Region:Asia

Author(s):Geetanshi

Product Code:KRAD4151

Pages:83

Published On:December 2025

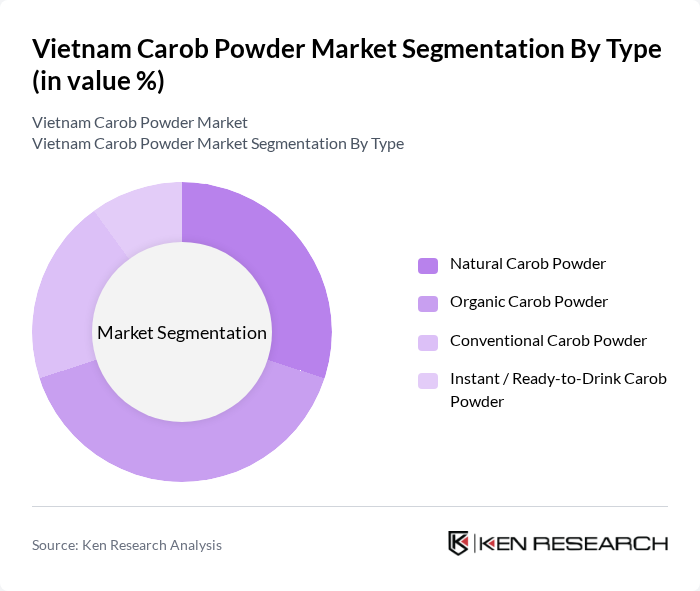

By Type:The carob powder market can be segmented into four types: Natural Carob Powder, Organic Carob Powder, Conventional Carob Powder, and Instant / Ready-to-Drink Carob Powder. Each type caters to different consumer preferences and applications, with organic and minimally processed natural options gaining traction due to health trends, rising demand for clean labels, and a shift toward plant-based ingredients in bakery, confectionery, and beverage formulations.

The Organic Carob Powder segment is currently leading the market due to the increasing consumer preference for organic and health-oriented products, consistent with global growth in organic carob offerings. This trend is driven by a growing awareness of the health benefits associated with organic foods, including lower pesticide exposure and alignment with clean-label positioning. Additionally, the rise of veganism, dairy- and caffeine-free diets, and broader plant-based eating has further propelled the demand for organic carob powder, as it serves as a natural alternative to chocolate and other sweeteners in snacks, beverages, and bakery applications.

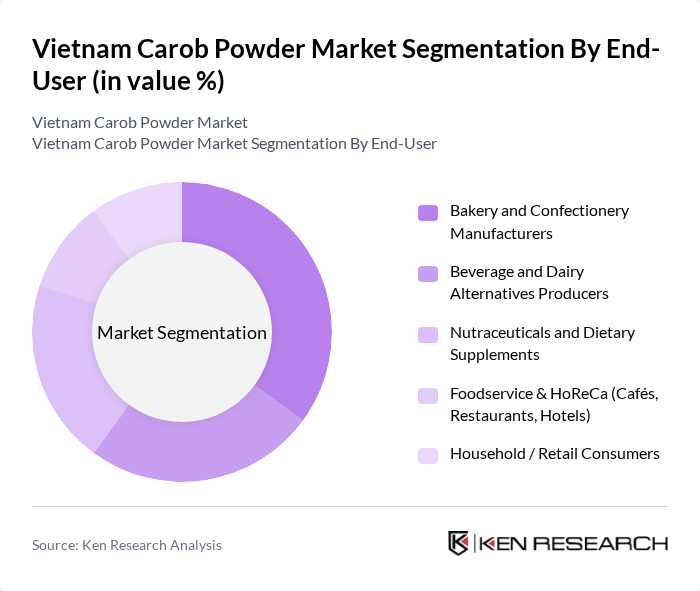

By End-User:The market can be segmented based on end-users into Bakery and Confectionery Manufacturers, Beverage and Dairy Alternatives Producers, Nutraceuticals and Dietary Supplements, Foodservice & HoReCa (Cafés, Restaurants, Hotels), and Household / Retail Consumers. Each segment has unique requirements and preferences that influence their purchasing decisions, mirroring global usage patterns where bakery and confectionery, followed by beverages and nutraceuticals, are the leading demand centers for carob powder.

The Bakery and Confectionery Manufacturers segment is the dominant player in the market, driven by the increasing incorporation of carob powder in baked goods, snack bars, and confectionery products, in line with its leading share in global applications. The versatility of carob powder as a natural sweetener, colorant, and flavoring agent makes it a preferred choice among manufacturers looking to cater to health-conscious consumers seeking caffeine-free, gluten-free, and lower-sugar options. Additionally, the growing trend of gluten-free, allergen-free, and vegan products has further enhanced the appeal of carob powder in this segment, particularly in chocolate alternatives, cookies, cakes, and functional snack formats.

The Vietnam Carob Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Erca Group (Erca Spa), The Australian Carob Co., The Carob Kitchen, Euroduna Food Ingredients GmbH, JBS Group (Carob Supply / Carobs Direct), Pedro Pérez, S.A., Lewis Confectionery Pty Ltd, Algarrobos Organicos del Peru S.A.C., Creta Carob S.A., Carob S.A., Savvy Foods Ltd, Sanei Dairy Food Co., Ltd. (Carob Powder Division), Vietnam Organic Agriculture JSC (VOA), Vinamit JSC, The Fruit Republic Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space, reflecting the globally fragmented but steadily professionalizing nature of the carob powder supply chain.

The future of the Vietnam carob powder market appears promising, driven by increasing health awareness and a shift towards natural ingredients. As consumers continue to seek healthier alternatives, the demand for carob powder is expected to rise significantly. Innovations in product applications, particularly in the bakery and snack sectors, will further enhance its market presence. Additionally, the growth of e-commerce platforms will facilitate wider distribution, making carob powder more accessible to consumers across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Carob Powder Organic Carob Powder Conventional Carob Powder Instant / Ready-to-Drink Carob Powder |

| By End-User | Bakery and Confectionery Manufacturers Beverage and Dairy Alternatives Producers Nutraceuticals and Dietary Supplements Foodservice & HoReCa (Cafés, Restaurants, Hotels) Household / Retail Consumers |

| By Packaging Type | Industrial Bulk (Bags, Sacks, Big Bags) Retail Pouches and Stand-up Packs Jars, Tins, and Canisters Eco-friendly & Recyclable Packaging |

| By Distribution Channel | B2B (Direct Sales, Distributors, Importers) Modern Trade (Supermarkets/Hypermarkets) Specialty & Health Food Stores Online Retail & E-commerce Platforms |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Export-oriented Production Clusters |

| By Application | Bakery Products Confectionery (Bars, Chips, Spreads) Beverages and Ready-to-Drink Mixes Dairy and Non-Dairy Alternatives Nutraceuticals and Functional Foods |

| By Consumer Demographics | Health-conscious and Weight-management Consumers Diabetic and Sugar-sensitive Consumers Vegan and Plant-based Lifestyle Consumers Premium and Export-focused Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Specialists |

| Health Food Retailers | 90 | Store Managers, Purchasing Agents |

| Organic Product Suppliers | 80 | Sales Directors, Supply Chain Managers |

| Agricultural Experts and Growers | 70 | Farm Owners, Agricultural Consultants |

| Nutritionists and Health Coaches | 60 | Registered Dietitians, Wellness Coaches |

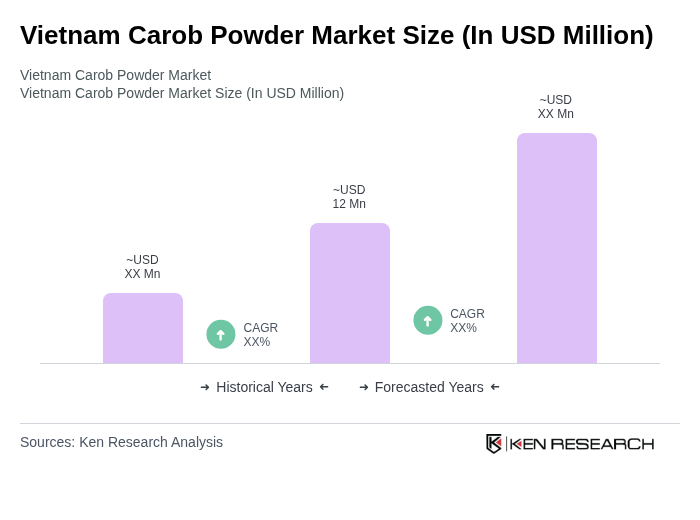

The Vietnam Carob Powder Market is valued at approximately USD 12 million, reflecting a growing demand for natural and organic food products, driven by increasing health consciousness among consumers and the expanding applications of carob powder in various food sectors.