in this space.

Netherlands Baby Food & Infant Formula Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Netherlands has seen a significant rise in health consciousness among parents, with 78% of them prioritizing nutritional quality in baby food. This trend is supported by the Dutch government’s initiatives promoting healthy eating habits, which have led to a 15% increase in organic baby food sales from the previous year to the current year. Furthermore, the World Health Organization emphasizes the importance of proper nutrition in early childhood, further driving demand for high-quality infant products.

- Rising Disposable Income:The average disposable income in the Netherlands is projected to reach €37,000 per household in the future, reflecting a 3% increase from the previous year. This economic growth allows families to allocate more funds towards premium baby food and infant formula products. As parents are willing to invest in higher-quality nutrition for their children, the market for premium and organic baby food is expected to expand significantly, catering to this affluent consumer base.

- Demand for Organic Products:The organic baby food segment in the Netherlands has experienced a remarkable growth rate, with sales increasing by €55 million in the current year alone. This surge is driven by a growing preference for natural ingredients, as 65% of parents express a desire for organic options. The Dutch government’s support for organic farming and sustainable practices further enhances this trend, making organic baby food a key growth driver in the market.

Market Challenges

- Stringent Regulatory Requirements:The Netherlands enforces strict regulations on baby food safety and quality, governed by EU standards. Compliance with these regulations can be costly, with companies spending an average of €1.1 million annually on quality assurance and testing. This financial burden can hinder smaller manufacturers from entering the market, limiting competition and innovation in the sector, which is crucial for meeting evolving consumer demands.

- High Competition:The baby food market in the Netherlands is characterized by intense competition, with over 50 brands vying for market share. Major players like Nutricia and Hero account for approximately 60% of the market, making it challenging for new entrants to establish a foothold. This competitive landscape pressures companies to continuously innovate and differentiate their products, often leading to increased marketing expenditures that can strain profit margins.

Netherlands Baby Food & Infant Formula Market Future Outlook

The future of the Netherlands baby food and infant formula market appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly seek personalized nutrition solutions, companies are likely to invest in research and development to create tailored products. Additionally, the rise of e-commerce platforms will facilitate greater accessibility to diverse product offerings, enhancing consumer convenience and driving market growth. Sustainability will also play a crucial role, influencing product development and packaging innovations.

Market Opportunities

- Expansion of E-commerce Platforms:The e-commerce sector for baby food is projected to grow by €110 million in the future, driven by increased online shopping trends. This growth presents an opportunity for brands to reach a wider audience, particularly tech-savvy parents who prefer the convenience of online purchasing. Enhanced digital marketing strategies can further capitalize on this trend, boosting brand visibility and sales.

- Innovations in Product Offerings:There is a growing demand for innovative baby food products, particularly those that cater to specific dietary needs. The introduction of fortified and allergen-free options can capture a significant market share, as 30% of parents express interest in specialized nutrition. Companies that invest in product innovation can differentiate themselves and meet the diverse needs of modern families, driving growth in this segment.