Region:Asia

Author(s):Geetanshi

Product Code:KRAD7301

Pages:83

Published On:December 2025

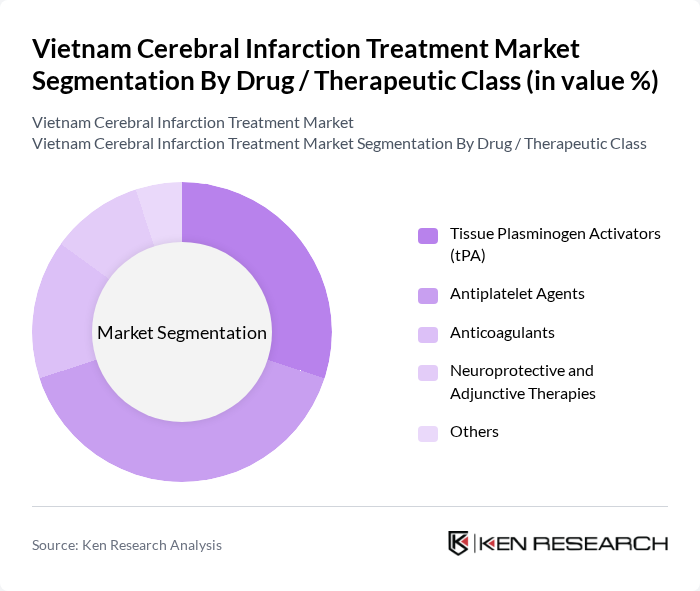

By Drug / Therapeutic Class:The market is segmented into various therapeutic classes that cater to the treatment of cerebral infarction. The leading sub-segment is Antiplatelet Agents, which are widely used for long?term secondary prevention of ischemic stroke and transient ischemic attack due to their effectiveness in preventing further clot formation. Tissue Plasminogen Activators (tPA) also hold a significant share in value terms, especially in acute treatment scenarios within the recommended therapeutic window, given their high unit cost and central role in reperfusion therapy. Anticoagulants are increasingly used for cardioembolic stroke related to atrial fibrillation and other high?risk conditions, while Neuroprotective and Adjunctive therapies (including agents targeting cerebral edema, neuroinflammation, and supportive care) are gaining traction as supportive treatments in comprehensive stroke pathways. The Others category includes emerging therapies such as novel thrombolytics, neuroregenerative agents, and combination regimens that are under clinical evaluation or in early commercialization stages.

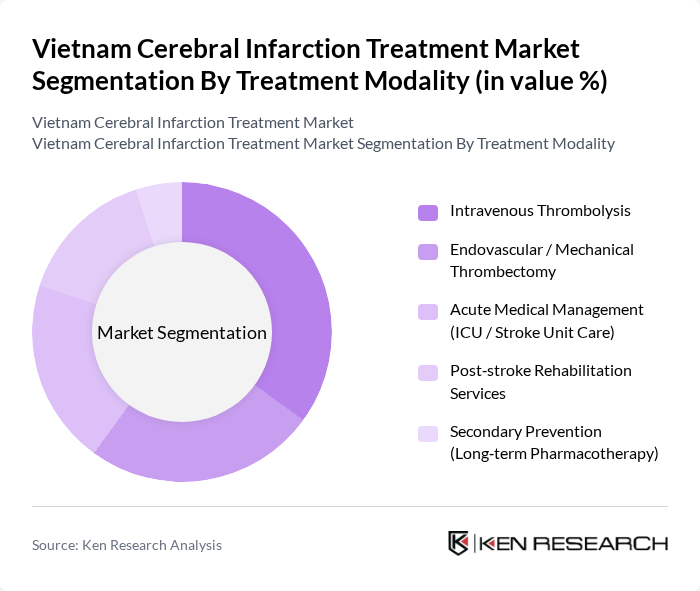

By Treatment Modality:The treatment modalities for cerebral infarction include various approaches tailored to patient needs along the acute–to?chronic care continuum. Intravenous Thrombolysis with agents such as alteplase or tenecteplase remains the most commonly applied reperfusion technique for eligible acute ischemic stroke patients in Vietnam, particularly in tertiary hospitals with established stroke protocols. Endovascular/Mechanical Thrombectomy is gaining rapid adoption for large?vessel occlusion cases as more comprehensive stroke centers invest in neurointerventional suites, specialized devices, and trained interventional neurologists and neurosurgeons. Acute Medical Management and Post-stroke Rehabilitation Services, including ICU or stroke unit monitoring, early mobilization, physiotherapy, occupational and speech therapy, are essential for reducing disability and improving functional outcomes, and they represent a growing share of total stroke?related expenditure. Secondary Prevention (long?term pharmacotherapy with antiplatelets, anticoagulants, statins, antihypertensives, and diabetes management) is a core component of chronic care models and is increasingly supported by national non?communicable disease strategies and primary care programs.

The Vietnam Cerebral Infarction Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinmec Healthcare System (Vinmec Times City International Hospital and network), FV Hospital (Franco-Vietnamese Hospital), Cho Ray Hospital, Bach Mai Hospital – Stroke Center, Viet Duc University Hospital, 108 Military Central Hospital, Hue Central Hospital, Da Nang General Hospital, Ho Chi Minh City University of Medicine and Pharmacy Hospital, Hanoi Medical University Hospital, People’s Hospital 115 – Stroke Center, National Institute of Neurology and Neurosurgery (Vietnam National Hospital of Neurology and Neurosurgery), An Sinh Hospital, Phu Tho Provincial General Hospital – Stroke Center, Thanh Hoa Provincial General Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam cerebral infarction treatment market appears promising, driven by ongoing advancements in medical technology and increased public awareness. As the government continues to invest in healthcare infrastructure, the accessibility of specialized treatment facilities is expected to improve. Additionally, the integration of telemedicine and AI in stroke management will likely enhance patient care. These developments will create a more robust framework for addressing the growing incidence of cerebral infarction, ultimately leading to better health outcomes for patients.

| Segment | Sub-Segments |

|---|---|

| By Drug / Therapeutic Class | Tissue Plasminogen Activators (tPA) Antiplatelet Agents Anticoagulants Neuroprotective and Adjunctive Therapies Others |

| By Treatment Modality | Intravenous Thrombolysis Endovascular / Mechanical Thrombectomy Acute Medical Management (ICU / Stroke Unit Care) Post?stroke Rehabilitation Services Secondary Prevention (Long?term Pharmacotherapy) |

| By Care Setting / End-User | Tertiary and Central Hospitals (Comprehensive Stroke Centers) Provincial and District General Hospitals Specialized Neurology and Rehabilitation Centers Private Hospitals and Clinics Others |

| By Route of Administration | Intravenous Intra-arterial Oral Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Payer / Reimbursement Type | Vietnam Social Security (Public Health Insurance) Private Health Insurance Out-of-Pocket Payments Others |

| By Patient Profile | Age Group (18–44 years, 45–64 years, 65+ years) First-ever Stroke vs Recurrent Stroke Time-to-Hospital Arrival (<3 hours, 3–4.5 hours, >4.5 hours) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurology Clinics | 100 | Neurologists, Clinic Managers |

| Rehabilitation Centers | 80 | Rehabilitation Specialists, Physiotherapists |

| General Hospitals | 120 | Emergency Room Physicians, Stroke Care Coordinators |

| Patient Support Groups | 60 | Stroke Survivors, Caregivers |

| Health Insurance Providers | 40 | Health Policy Analysts, Claims Managers |

The Vietnam Cerebral Infarction Treatment Market is valued at approximately USD 220 million, driven by factors such as the increasing prevalence of stroke, an aging population, and advancements in treatment options like thrombolysis and mechanical thrombectomy.