Region:Asia

Author(s):Dev

Product Code:KRAD5213

Pages:90

Published On:December 2025

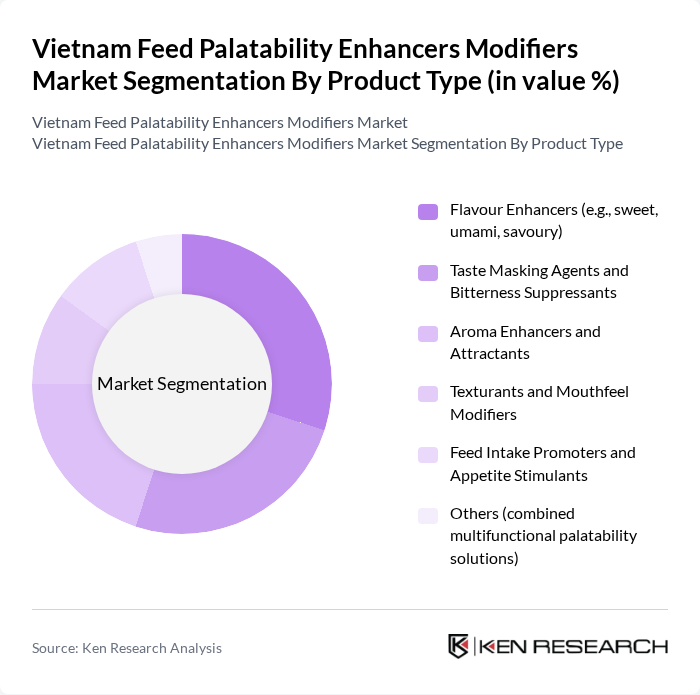

By Product Type:The product type segmentation includes various enhancers and modifiers that improve the palatability of animal feed. The subsegments are as follows:

The Flavour Enhancers segment is currently dominating the market, in line with global trends where flavors, sweeteners, and aroma compounds are widely used to offset the bitterness or off-notes of functional additives and medicated feeds, thereby improving voluntary intake. This trend is particularly evident in poultry and aquaculture in Vietnam, where the quality and consistency of feed directly impact growth rates, feed conversion ratios, and survivability in intensive systems. The demand for natural and plant-derived flavour enhancers is also rising, supported by the growing use of phytogenic and herbal additives as part of “antibiotic-free” and sustainable feeding programs.

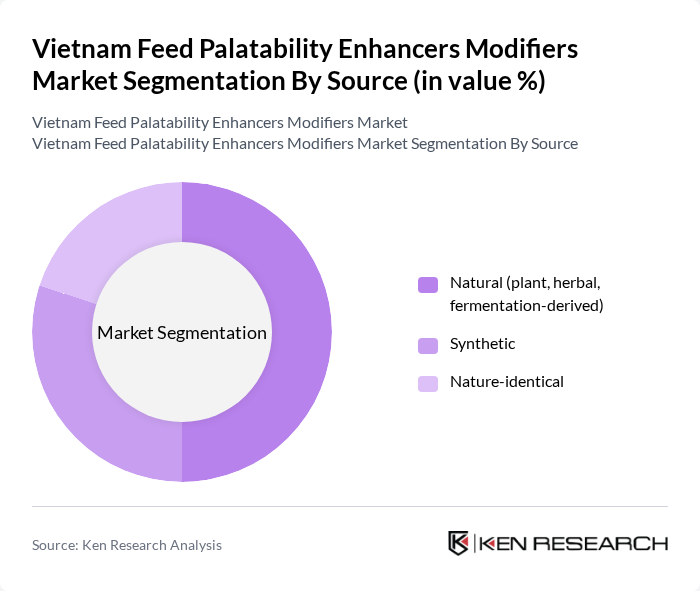

By Source:The source segmentation categorizes palatability enhancers based on their origin. The subsegments are as follows:

The Natural source segment is leading the market, driven by the growing demand for phytogenic, herbal, and essential oil–based feed additives in Vietnam, which are perceived as safer, eco-friendly, and compatible with residue-conscious export markets. Farmers and integrators are increasingly opting for natural palatability enhancers and botanical blends to support gut health, digestion, and immunity while also improving feed flavor and aroma, aligning with broader trends in specialty and phytogenic feed additives. This shift is further supported by regulatory and customer requirements from international meat and seafood buyers, who emphasize responsible use of additives and preference for sustainable, plant-based solutions in animal nutrition.

The Vietnam Feed Palatability Enhancers Modifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill Vietnam Co., Ltd., De Heus LLC (De Heus Vietnam), Alltech Vietnam Co., Ltd., Kemin Industries, Inc. (Kemin Vietnam), Novus International, Inc. (Novus Vietnam), Adisseo France SAS (Adisseo Vietnam), Koninklijke DSM N.V. (dsm-firmenich Vietnam), BASF Vietnam Co., Ltd., Evonik Vietnam Co., Ltd., Nutreco N.V. (Trouw Nutrition Vietnam), Phibro Animal Health Corporation, Biomin Vietnam Co., Ltd. (DSM/BIOMIN), CJ Vina Agri Co., Ltd., GreenFeed Vietnam Corporation, Proconco (Vietnam France Joint-Stock Company of Cattle Feed – Vinafeed) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Feed Palatability Enhancers Modifiers Market is poised for significant evolution, driven by increasing consumer demand for sustainable and high-quality animal products. As the livestock sector expands, innovations in feed formulations will likely emerge, focusing on natural ingredients and enhanced nutritional profiles. Additionally, the integration of technology in feed processing is expected to streamline production and improve efficiency, aligning with global trends towards sustainability and traceability in food supply chains.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Flavour Enhancers (e.g., sweet, umami, savoury) Taste Masking Agents and Bitterness Suppressants Aroma Enhancers and Attractants Texturants and Mouthfeel Modifiers Feed Intake Promoters and Appetite Stimulants Others (combined multifunctional palatability solutions) |

| By Source | Natural (plant, herbal, fermentation-derived) Synthetic Nature-identical |

| By Livestock | Poultry Swine Ruminants (beef, dairy, small ruminants) Aquaculture (fish, shrimp) Pets Others |

| By Application within Feed | Compound Feed Premixes Concentrates Liquid Supplements and Top-dressings Others |

| By Form | Dry (powder, granules) Liquid Encapsulated / Coated |

| By Function | Feed Intake Improvement Masking Off-flavours / Odours Enhancing Feed Conversion and Performance Stress and Weaning Management Others |

| By Region | Red River Delta (Northern Vietnam) North Central and Central Coast Southeast Mekong River Delta Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Feed Manufacturers | 60 | Production Managers, Quality Control Officers |

| Swine Nutritionists | 40 | Veterinarians, Animal Nutrition Consultants |

| Aquaculture Feed Suppliers | 40 | Product Development Managers, Sales Executives |

| Livestock Farmers | 80 | Farm Owners, Feed Procurement Managers |

| Feed Additive Distributors | 40 | Supply Chain Managers, Marketing Directors |

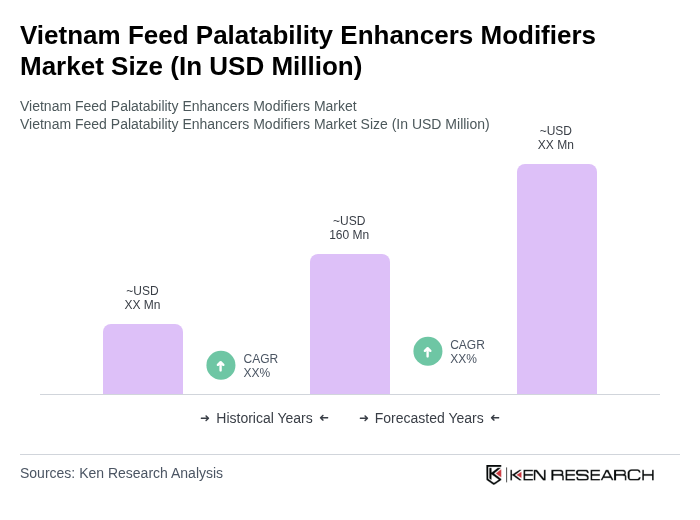

The Vietnam Feed Palatability Enhancers Modifiers Market is valued at approximately USD 160 million, reflecting its significant role within the broader feed additives market in Vietnam, driven by the demand for high-quality animal feed.