Region:Central and South America

Author(s):Rebecca

Product Code:KRAB4660

Pages:98

Published On:October 2025

By Type:The market is segmented into various types, including Real Estate, Automotive, Job Listings, Services, Consumer Goods, Events & Tickets, and Pets & Animals. Each of these segments caters to specific consumer needs and preferences, driving their respective growth within the overall market .

The Real Estate segment is currently the dominant force in the market, driven by Brazil's growing urbanization and the increasing demand for housing. The rise in property investments and the popularity of online platforms for buying, selling, and renting properties have significantly contributed to this segment's growth. Additionally, the Automotive segment follows closely, fueled by the high demand for vehicles and the convenience of online listings for both buyers and sellers .

By End-User:The market is segmented by end-users, including Individuals, Small and Medium Businesses (PMEs), Large Enterprises, and Government & Public Sector. Each segment has unique needs and contributes differently to the overall market dynamics.

The Individuals segment is the largest end-user group, as consumers increasingly turn to online platforms for various needs, from job searches to purchasing goods. Small and Medium Businesses also play a significant role, utilizing these platforms for advertising and reaching potential customers. Large enterprises and government entities, while smaller in number, contribute to the market through specialized listings and services.

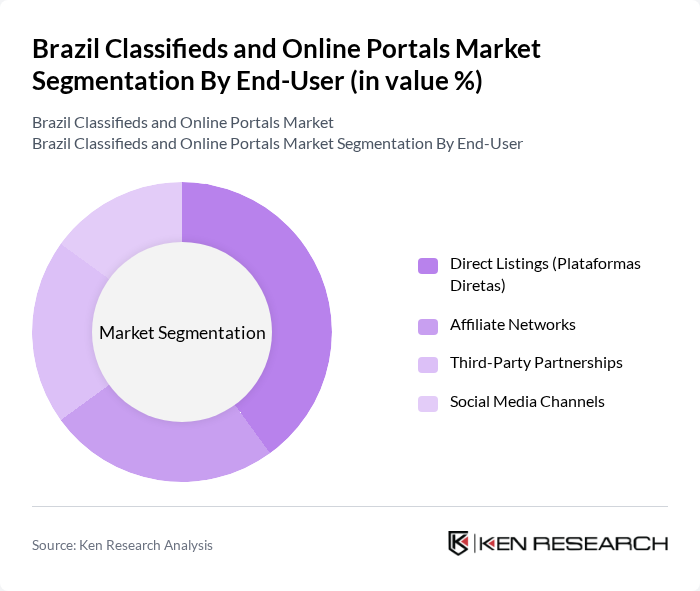

By Sales Channel:The market is segmented by sales channels, including Direct Listings, Affiliate Networks, Third-Party Partnerships, and Social Media Channels. Each channel offers distinct advantages and caters to different user preferences .

Direct Listings dominate the sales channel segment, as they provide users with immediate access to listings without intermediaries. Affiliate Networks are also significant, leveraging partnerships to expand reach and visibility. Social Media Channels are increasingly being utilized for advertising and engagement, reflecting changing consumer behaviors.

By Pricing Model:The market is segmented by pricing models, including Free Listings, Subscription-Based, Pay-Per-Listing, and Freemium & Featured Listings. Each model appeals to different user segments and influences market dynamics.

Free Listings are the most popular pricing model, attracting a large number of users who prefer no-cost options. Subscription-Based models are also significant, providing businesses with consistent revenue streams. Pay-Per-Listing models cater to users who prefer to pay only for what they use, while Freemium & Featured Listings offer enhanced visibility for a fee.

By Geographic Coverage:The market is segmented by geographic coverage, including Major Urban Centers, Secondary Cities, Rural & Remote Areas, and National Coverage. Each segment reflects the varying levels of access and demand across different regions.

Major Urban Centers dominate the market due to their high population density and economic activity. Secondary Cities also contribute significantly, while Rural & Remote Areas represent a smaller but growing segment as internet access improves. National Coverage ensures that platforms can reach users across the entire country .

By User Demographics:The market is segmented by user demographics, including Age Groups, Income Levels, Education Levels, and Gender. Understanding these demographics is crucial for tailoring services and marketing strategies.

The Age Groups segment is significant, with younger users being more inclined to use online platforms. Income Levels also play a role, as higher-income individuals may have different purchasing behaviors. Education Levels influence user engagement, while Gender demographics help in creating targeted marketing campaigns .

By Service Type:The market is segmented by service type, including B2C, C2C, B2B, and Classifieds Aggregators & Meta-search. Each service type caters to different user needs and market dynamics.

The B2C segment is the largest, as businesses leverage online platforms to reach consumers directly. C2C services are also significant, enabling peer-to-peer transactions. B2B services cater to businesses looking to connect with other businesses, while Classifieds Aggregators & Meta-search provide users with comprehensive search capabilities across multiple platforms.

The Brazil Classifieds and Online Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as OLX Brasil, Webmotors, ZAP Imóveis, Mercado Livre, iCarros, VivaReal, Trovit Brasil, InfoJobs Brasil, Anúncios Grátis Brasil, Digo!, Oportuno, Classificados Brasil, AlugueTemporada (Vrbo Brasil), Emprego Ligado, Enjoei contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's classifieds and online portals market appears promising, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to grow, platforms that prioritize user experience and security will likely thrive. Additionally, the integration of AI and machine learning will enhance personalization, making services more relevant to users. With ongoing government initiatives to improve internet access, the market is poised for expansion, particularly in underserved regions, creating new opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate (e.g., Imóveis, Aluguel, Compra e Venda) Automotive (e.g., Carros, Motos, Caminhões) Job Listings (e.g., Empregos, Oportunidades de Trabalho) Services (e.g., Serviços Profissionais, Reparos, Aulas) Consumer Goods (e.g., Eletrônicos, Móveis, Moda, Eletrodomésticos) Events & Tickets (e.g., Ingressos, Eventos Locais) Pets & Animals (e.g., Adoção, Venda de Animais, Serviços para Pets) |

| By End-User | Individuals (Consumidores Finais) Small and Medium Businesses (PMEs) Large Enterprises Government & Public Sector |

| By Sales Channel | Direct Listings (Plataformas Diretas) Affiliate Networks Third-Party Partnerships Social Media Channels |

| By Pricing Model | Free Listings (Grátis) Subscription-Based (Assinatura) Pay-Per-Listing (Pagamento por Anúncio) Freemium & Featured Listings |

| By Geographic Coverage | Major Urban Centers (e.g., São Paulo, Rio de Janeiro, Belo Horizonte) Secondary Cities Rural & Remote Areas National Coverage |

| By User Demographics | Age Groups (18-24, 25-34, 35-44, 45+) Income Levels (Baixa, Média, Alta Renda) Education Levels Gender |

| By Service Type | B2C (Business-to-Consumer) C2C (Consumer-to-Consumer) B2B (Business-to-Business) Classifieds Aggregators & Meta-search |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales | 80 | Car Dealership Owners, Sales Managers |

| Job Listings | 90 | HR Managers, Recruitment Specialists |

| Consumer Goods Marketplace | 60 | Small Business Owners, E-commerce Managers |

| Service Offerings (e.g., home services) | 50 | Service Providers, Business Development Managers |

The Brazil Classifieds and Online Portals Market is valued at approximately USD 390 million, reflecting significant growth driven by increased internet penetration and mobile device usage among the Brazilian population.