Region:Asia

Author(s):Rebecca

Product Code:KRAD6101

Pages:90

Published On:December 2025

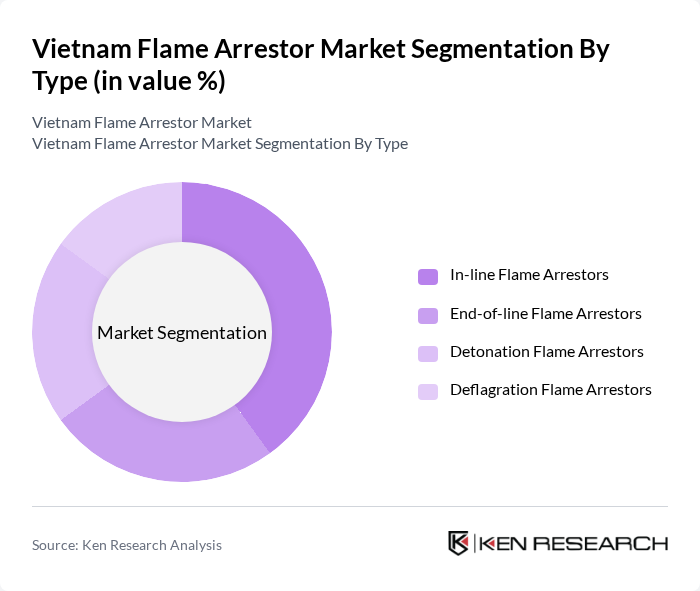

By Type:The flame arrestor market can be segmented into four main types: In-line Flame Arrestors, End-of-line Flame Arrestors, Detonation Flame Arrestors, and Deflagration Flame Arrestors. Among these, In-line Flame Arrestors are gaining traction due to their effectiveness in preventing flame propagation in pipelines, which is crucial for industries like oil and gas. The increasing focus on safety and compliance with regulations is driving the demand for these products.

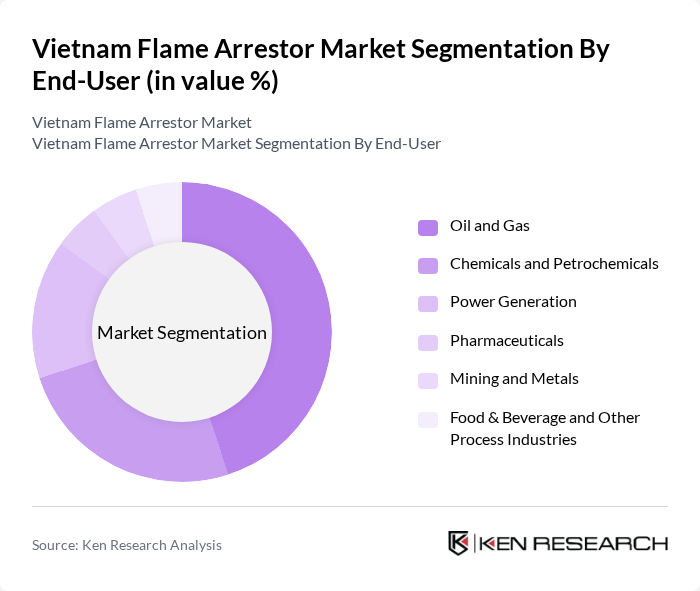

By End-User:The flame arrestor market is segmented by end-user industries, including Oil and Gas, Chemicals and Petrochemicals, Power Generation, Pharmaceuticals, Mining and Metals, and Food & Beverage and Other Process Industries. The Oil and Gas sector is the leading end-user, driven by stringent safety regulations and the need for reliable fire protection systems in exploration and production activities.

The Vietnam Flame Arrestor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co. (Enardo / Fisher Flame Arrestors), Braunschweiger Flammenfilter GmbH (Protego), Elmac Technologies Ltd, BS&B Safety Systems LLC, L&J Technologies (Shand & Jurs), Groth Corporation, Braunschweiger Flammenfilter GmbH Representative / Distributor in Vietnam, Emerson Process Management Vietnam Co., Ltd., PETROLIMEX Equipment JSC (Petrolimex Engineering and Construction JSC – PEC), PVOIL Engineering (a subsidiary of Vietnam Oil and Gas Group’s network), Lilama 69-3 JSC (Industrial EPC & Process Equipment Integration), PVC-MS – PetroVietnam Construction JSC – Mechanical & Structural, DANG KHOA Engineering Co., Ltd. (Industrial Safety & Process Equipment Distributor), Neway Valve (Vietnam Representative / Distributor), Hai Nam Engineering & Trading Co., Ltd. (Process Safety and Flow Control Equipment) contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam flame arrestor market is poised for significant growth as industrialization and urbanization continue to accelerate. With the government's commitment to enhancing fire safety regulations and increasing awareness among businesses, the demand for flame arrestors is expected to rise. Additionally, technological advancements in fire safety solutions will likely lead to innovative products that cater to specific industry needs, further driving market expansion. The focus on workplace safety will also play a crucial role in shaping the future landscape of this market.

| Segment | Sub-Segments |

|---|---|

| By Type | In-line Flame Arrestors End-of-line Flame Arrestors Detonation Flame Arrestors Deflagration Flame Arrestors |

| By End-User | Oil and Gas Chemicals and Petrochemicals Power Generation Pharmaceuticals Mining and Metals Food & Beverage and Other Process Industries |

| By Application | Storage Tanks and Vessels Pipelines and Piping Systems Vent Lines and Exhaust Systems Tank Vents and Breather Vents Compressors, Pumps, and Gas Handling Equipment |

| By Material | Stainless Steel Carbon Steel Alloy Steel (Including Duplex and Super Duplex) Aluminum and Other Materials |

| By Installation Type | New Installations (Greenfield Projects) Retrofit and Replacement (Brownfield Projects) |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Policy Support | Government Safety and Fire Protection Regulations Environmental and Emissions Compliance Requirements Tax Incentives and Investment Support for Industrial Safety Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Facilities | 120 | Safety Managers, Plant Engineers |

| Oil & Gas Industry | 90 | Operations Directors, Compliance Officers |

| Manufacturing Sector | 80 | Production Managers, Quality Assurance Leads |

| Fire Safety Equipment Suppliers | 60 | Sales Managers, Product Development Engineers |

| Regulatory Bodies | 50 | Policy Makers, Safety Inspectors |

The Vietnam Flame Arrestor Market is valued at approximately USD 12 million, driven by increasing demand for safety equipment in industries such as oil and gas, chemicals, and power generation, alongside rapid industrialization and investments in energy sectors.