Region:Europe

Author(s):Geetanshi

Product Code:KRAB1520

Pages:82

Published On:October 2025

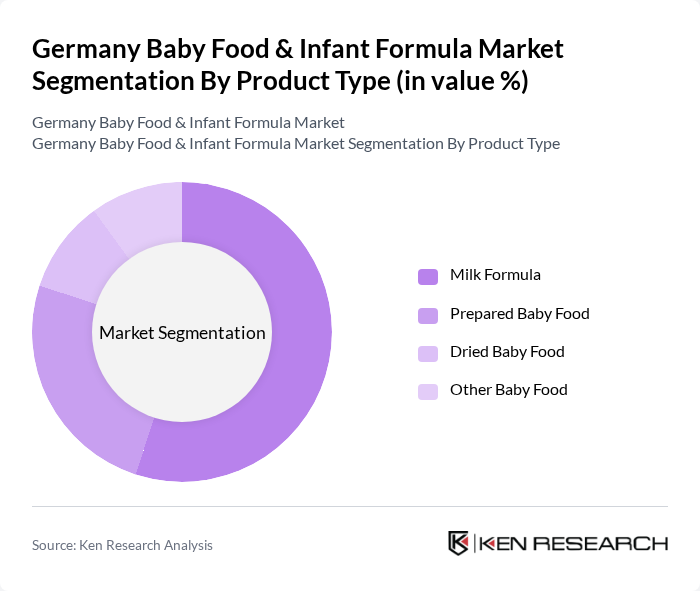

By Product Type:The product type segmentation includes milk formula, prepared baby food, dried baby food, and other baby food. Among these, milk formula is the most significant segment, driven by its essential role in infant nutrition and its convenience for parents. Standard formula and follow-on formula are particularly popular due to their nutritional adequacy and ease of use. Prepared baby food is also gaining traction as parents increasingly seek ready-to-eat and convenient options for their infants .

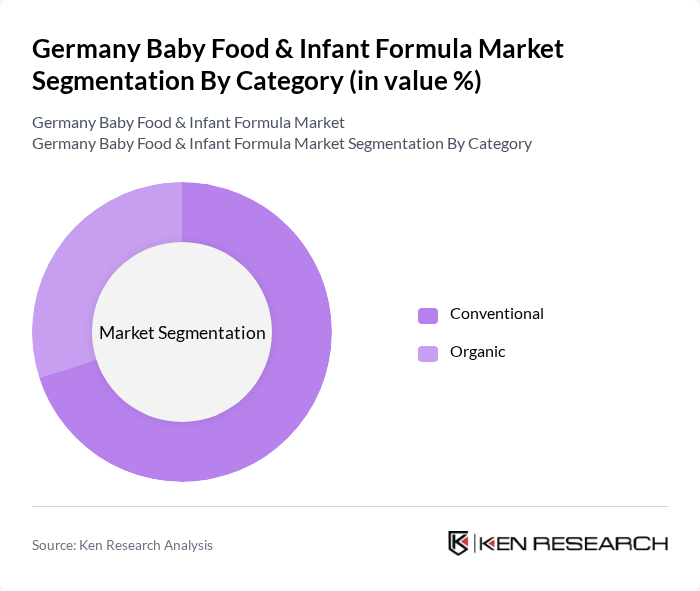

By Category:The category segmentation includes conventional and organic products. The organic segment is witnessing significant growth as parents increasingly prefer products made from natural ingredients without artificial additives. This trend is driven by a growing awareness of health and wellness, as well as environmental sustainability, leading to a preference for organic baby food options. Conventional products continue to hold a substantial market share due to their affordability and broad availability .

The Germany Baby Food & Infant Formula Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Hero Group, Mead Johnson Nutrition Company (Reckitt Benckiser Group plc), Hain Celestial Group, Inc., FrieslandCampina, Abbott Laboratories, Milupa GmbH (Danone), Holle baby food GmbH, HiPP GmbH & Co. Vertrieb KG, Bimbosan AG, I Love You Veggie Much GmbH, Babybio (Vitagermine SAS), Nutricia GmbH (Danone), and Töpfer GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the baby food and infant formula market in Germany appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on health and sustainability will likely shape product development, with brands innovating to meet these demands. Additionally, the rise of digital marketing and e-commerce will enhance brand visibility and accessibility, allowing companies to reach a broader audience. As parents continue to seek high-quality, nutritious options, the market is poised for sustained growth in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Milk Formula Standard Formula Follow-on Formula Growing-Up Formula Specialty Formula Prepared Baby Food Dried Baby Food Other Baby Food |

| By Category | Conventional Organic |

| By Age Group | Below 6 Months –12 Months –24 Months Months + |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies and Drugstores Convenience Stores Online Retail Stores Other Distribution Channels |

| By Packaging Type | Cans/Tins Jars Pouches Stick Packs/Sachets Others |

| By Ingredient Source | Cow Milk-Based Goat Milk-Based Plant-Based |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Category Buyers |

| Healthcare Professional Opinions | 80 | Pediatricians, Nutritionists |

| Consumer Preferences Survey | 120 | Parents of infants and toddlers |

| Manufacturers' Perspectives | 60 | Product Development Managers, Marketing Directors |

| Distribution Channel Analysis | 50 | Logistics Managers, E-commerce Specialists |

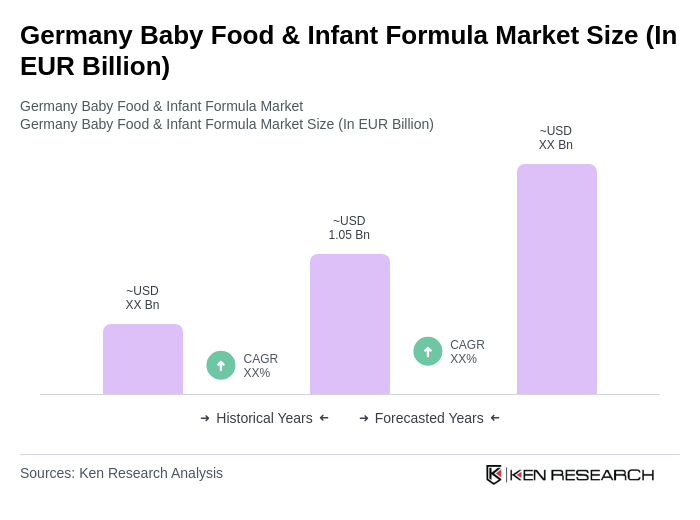

The Germany Baby Food & Infant Formula Market is valued at approximately EUR 1.05 billion, reflecting a significant growth trend driven by factors such as increased parental awareness of nutrition and a rise in disposable income among families.