Region:Asia

Author(s):Dev

Product Code:KRAA8364

Pages:97

Published On:November 2025

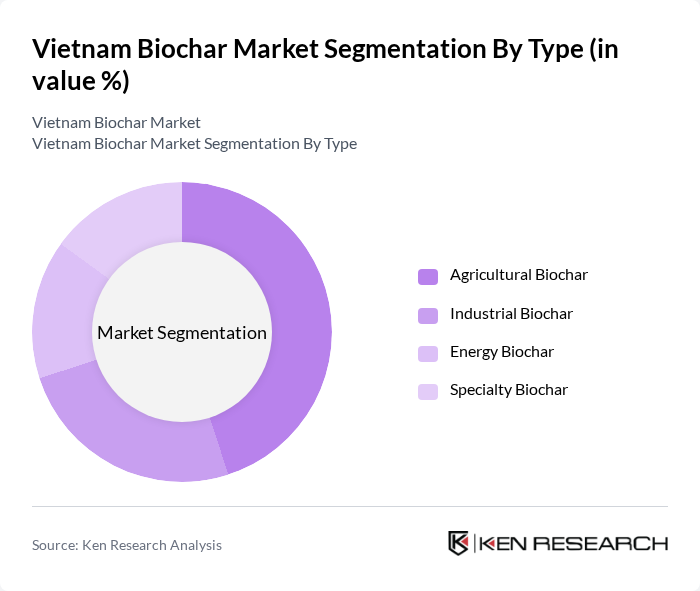

By Type:The Vietnam biochar market is segmented into four main types: Agricultural Biochar, Industrial Biochar, Energy Biochar, and Specialty Biochar. Agricultural Biochar is primarily applied to enhance soil fertility and crop yield, supporting sustainable farming. Industrial Biochar is used in various industrial processes, including construction and environmental remediation. Energy Biochar serves as a renewable energy source, while Specialty Biochar is tailored for applications such as water filtration and livestock feed. The market is witnessing increased adoption of high-carbon-content biochar, meeting international standards for carbon credits and environmental impact .

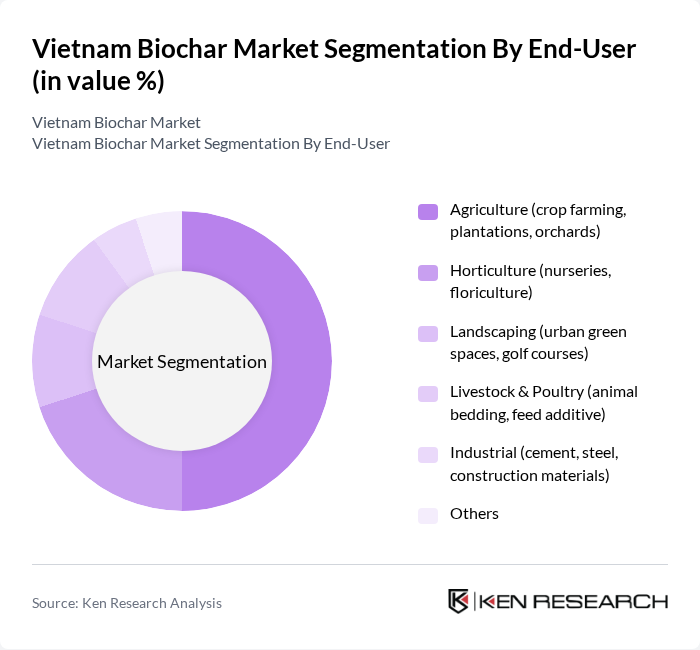

By End-User:The end-user segmentation comprises Agriculture, Horticulture, Landscaping, Livestock & Poultry, Industrial, and Others. Agriculture remains the largest segment, driven by the need for improved soil health, crop productivity, and sustainable farming practices. Horticulture and Landscaping are significant growth areas, with biochar increasingly used in urban green spaces and ornamental gardening. Livestock & Poultry applications focus on animal bedding and feed additives, improving barn environments and animal health. Industrial applications leverage biochar in construction materials and cement, while the “Others” category includes emerging uses such as water treatment and environmental remediation .

The Vietnam Biochar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Biochar Company Ltd., Green Carbon Vietnam Co., Ltd., Biogreen Vietnam JSC, VinaChar (Vina Biochar Technology JSC), BIWASE (Binh Duong Water – Environment Joint Stock Company), BioFix Fresh Vietnam, Thanh Cong Biochar Co., Ltd., Ecochar Vietnam (Ecochar Technology Co., Ltd.), VietGreen Biochar Solutions, Biochar Production Group (BPG) Vietnam, Green Energy Vietnam JSC, Biochar Research Institute – Vietnam National University of Agriculture, Mekong Biochar Initiative, Biochar for Life Vietnam (ADRA Vietnam Project), Biochar Development Center – Institute of Agricultural Environment contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam biochar market is poised for significant growth, driven by increasing agricultural productivity and a shift towards sustainable farming practices. As awareness of biochar's benefits expands, coupled with government support for renewable energy initiatives, adoption rates are expected to rise. Innovations in biochar production technologies will further enhance its appeal. The integration of biochar into urban gardening and landscaping will also create new avenues for market expansion, positioning Vietnam as a leader in sustainable agricultural solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Agricultural Biochar Industrial Biochar Energy Biochar Specialty Biochar (e.g., for water filtration, livestock feed) |

| By End-User | Agriculture (crop farming, plantations, orchards) Horticulture (nurseries, floriculture) Landscaping (urban green spaces, golf courses) Livestock & Poultry (animal bedding, feed additive) Industrial (cement, steel, construction materials) Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Application | Soil Amendment Carbon Sequestration Waste Management (biomass, municipal waste) Water Filtration & Remediation Animal Husbandry Others |

| By Production Method | Pyrolysis (slow, fast, and flash) Gasification Hydrothermal Carbonization Open/Traditional Kilns Others |

| By Market Channel | Direct Sales (B2B, institutional buyers) Distributors & Dealers Online Sales (e-commerce platforms, company websites) Agricultural Cooperatives Others |

| By Policy Support | Government Grants Tax Incentives Research Funding International Development Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Biochar Usage | 120 | Farmers, Agricultural Extension Officers |

| Biochar Production Facilities | 60 | Plant Managers, Production Supervisors |

| Environmental Impact Assessments | 50 | Environmental Consultants, Policy Makers |

| Research Institutions on Soil Health | 40 | Soil Scientists, Agronomy Researchers |

| Biochar Market Distributors | 45 | Sales Managers, Distribution Coordinators |

The Vietnam Biochar Market is valued at approximately USD 120 million, driven by increasing awareness of sustainable agricultural practices, government support for eco-friendly technologies, and rising demand for soil enhancement products.