Region:Asia

Author(s):Shubham

Product Code:KRAD1983

Pages:88

Published On:December 2025

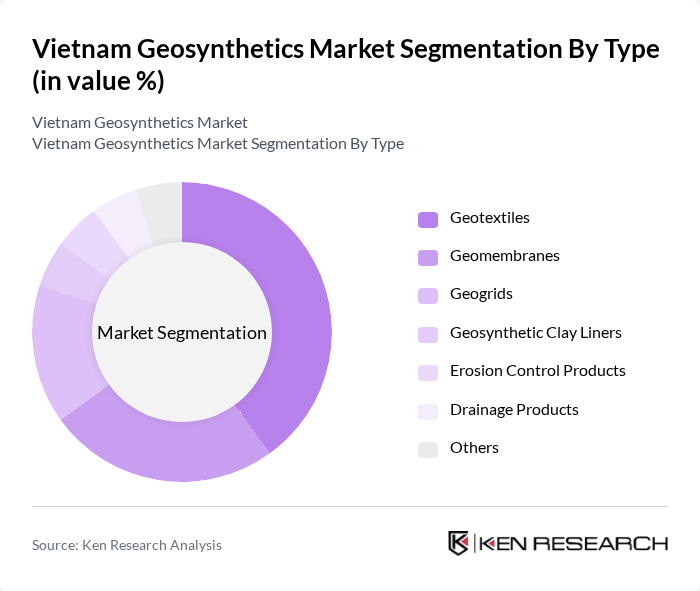

By Type:The geosynthetics market in Vietnam is segmented into various types, including geotextiles, geomembranes, geogrids, geosynthetic clay liners, erosion control products, drainage products, and others. Among these, geotextiles dominate the market due to their extensive use in construction and civil engineering projects, particularly in road and railway construction, as well as erosion control applications. The increasing focus on sustainable construction practices and the need for effective soil stabilization solutions further enhance the demand for geotextiles.

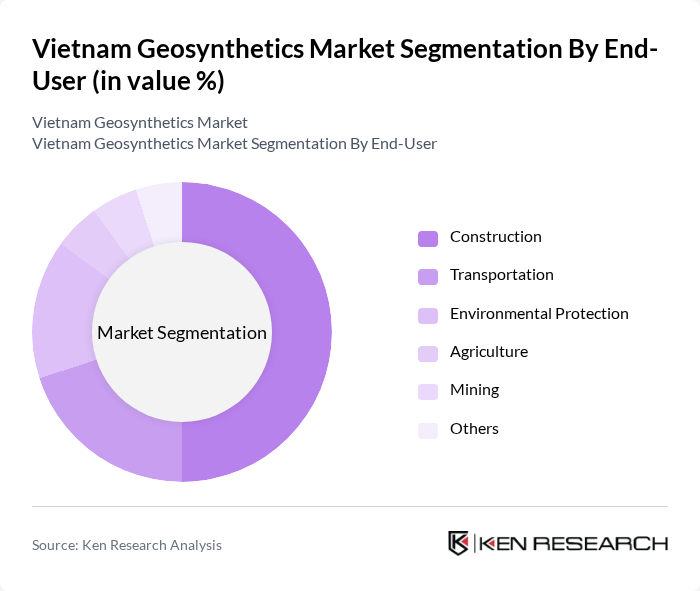

By End-User:The end-user segmentation of the geosynthetics market includes construction, transportation, environmental protection, agriculture, mining, and others. The construction sector is the largest end-user, driven by the rapid growth of infrastructure projects in Vietnam. The increasing investment in road, bridge, and building construction, along with the need for effective waste management solutions, significantly boosts the demand for geosynthetics in this sector.

The Vietnam Geosynthetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as TenCate Geosynthetics, GSE Environmental, Solmax, Geosynthetics International, Maccaferri, Huesker, NAUE, Agru America, Terram, Fibertex Nonwovens, Propex Global, CETCO, Sika AG, AECOM, Geofabrics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam geosynthetics market appears promising, driven by emerging trends such as the integration of geosynthetics in smart, climate-resilient infrastructure projects. As urbanization accelerates, the demand for innovative solutions in waste management and landfill applications is expected to rise. Additionally, the shift towards sustainable and recycled geosynthetic materials aligns with global environmental standards, further enhancing market opportunities. These trends indicate a dynamic landscape for geosynthetics in Vietnam, fostering growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Geotextiles Geomembranes Geogrids Geosynthetic Clay Liners Erosion Control Products Drainage Products Others |

| By End-User | Construction Transportation Environmental Protection Agriculture Mining Others |

| By Application | Road Construction Landfills Retaining Walls Slope Stabilization Water Management Others |

| By Material | Polypropylene Polyester Polyethylene Natural Fibers Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Infrastructure Development Projects | 100 | Project Managers, Civil Engineers |

| Geosynthetics Manufacturing | 80 | Production Managers, Quality Control Specialists |

| Environmental Protection Initiatives | 70 | Environmental Engineers, Sustainability Consultants |

| Construction Material Suppliers | 90 | Sales Managers, Procurement Officers |

| Government Regulatory Bodies | 60 | Policy Makers, Regulatory Compliance Officers |

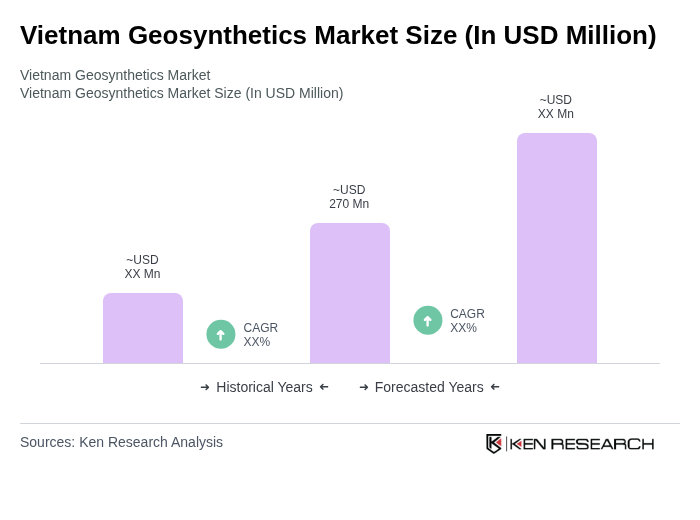

The Vietnam Geosynthetics Market is valued at approximately USD 270 million. This valuation reflects the growing demand for geosynthetic materials driven by infrastructure development, urbanization, and sustainable construction practices.