Region:Asia

Author(s):Dev

Product Code:KRAC2682

Pages:88

Published On:October 2025

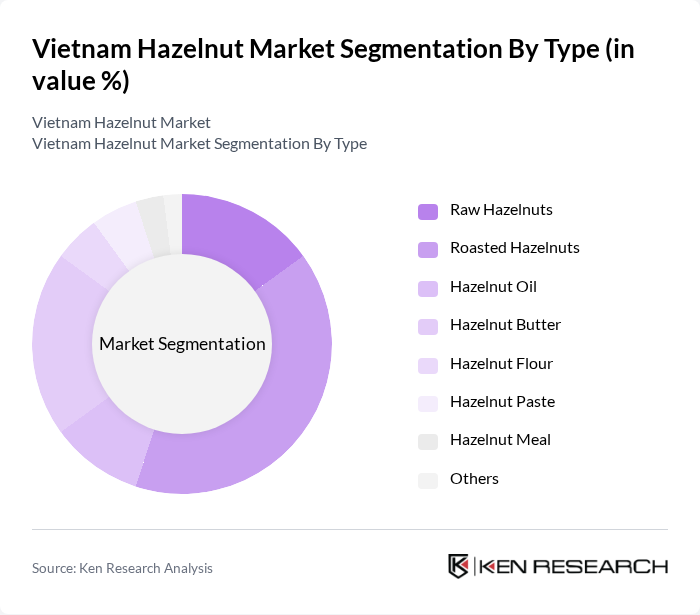

By Type:The Vietnam hazelnut market is segmented into raw hazelnuts, roasted hazelnuts, hazelnut oil, hazelnut butter, hazelnut flour, hazelnut paste, hazelnut meal, and others. Roasted hazelnuts remain the most popular due to their enhanced flavor and versatility in culinary applications. The healthy snacking trend has also increased demand for hazelnut butter and oil, which are perceived as nutritious alternatives to conventional spreads and cooking oils. Hazelnut flour and paste are increasingly used in bakery and confectionery segments, reflecting broader adoption in food manufacturing.

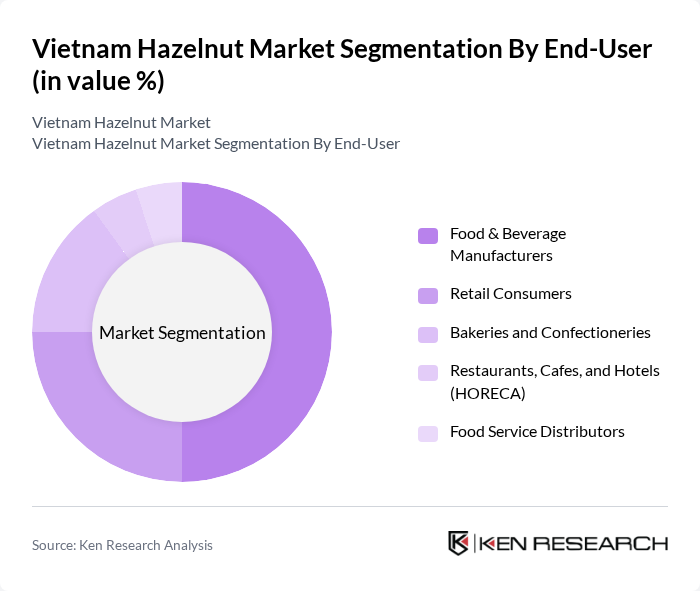

By End-User:The end-user segmentation includes food and beverage manufacturers, retail consumers, bakeries and confectioneries, restaurants, cafes, hotels (HORECA), and food service distributors. Food and beverage manufacturers lead the market, driven by increased incorporation of hazelnuts in chocolates, snacks, and health foods. Retail consumers are also a significant segment, with demand rising for healthy and premium nut products. Bakeries and confectioneries are expanding their use of hazelnut ingredients, while HORECA and food service distributors support broader market penetration.

The Vietnam Hazelnut Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olam Food Ingredients Vietnam Ltd., Vinanuts Food JSC, Lafooco (Long An Food Processing Export JSC), Intimex Group JSC, Hapro (Hanoi Trade Corporation), LTP Import Export B.V., Tanifood (Thanh Thanh Cong Group), Vinapro Production & Import Export Co., Ltd., Binh Minh Nut Company, Golden Nuts Vietnam Co., Ltd., Barry Callebaut Vietnam Ltd., Ferrero Asia Ltd. (Vietnam Representative Office), Intersnack Vietnam Co., Ltd., Nutifood Nutrition Food JSC, Nestlé Vietnam Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hazelnut market in Vietnam appears promising, driven by increasing health awareness and the expansion of the food processing sector. As consumers continue to seek healthier snack options, the demand for hazelnuts is expected to rise. Additionally, the government’s initiatives to support local agriculture may lead to increased domestic production, reducing reliance on imports. Innovations in product development and marketing strategies will likely enhance market penetration, creating a more robust hazelnut industry in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Raw Hazelnuts Roasted Hazelnuts Hazelnut Oil Hazelnut Butter Hazelnut Flour Hazelnut Paste Hazelnut Meal Others |

| By End-User | Food & Beverage Manufacturers Retail Consumers Bakeries and Confectioneries Restaurants, Cafes, and Hotels (HORECA) Food Service Distributors |

| By Sales Channel | Online Retail Supermarkets & Hypermarkets Specialty Stores Wholesale Distributors Convenience Stores |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Vacuum Packaging |

| By Geographic Distribution | Northern Vietnam Central Vietnam Southern Vietnam |

| By Product Form | Whole Nuts Chopped Nuts Sliced Nuts Ground Hazelnuts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 80 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | End Consumers, Health-Conscious Shoppers |

| Distribution Channel Analysis | 60 | Wholesalers, Distributors |

| Production Insights | 40 | Farmers, Agricultural Cooperatives |

| Market Trends and Forecasts | 50 | Market Analysts, Industry Experts |

The Vietnam Hazelnut Market is valued at approximately USD 85 million, reflecting a growing consumer interest in healthy snacks and premium nut products, alongside increased imports from countries like Thailand and Turkey.