Region:Asia

Author(s):Geetanshi

Product Code:KRAD7251

Pages:82

Published On:December 2025

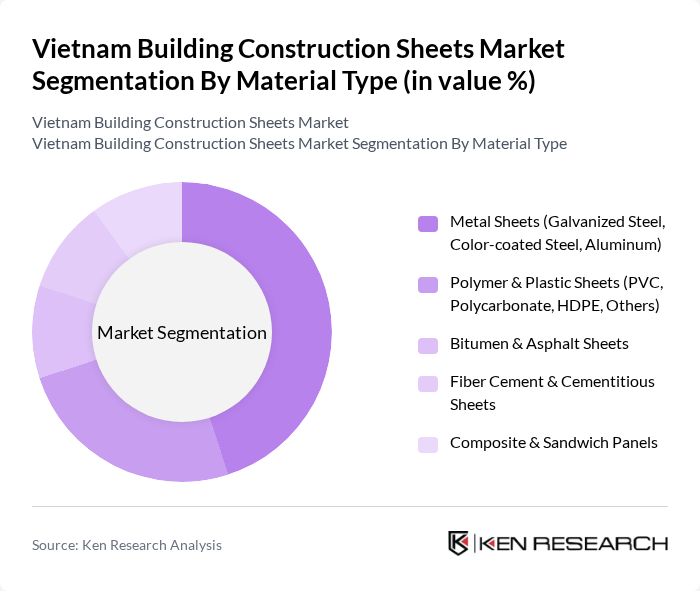

By Material Type:The market is segmented into various material types, including Metal Sheets, Polymer & Plastic Sheets, Bitumen & Asphalt Sheets, Fiber Cement & Cementitious Sheets, and Composite & Sandwich Panels. Among these, Metal Sheets, particularly galvanized steel and color-coated steel, dominate the market due to their strength, durability, and versatility in construction applications. The increasing preference for lightweight and corrosion-resistant materials further drives the demand for metal sheets.

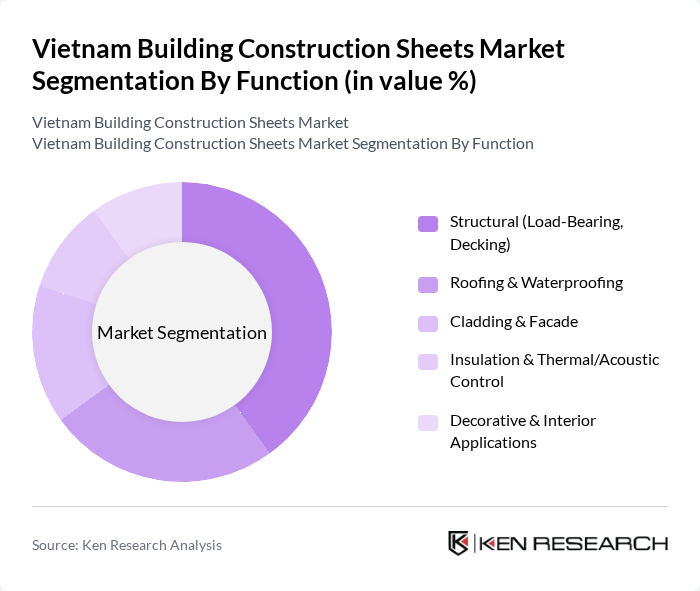

By Function:The market is categorized based on functions such as Structural, Roofing & Waterproofing, Cladding & Facade, Insulation & Thermal/Acoustic Control, and Decorative & Interior Applications. The Structural segment, which includes load-bearing and decking applications, is the leading segment due to the increasing demand for robust construction solutions in both residential and commercial projects. The focus on safety and durability in construction practices further enhances the growth of this segment.

The Vietnam Building Construction Sheets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hoa Sen Group JSC, Tôn ?ông Á Corporation, Vietnam Steel Corporation (VNSteel), Hòa Phát Group JSC, Nam Kim Steel JSC, Sika Vietnam Co., Ltd., Saint-Gobain Vietnam Co., Ltd. (Gyproc, V?nh T??ng, Weber), Ph??ng Nam Plastic JSC, Austnam JSC (Austnam Roofing Sheets), V?nh T??ng Industrial Corporation, Bình Minh Plastics JSC, An Phát Holdings JSC, ??ng Nai Plastics JSC, Tân Á ??i Thành Group, Hoa Sen Building Materials Distribution Network (Exclusive & Franchise Outlets) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam building construction sheets market is poised for significant growth, driven by urbanization and government infrastructure investments. As the demand for sustainable materials rises, manufacturers are likely to innovate and adapt to eco-friendly practices. Additionally, the integration of smart technologies in construction is expected to enhance efficiency and reduce costs. Overall, the market is set to evolve, presenting opportunities for companies that can navigate regulatory challenges and capitalize on emerging trends in construction.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Metal Sheets (Galvanized Steel, Color-coated Steel, Aluminum) Polymer & Plastic Sheets (PVC, Polycarbonate, HDPE, Others) Bitumen & Asphalt Sheets Fiber Cement & Cementitious Sheets Composite & Sandwich Panels |

| By Function | Structural (Load-Bearing, Decking) Roofing & Waterproofing Cladding & Facade Insulation & Thermal/Acoustic Control Decorative & Interior Applications |

| By Application | Roofing & Roof Coverings Wall Cladding & Facades Flooring & Decking Ceilings & Partitions Skylights, Canopies & Greenhouses |

| By End-User Sector | Residential Buildings Commercial Buildings (Retail, Offices, Hospitality) Industrial & Logistics Facilities Infrastructure & Public Buildings Agricultural & Farm Structures |

| By Thickness Category | ?0.5 mm –1.0 mm –3.0 mm >3.0 mm |

| By Distribution Channel | Direct Project Sales (B2B & EPC Contracts) Building Material Dealers & Retailers Modern Trade & Home Improvement Stores Online & E-procurement Platforms Distributors & Importers |

| By Region | Northern Vietnam (Including Hanoi, Hai Phong & Surrounding Provinces) Central Vietnam (Including Da Nang & Central Coastal Provinces) Southern Vietnam (Including Ho Chi Minh City, Binh Duong & Dong Nai) Other Emerging Provinces |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Supervisors |

| Commercial Building Developments | 100 | Architects, Construction Managers |

| Infrastructure Projects (Roads, Bridges) | 80 | Civil Engineers, Procurement Officers |

| Material Suppliers and Distributors | 70 | Sales Managers, Supply Chain Directors |

| Regulatory and Compliance Experts | 50 | Policy Advisors, Industry Analysts |

The Vietnam Building Construction Sheets Market is valued at approximately USD 1.1 billion, driven by urbanization, population growth, and increased demand for durable building materials. This growth is supported by government initiatives and investments in the construction sector.