Region:Asia

Author(s):Rebecca

Product Code:KRAB2881

Pages:82

Published On:October 2025

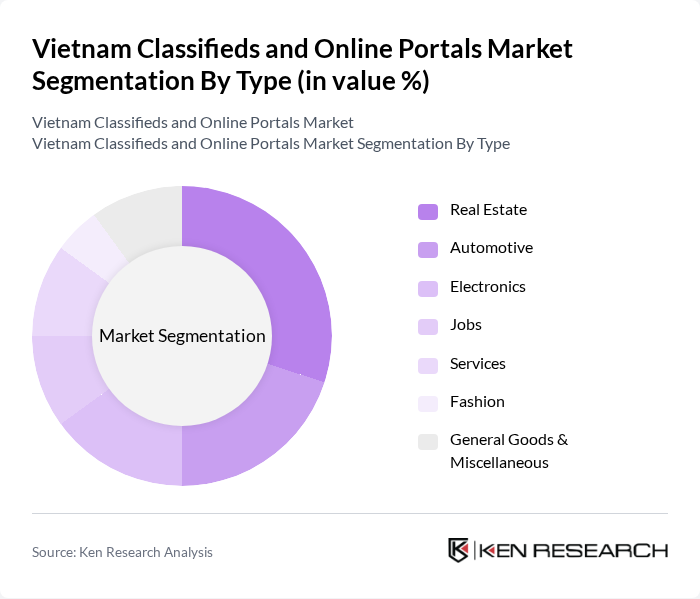

By Type:The market can be segmented into various types, including Real Estate, Automotive, Electronics, Jobs, Services, Fashion, and General Goods & Miscellaneous. Each of these segments caters to different consumer needs and preferences, with Real Estate and Automotive remaining dominant due to high-value transactions, while Electronics and Jobs benefit from rapid digital adoption and urban workforce mobility .

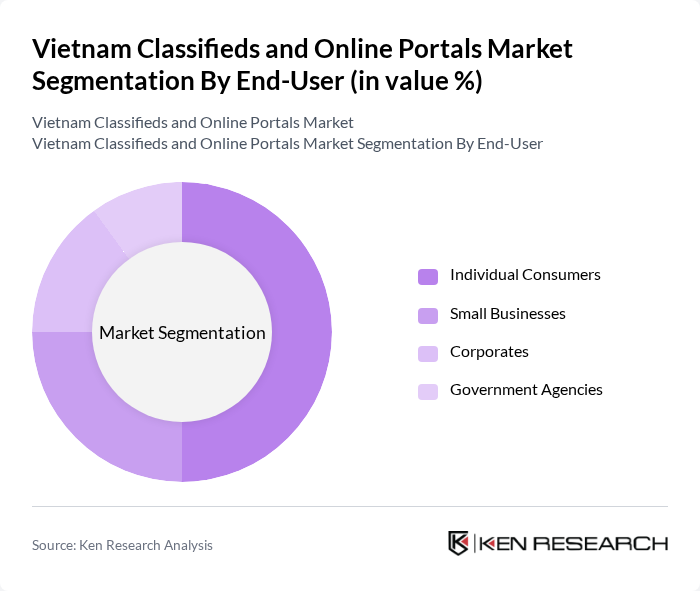

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporates, and Government Agencies. Each segment has distinct requirements and usage patterns, with individual consumers driving the bulk of transactions, and small businesses and corporates leveraging digital classifieds for reach and cost efficiency .

The Vietnam Classifieds and Online Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chotot.com, Muaban.net, Sendo.vn, Tiki.vn, Lazada.vn, FPT Telecom, VNG Corporation, Shopee.vn, 5giay.vn, Vatgia.com, Rongbay.com, Nhadat24h.net, Timnhanh.com, Muabannhadat.vn, Batdongsan.com.vn, Dothi.net, MuaBanNhanh.com, Baokim.vn contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Vietnam classifieds and online portals market appears promising, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to expand, platforms that prioritize user experience and security will likely thrive. Additionally, the integration of AI and machine learning will enhance personalization, making online shopping more efficient. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture emerging market opportunities and address existing challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Electronics Jobs Services Fashion General Goods & Miscellaneous |

| By End-User | Individual Consumers Small Businesses Corporates Government Agencies |

| By Sales Channel | Online Platforms Mobile Applications Social Commerce (e.g., Facebook, TikTok Shop) Offline Listings |

| By Geographic Coverage | Urban Areas Rural Areas Regional Markets |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Product Condition | New Used Refurbished |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales | 60 | Car Dealership Owners, Sales Managers |

| Job Portals | 110 | HR Managers, Recruitment Consultants |

| Consumer Goods Marketplace | 80 | Small Business Owners, E-commerce Managers |

| Service Listings (e.g., home services) | 50 | Service Providers, Business Development Managers |

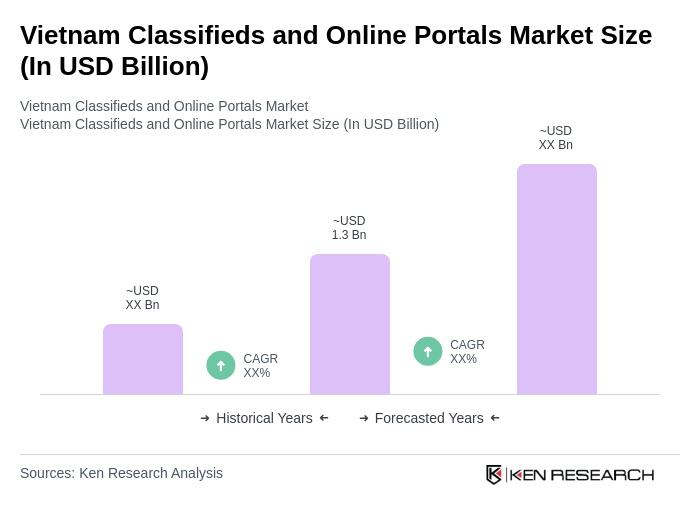

The Vietnam Classifieds and Online Portals Market is valued at approximately USD 1.3 billion, driven by increased internet penetration, mobile device usage, and a growing preference for online shopping among consumers.