Region:Asia

Author(s):Geetanshi

Product Code:KRAB3353

Pages:87

Published On:October 2025

By Type:The market is segmented into various types of APIs that cater to different financial services needs. The dominant sub-segment is Payment APIs, which facilitate seamless transactions and are widely adopted by both consumers and businesses. Other significant types include Data Aggregation APIs, which help in consolidating financial data, and Identity Verification APIs, crucial for ensuring security and compliance in digital transactions. API adoption is also accelerating in loan management, investment, and insurance, reflecting the broadening scope of digital financial services .

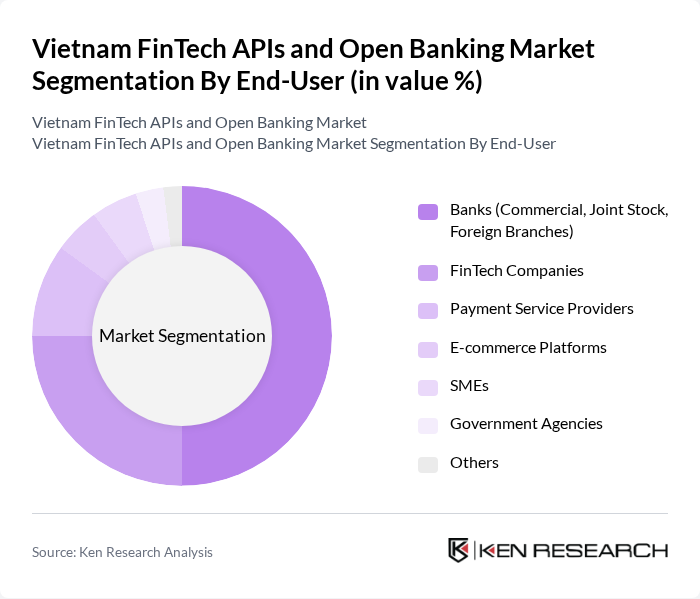

By End-User:The end-user segment includes various stakeholders utilizing FinTech APIs and Open Banking services. Banks, particularly commercial and joint-stock banks, are the largest users due to their need for enhanced service offerings and customer engagement. FinTech companies also play a significant role, leveraging APIs to innovate and provide tailored financial solutions to consumers and businesses. Payment service providers and e-commerce platforms are increasingly integrating APIs to streamline transactions and improve user experience, while SMEs and government agencies are adopting API-driven solutions for operational efficiency and expanded service reach .

The Vietnam FinTech APIs and Open Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo, ZaloPay, Timo, VNPay, Payoo, FPT Corporation, ViettelPay, BankPlus (Viettel), Trusting Social, Finhay, ShopeePay, Moca, VIB (Vietnam International Bank), Sacombank, BIDV (Bank for Investment and Development of Vietnam), VPBank (Vietnam Prosperity Joint Stock Commercial Bank), VietinBank (Vietnam Joint Stock Commercial Bank for Industry and Trade), TPBank (Tien Phong Commercial Joint Stock Bank), Brankas, SAVIS, Konsentus, FinOS, Fvndit contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam FinTech APIs and open banking market is poised for significant growth, driven by technological advancements and increasing consumer demand for digital solutions. The integration of AI and machine learning will enhance service personalization, while the shift towards open banking models will foster collaboration between banks and FinTech firms. As the government continues to support digital initiatives, the market is expected to attract more investments, leading to innovative financial products and services that cater to diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment APIs Data Aggregation APIs Identity Verification APIs Loan Management APIs Investment APIs Insurance APIs Open Banking APIs Compliance & Regulatory APIs Others |

| By End-User | Banks (Commercial, Joint Stock, Foreign Branches) FinTech Companies Payment Service Providers E-commerce Platforms SMEs Government Agencies Others |

| By Application | Payment Processing Financial Management Risk Assessment & Credit Scoring Customer Onboarding & KYC Fraud Detection & Prevention Lending & Loan Origination Investment & Wealth Management Others |

| By Distribution Channel | Direct Sales Online Platforms & Marketplaces Partnerships with Financial Institutions Resellers & System Integrators Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Non-Profit Organizations Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Tiered Pricing Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Programs Sandbox Participation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector API Integration | 85 | IT Managers, Digital Transformation Leads |

| FinTech Startups Offering APIs | 65 | Founders, Product Managers |

| Consumer Adoption of Open Banking | 120 | End-users, Financial Service Customers |

| Regulatory Impact Assessment | 50 | Compliance Officers, Legal Advisors |

| API Security and Risk Management | 60 | Security Analysts, Risk Management Professionals |

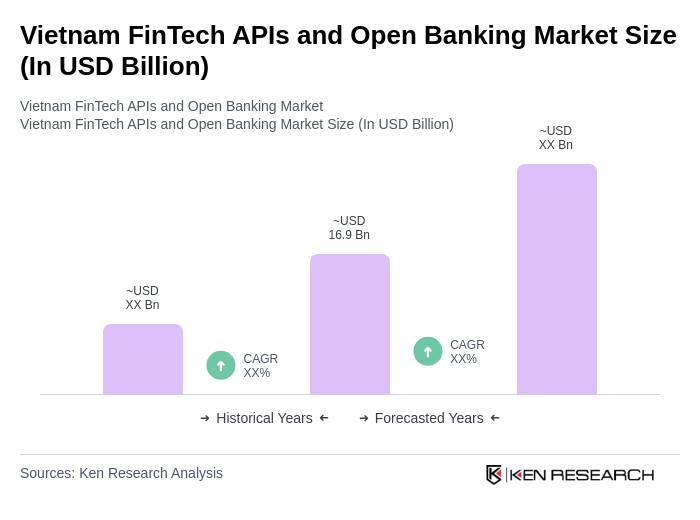

The Vietnam FinTech APIs and Open Banking market is valued at approximately USD 16.9 billion, driven by the increasing adoption of digital payment solutions and the demand for seamless financial services integration.