Region:Asia

Author(s):Shubham

Product Code:KRAD5548

Pages:94

Published On:December 2025

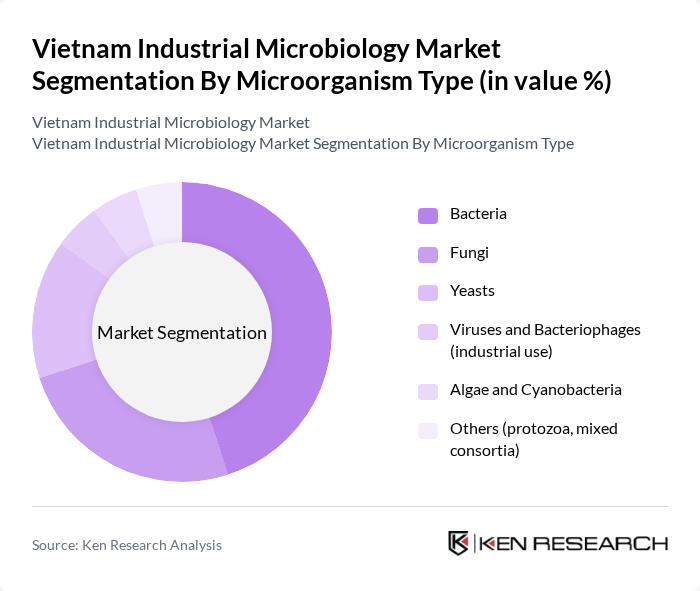

By Microorganism Type:The market is segmented into various microorganism types, including bacteria, fungi, yeasts, viruses and bacteriophages, algae and cyanobacteria, and others. Among these, bacteria are the most dominant due to their extensive applications in food processing, pharmaceuticals, and environmental management. The versatility of bacterial strains in producing enzymes and bioactive compounds makes them essential in industrial processes. Fungi and yeasts also play significant roles, particularly in fermentation processes, but bacteria lead in terms of market share and application breadth.

By Product Category:The product category segmentation includes equipment and systems, culture media and reaction consumables, laboratory supplies, microbial strains and starter cultures, industrial enzymes and biocatalysts, and others. Equipment and systems dominate this segment due to the increasing need for advanced bioprocessing technologies in various industries. The demand for high-quality culture media and microbial strains is also significant, driven by the growth in research and development activities in biotechnology and pharmaceuticals.

The Vietnam Industrial Microbiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Merck KGaA (MilliporeSigma), Thermo Fisher Scientific Inc., Sartorius AG, bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher Corporation (Cytiva & Pall), Eppendorf SE, Agilent Technologies, Inc., Lonza Group Ltd., Novozymes A/S, BASF SE, Evonik Industries AG, Masan Group Corporation (Masan Consumer & Masan MeatLife), Vinamilk (Vietnam Dairy Products Joint Stock Company), Vinh Hoan Corporation, BioNet-Asia Co., Ltd., Company for Vaccine and Biological Production No.1 (VABIOTECH) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam industrial microbiology market appears promising, driven by increasing investments in biotechnology and a shift towards sustainable practices. As the government enhances support for research initiatives, the integration of advanced technologies like AI in microbiology is expected to revolutionize product development. Additionally, the rising demand for probiotics and functional foods will likely create new avenues for growth, positioning Vietnam as a competitive player in the global microbiology landscape.

| Segment | Sub-Segments |

|---|---|

| By Microorganism Type | Bacteria Fungi Yeasts Viruses and Bacteriophages (industrial use) Algae and Cyanobacteria Others (protozoa, mixed consortia) |

| By Product Category | Equipment and Systems (bioreactors, fermenters, incubators, autoclaves) Culture Media and Reaction Consumables Laboratory Supplies (filtration, PPE, disposables) Microbial Strains and Starter Cultures Industrial Enzymes and Biocatalysts Others |

| By Industrial Application | Food and Beverage Processing (brewing, dairy, fermentation) Pharmaceuticals and Biopharmaceutical Production Agriculture and Animal Feed (biofertilizers, biopesticides, probiotics) Industrial Enzymes, Chemicals and Bio-based Materials Environmental and Wastewater Treatment (bioremediation, sludge treatment) Energy and Biofuels Others |

| By Test Type / Use Case | Sterility Testing Microbial Limits and Bioburden Testing Water and Environmental Testing Quality Assurance / Quality Control in Production Process Development and Optimization Others |

| By End-User Industry | Food and Beverage Manufacturers Pharmaceutical and Biotechnology Companies Agricultural Input and Animal Feed Producers Environmental Services and Waste Management Companies Industrial Chemical, Pulp & Paper, and Textile Manufacturers Contract Research and Testing Laboratories Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Facility Type | In?house Industrial Microbiology Laboratories Independent Contract Testing Laboratories Academic and Government Research Institutes Serving Industry Pilot-Scale and Demo Plants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Microbiology Applications | 75 | Quality Control Managers, Food Safety Officers |

| Pharmaceutical Manufacturing Processes | 65 | Production Supervisors, Regulatory Affairs Specialists |

| Agricultural Biotechnology Innovations | 55 | Research Scientists, Agronomists |

| Environmental Microbiology Solutions | 50 | Environmental Engineers, Sustainability Managers |

| Industrial Waste Treatment Technologies | 70 | Operations Managers, Waste Management Experts |

The Vietnam Industrial Microbiology Market is valued at approximately USD 220 million, reflecting a robust growth trajectory driven by increasing demand for biotechnological applications across sectors such as food and beverage, pharmaceuticals, and agriculture.