Region:Asia

Author(s):Rebecca

Product Code:KRAA9309

Pages:81

Published On:November 2025

By Type:The ECG equipment market can be segmented into various types, including Resting 12-Lead ECG Systems, Holter Monitors, Stress ECG Systems, Event Monitors, Wireless/Portable ECG Devices, ECG Management Software, and Others. Among these, Resting 12-Lead ECG Systems are the most widely used due to their reliability and comprehensive diagnostic capabilities. Holter Monitors are also gaining traction as they allow for continuous monitoring of patients over extended periods, which is crucial for detecting intermittent cardiac issues. The increasing adoption of wireless and portable devices is driven by the demand for remote patient monitoring solutions, especially in the wake of the COVID-19 pandemic.

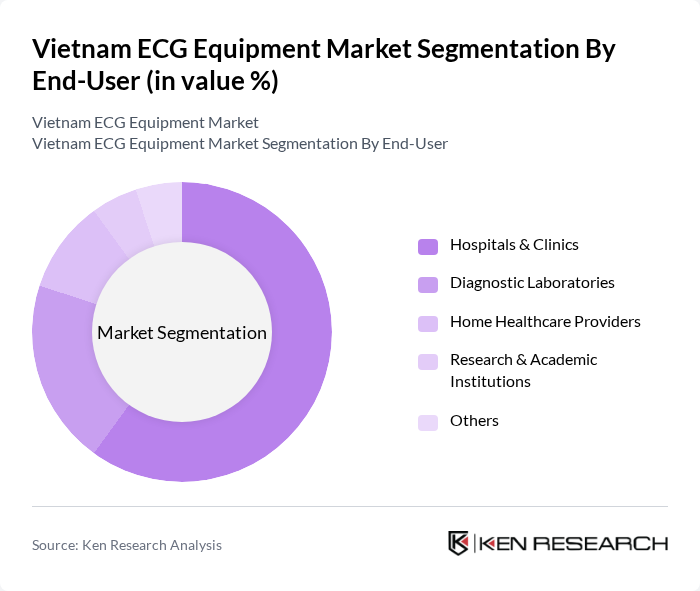

By End-User:The end-user segmentation includes Hospitals & Clinics, Diagnostic Laboratories, Home Healthcare Providers, Research & Academic Institutions, and Others. Hospitals and clinics are the primary consumers of ECG equipment, driven by the need for accurate and timely diagnosis of cardiovascular conditions. The rise of home healthcare services has also led to increased demand for portable ECG devices, allowing patients to monitor their heart health from the comfort of their homes. Diagnostic laboratories are increasingly investing in advanced ECG systems to enhance their testing capabilities and improve patient outcomes.

The Vietnam ECG Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE Healthcare, Philips Healthcare, Siemens Healthineers, Mindray Medical International Limited, Nihon Kohden Corporation, Schiller AG, Bionet Co., Ltd., Edan Instruments, Inc., CPT Sutures Co., Ltd., J&V Medical Instrument Joint Stock Company (J&V Medical Instrument JSC), VietMedical, Medtronic plc, Johnson & Johnson, Dexcom, Inc., VivaChek Laboratories, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam ECG equipment market is poised for significant growth, driven by increasing healthcare investments and technological innovations. The integration of digital health solutions and AI in ECG analysis is expected to enhance diagnostic capabilities, making healthcare more efficient. Additionally, the expansion of telemedicine services will facilitate remote monitoring, particularly in underserved areas. As awareness of preventive healthcare rises, the demand for ECG devices will likely increase, leading to improved patient outcomes and a more robust healthcare system in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Resting 12-Lead ECG Systems Holter Monitors Stress ECG Systems Event Monitors Wireless/Portable ECG Devices ECG Management Software Others |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Home Healthcare Providers Research & Academic Institutions Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Technology | Analog ECG Devices Digital ECG Devices Tele-ECG Technology Others |

| By Application | Clinical Diagnosis Remote Patient Monitoring Emergency Care Cardiology Research Others |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospitals ECG Equipment Usage | 100 | Cardiologists, Hospital Administrators |

| Private Clinics ECG Equipment Procurement | 80 | Clinic Owners, Medical Directors |

| Medical Device Distributors Insights | 60 | Sales Managers, Product Specialists |

| Healthcare Policy Impact on ECG Adoption | 40 | Health Policy Analysts, Government Officials |

| Technological Trends in ECG Equipment | 70 | Biomedical Engineers, R&D Managers |

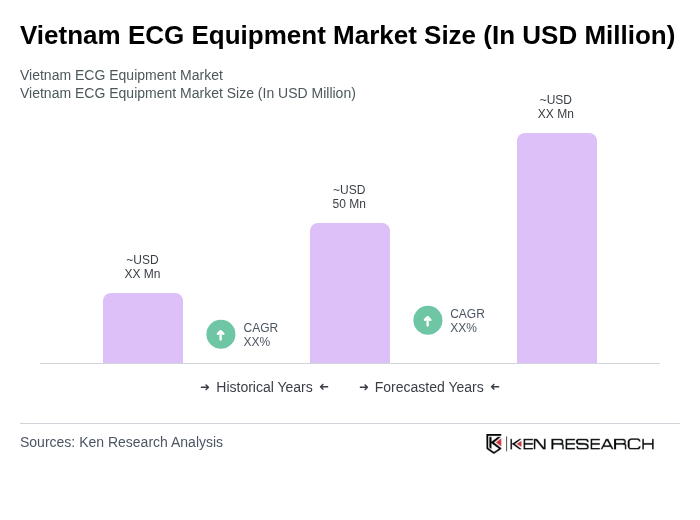

The Vietnam ECG Equipment Market is valued at approximately USD 50 million, reflecting a significant growth driven by the increasing prevalence of cardiovascular diseases and advancements in ECG technology.