Region:Central and South America

Author(s):Rebecca

Product Code:KRAA6936

Pages:90

Published On:September 2025

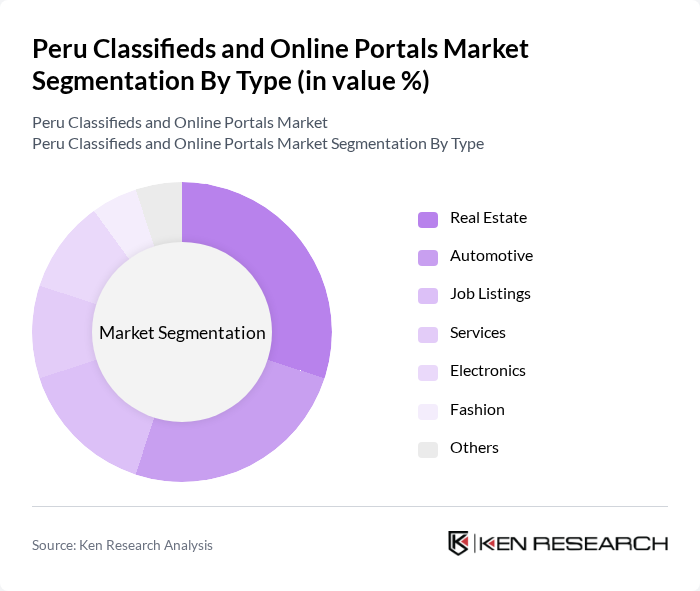

By Type:The market is segmented into various types, including Real Estate, Automotive, Job Listings, Services, Electronics, Fashion, and Others. Each of these segments caters to different consumer needs and preferences, with varying levels of demand and competition.

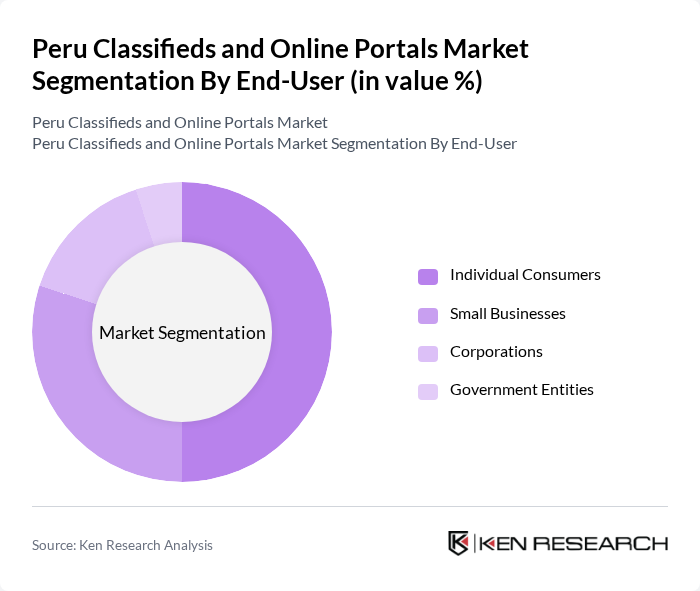

By End-User:The end-user segmentation includes Individual Consumers, Small Businesses, Corporations, and Government Entities. Each group utilizes online classifieds for different purposes, such as personal transactions, business promotions, and public service announcements.

The Peru Classifieds and Online Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Peru, MercadoLibre, Adondevivir, Laika, Yapo, Compreo, BuscaLibre, Trabajando.com, Zubale, Trovit, Inmuebles24, Locanto, Vivastreet, Segundamano, Clasificados contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Peru classifieds and online portals market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, platforms that leverage artificial intelligence for personalized user experiences are likely to gain traction. Additionally, the integration of social media features will enhance user engagement, while subscription models may emerge as a viable revenue stream, allowing businesses to adapt to changing market dynamics and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Automotive Job Listings Services Electronics Fashion Others |

| By End-User | Individual Consumers Small Businesses Corporations Government Entities |

| By Sales Channel | Direct Sales Online Marketplaces Mobile Applications Social Media Platforms |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Payment Method | Credit/Debit Cards Mobile Payments Bank Transfers Cash on Delivery |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales | 80 | Car Dealership Owners, Sales Managers |

| Job Portals | 120 | HR Managers, Recruitment Specialists |

| Consumer Goods Sales | 90 | Small Business Owners, E-commerce Managers |

| Service Providers | 70 | Service Business Owners, Marketing Directors |

The Peru Classifieds and Online Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, mobile device usage, and a shift towards digital platforms for buying and selling goods and services.