Region:Middle East

Author(s):Shubham

Product Code:KRAC3698

Pages:97

Published On:January 2026

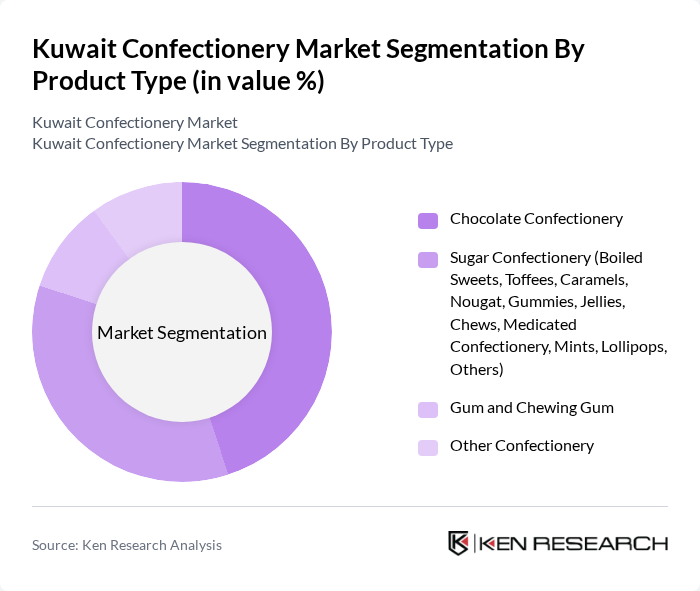

By Product Type:The product type segmentation includes various categories such as chocolate confectionery, sugar confectionery, gum and chewing gum, and other confectionery items. Chocolate confectionery is the leading segment within packaged sweets in Kuwait, supported by strong consumer affinity for international brands and significant representation in the overall snacks basket. The increasing demand for premium, filled, and gift-box chocolates, as well as artisanal and origin-specific products, has further fueled growth in this category. Sugar confectionery, which includes a wide range of boiled sweets, gummies, jellies, toffees, caramels, mints, lollipops, and medicated confectionery, also holds a significant share, appealing particularly to children and families and benefiting from impulse purchases in convenience and grocery channels. Gum and chewing gum, while smaller in comparison, remains a staple for young adults and teens, particularly for functional and sugar-free variants positioned around freshness and oral care. Other confectionery items, including seasonal, novelty, and ethnic sweets, contribute to the market's diversity, especially during festive periods and special occasions.

By Consumer Type:The consumer type segmentation encompasses children and teens, young adults, families, health-conscious and sugar-restricted consumers, and tourists and gifting buyers. Children and teens represent a significant portion of the market, driven by their preference for colorful, fun, and novelty confectionery products, especially gummies, lollipops, and chocolate bars. Young adults are increasingly drawn to premium, innovative, and on-the-go offerings, including filled chocolates, portion-controlled packs, and products marketed through digital and social media channels. Families often purchase in bulk for gatherings, celebrations, and everyday snacking, supporting multipack and family-size formats across both chocolate and sugar confectionery. Health-conscious consumers are shifting towards sugar-reduced, sugar-free, and organic options, as well as products featuring functional claims, reflecting a growing trend towards healthier eating within the broader snacks category. Tourists and gifting buyers contribute to seasonal spikes in demand, particularly during holidays and festivals, supporting sales of boxed chocolates, premium assortments, and specialty local confectionery in duty-free and modern retail outlets.

The Kuwait Confectionery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars, Incorporated (Mars Kuwait), Mondelez International, Nestlé S.A. (Nestlé Kuwait), Ferrero Group, The Hershey Company, Lindt & Sprüngli AG, Kuwait Danish Dairy Company (KDD), Kuwait Indo Trading Co. WLL, IFFCO Group, United Beverage Company K.S.C.C (UNIBEV), Local Premium Chocolatiers and Artisanal Brands (e.g., Fadaella Foods, Haven Chocolates), Leading Supermarket and Hypermarket Private Labels, Regional Importers and Distributors of International Confectionery Brands, Online-First and D2C Confectionery Brands Active in Kuwait, Other Notable Local Confectionery Manufacturers and Retailers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait confectionery market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on health and wellness is likely to spur innovation in product offerings, with manufacturers exploring healthier alternatives. Additionally, the rise of e-commerce platforms will facilitate greater accessibility to a diverse range of confectionery products, enhancing consumer convenience. As the market adapts to these trends, it is expected to witness sustained growth and diversification in product lines.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Chocolate Confectionery Sugar Confectionery (Boiled Sweets, Toffees, Caramels, Nougat, Gummies, Jellies, Chews, Medicated Confectionery, Mints, Lollipops, Others) Gum and Chewing Gum Other Confectionery |

| By Consumer Type | Children and Teens Young Adults Families Health-Conscious and Sugar-Restricted Consumers Tourists and Gifting Buyers |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Specialty Confectionery and Chocolate Boutiques Online Retail and E-commerce Platforms HoReCa and Institutional Channels |

| By Packaging Type | Single-Serve and On-the-Go Packs Family and Value Packs Gift Boxes and Premium Packaging Bulk and Institutional Packs |

| By Price Segment | Mass Mid-Priced Premium and Super-Premium |

| By Claim and Product Positioning | Sugar-Free and Reduced-Sugar Organic and Natural Ingredients Halal-Certified and Clean Label Functional and Fortified Confectionery Indulgent and Gifting-Focused |

| By Occasion and Consumption Moment | Everyday Snacking Festivals and Religious Occasions Weddings and Family Celebrations Corporate Gifting and Events Tourism, Travel Retail, and Duty-Free Purchases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Confectionery Sales | 120 | Store Managers, Retail Buyers |

| Consumer Preferences in Confectionery | 140 | General Consumers, Age 18-45 |

| Distribution Channel Insights | 90 | Distributors, Wholesalers |

| Health-Conscious Product Trends | 80 | Nutritionists, Health Food Retailers |

| Market Entry Strategies for New Brands | 70 | Marketing Managers, Brand Strategists |

The Kuwait Confectionery Market is valued at approximately USD 1.3 billion, driven by factors such as increasing disposable incomes, a growing population, and a rising culture of gifting during festivals like Ramadan and Eid.