Region:Asia

Author(s):Shubham

Product Code:KRAD6774

Pages:98

Published On:December 2025

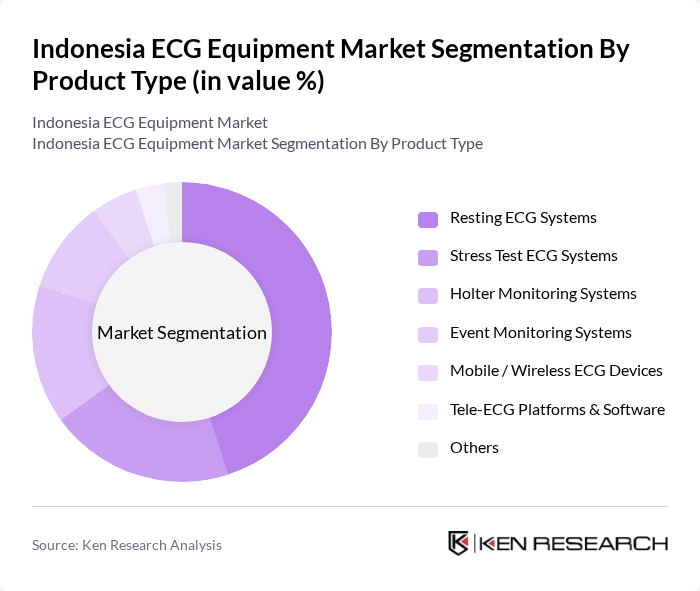

By Product Type:The product type segmentation includes various ECG systems and devices that cater to different diagnostic needs. The subsegments are as follows:

The Resting ECG Systems segment is currently dominating the market due to their widespread use in hospitals and clinics for routine cardiac assessments. These systems are essential for diagnosing various heart conditions and are favored for their reliability and ease of use. The increasing focus on preventive healthcare and early diagnosis of cardiovascular diseases has further propelled the demand for resting ECG systems. Additionally, advancements in technology have led to the development of more compact and efficient devices, making them more accessible to healthcare providers.

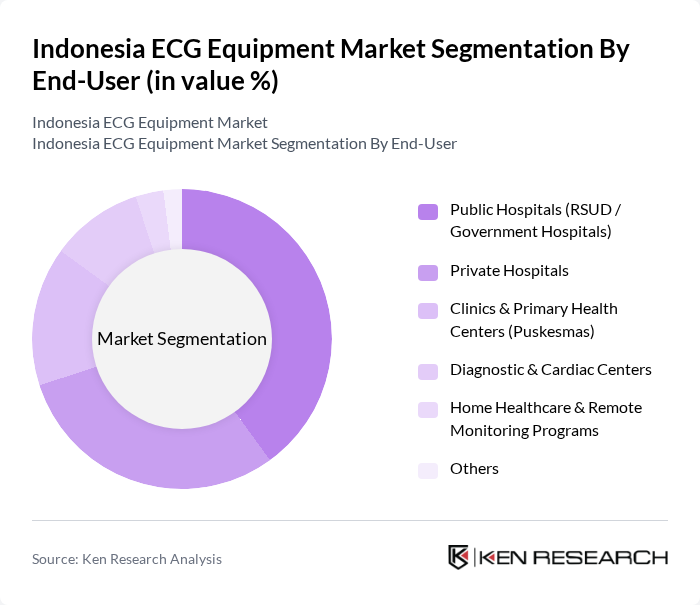

By End-User:The end-user segmentation includes various healthcare facilities that utilize ECG equipment for patient care. The subsegments are as follows:

Public Hospitals are the leading end-users of ECG equipment, accounting for a significant portion of the market. This dominance is attributed to the large patient volumes they handle and the essential role of ECG in emergency and routine care. Government hospitals are increasingly investing in advanced ECG technologies to enhance diagnostic capabilities and improve patient outcomes. Additionally, the integration of ECG services in public health initiatives has further solidified their position as the primary users of ECG equipment.

The Indonesia ECG Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Philips Indonesia (Koninklijke Philips N.V.), PT GE HealthCare Indonesia (GE HealthCare Technologies Inc.), PT Siemens Healthineers Indonesia (Siemens Healthineers AG), Nihon Kohden Corporation, Mindray Medical International Limited, Schiller AG, BPL Medical Technologies, Edan Instruments, Inc., PT Oneject / PT Itama Ranoraya Tbk (local ECG & medical device distributors), PT Mega Andalan Kalasan (MAK), PT AbadiNusa Usahasemesta (local medical equipment distributor), PT Enseval Medika Prima, PT Globalmedika, PT Kimia Farma Tbk (Healthcare & diagnostics network buyer), Other Emerging Local ECG & Tele-ECG Solution Providers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ECG equipment market in Indonesia appears promising, driven by ongoing technological innovations and increased healthcare investments. The integration of telemedicine and remote monitoring solutions is expected to enhance patient access to ECG services, particularly in rural areas. Additionally, the growing emphasis on preventive healthcare will likely lead to increased demand for ECG devices. As the government continues to support healthcare infrastructure development, the market is poised for significant growth, fostering improved health outcomes for the population.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Resting ECG Systems Stress Test ECG Systems Holter Monitoring Systems Event Monitoring Systems Mobile / Wireless ECG Devices Tele-ECG Platforms & Software Others |

| By End-User | Public Hospitals (RSUD / Government Hospitals) Private Hospitals Clinics & Primary Health Centers (Puskesmas) Diagnostic & Cardiac Centers Home Healthcare & Remote Monitoring Programs Others |

| By Region | Java (including Jakarta) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Maluku & Papua |

| By Technology | Analog ECG Devices Digital ECG Devices PC-based ECG Systems Cloud-connected / Web-based ECG Tele-ECG Technology Others |

| By Application | Clinical Diagnosis & Routine Screening Remote & Continuous Cardiac Monitoring Emergency & Critical Care Occupational Health & Wellness Programs Others |

| By Investment Source | Public Sector & Government Budget Private Hospitals & Corporate Investments Donor Agencies & International Aid Public-Private Partnerships (PPP) Others |

| By Policy & Reimbursement Environment | BPJS Kesehatan Reimbursement-supported Procurement Non-reimbursed / Out-of-pocket Segment Government Programs & Grants Local Content (TKDN)–compliant Procurement Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments in Hospitals | 100 | Cardiologists, Department Heads |

| Healthcare Equipment Distributors | 90 | Sales Managers, Product Specialists |

| Medical Device Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| Private Clinics and Diagnostic Centers | 80 | Clinic Owners, Medical Directors |

| Healthcare Policy Makers | 60 | Health Economists, Policy Analysts |

The Indonesia ECG Equipment Market is valued at approximately USD 45 million, reflecting a significant growth driven by the rising prevalence of cardiovascular diseases and advancements in ECG technology, including digital systems and telemedicine connectivity.