Region:Asia

Author(s):Geetanshi

Product Code:KRAD7318

Pages:95

Published On:December 2025

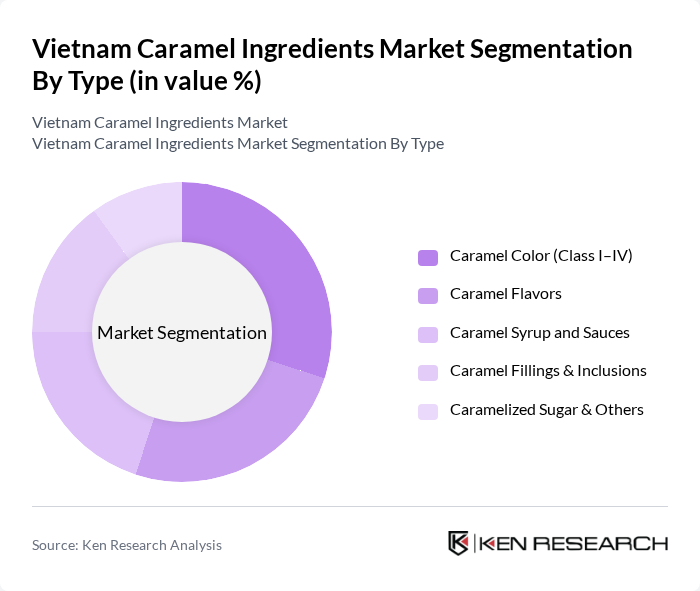

By Type:The caramel ingredients market can be segmented into various types, including caramel color (Class I–IV), caramel flavors, caramel syrup and sauces, caramel fillings & inclusions, and caramelized sugar & others. Each of these subsegments plays a crucial role in the overall market dynamics, catering to different applications and consumer preferences.

The caramel color segment, particularly Class IV, is dominating the market due to its widespread use in various food products, including beverages and baked goods. This segment is favored for its ability to enhance the visual appeal of products without altering their flavor significantly. The increasing trend towards natural and clean-label products has also led to a rise in demand for caramel colors that meet these consumer preferences. As a result, manufacturers are focusing on developing high-quality caramel colors that comply with safety regulations, further solidifying this segment's leadership in the market.

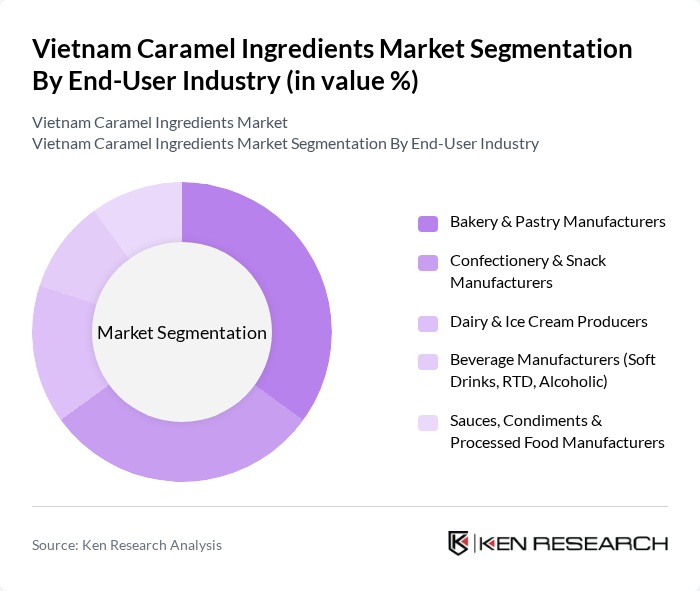

By End-User Industry:The end-user industries for caramel ingredients include bakery & pastry manufacturers, confectionery & snack manufacturers, dairy & ice cream producers, beverage manufacturers (soft drinks, RTD, alcoholic), and sauces, condiments & processed food manufacturers. Each of these industries utilizes caramel ingredients for various applications, contributing to the overall market growth.

The bakery and pastry manufacturers segment is leading the market due to the high demand for caramel in various baked goods, including cakes, cookies, and pastries. The trend towards indulgent and premium bakery products has driven the need for high-quality caramel ingredients that enhance flavor and texture. Additionally, the growing popularity of artisanal and gourmet baked goods has further fueled the demand for caramel, making this segment a key player in the overall market landscape.

The Vietnam Caramel Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated (Cargill Vietnam), Kerry Group plc (Kerry Vietnam), Archer Daniels Midland Company (ADM), Sensient Technologies Corporation, Givaudan SA, Symrise AG, Tate & Lyle PLC, Ingredion Incorporated, Mane Vietnam Co., Ltd., Firmenich (dsm-firmenich), Brenntag Vietnam Co., Ltd., DKSH Vietnam Co., Ltd., FONA International (a McCormick & Company brand), Vi?t H??ng Food Flavor & Ingredients Co., Ltd., IFF (International Flavors & Fragrances Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam caramel ingredients market appears promising, driven by increasing consumer demand for natural and clean label products. Innovations in production techniques are expected to enhance efficiency and reduce costs, while the growing popularity of caramel in various food applications will further stimulate market growth. Additionally, as the export potential expands, Vietnamese manufacturers may find new opportunities in international markets, contributing to the overall development of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Caramel Color (Class I–IV) Caramel Flavors Caramel Syrup and Sauces Caramel Fillings & Inclusions Caramelized Sugar & Others |

| By End-User Industry | Bakery & Pastry Manufacturers Confectionery & Snack Manufacturers Dairy & Ice Cream Producers Beverage Manufacturers (Soft Drinks, RTD, Alcoholic) Sauces, Condiments & Processed Food Manufacturers |

| By Application Function | Coloring Agent Flavoring Agent Sweetener / Caramelized Sugar Texturizing & Topping Applications |

| By Sales / Distribution Channel | Direct Sales to Food & Beverage Manufacturers Sales via Distributors & Importers Online B2B Platforms Wholesale & Foodservice Channels Others |

| By Region | Northern Vietnam (Hanoi, Hai Phong and surrounding) Central Vietnam (Da Nang and surrounding) Southern Vietnam (Ho Chi Minh City and Mekong Delta) |

| By Product Form | Liquid Caramel Paste & Syrup Caramel Powdered / Granulated Caramel Others (Chunks, Chips, Flakes) |

| By Packaging Type | Bulk Industrial Packaging (Drums, IBCs, Bags) Foodservice Packaging Retail & Small Pack Formats |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Confectionery Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Bakery Product Developers | 80 | R&D Managers, Ingredient Sourcing Specialists |

| Dairy Product Manufacturers | 70 | Production Managers, Flavor Technologists |

| Food Safety Regulators | 40 | Compliance Officers, Regulatory Affairs Managers |

| Ingredient Distributors | 60 | Sales Managers, Supply Chain Coordinators |

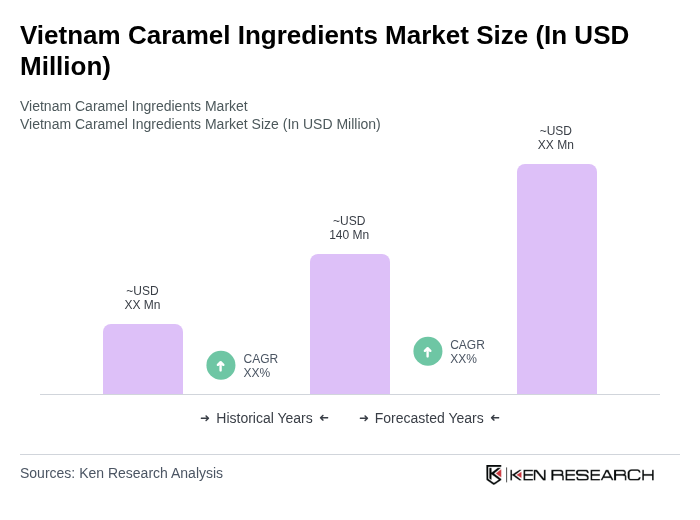

The Vietnam Caramel Ingredients Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increasing demand across various food and beverage applications, including bakery products, confectionery, and dairy items.