Region:Asia

Author(s):Geetanshi

Product Code:KRAD4055

Pages:91

Published On:December 2025

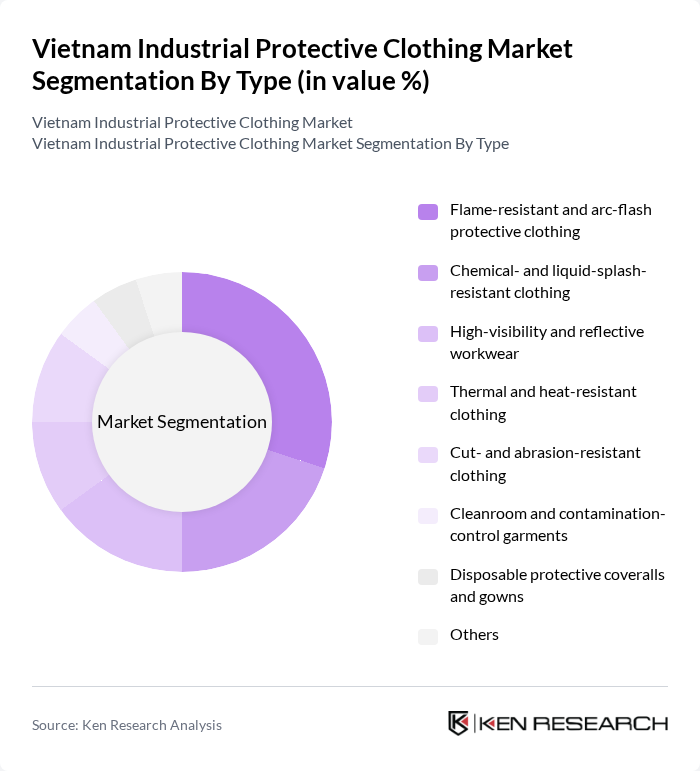

By Type:The market is segmented into various types of protective clothing, each designed to meet specific safety requirements. The subsegments include flame-resistant and arc-flash protective clothing, chemical- and liquid-splash-resistant clothing, high-visibility and reflective workwear, thermal and heat-resistant clothing, cut- and abrasion-resistant clothing, cleanroom and contamination-control garments, disposable protective coveralls and gowns, and others. Among these, flame-resistant and arc-flash protective clothing is currently the leading subsegment due to the increasing risks associated with electrical hazards in industries such as oil and gas, manufacturing, and construction.

By End-User:The end-user segmentation includes various industries that utilize protective clothing, such as manufacturing (electronics, automotive, general industry), construction and infrastructure, oil, gas, and petrochemicals, power, utilities, and mining, healthcare, pharmaceuticals, and laboratories, food processing and beverages, defense, firefighting, and public safety, and others. The manufacturing sector is the dominant end-user, driven by stringent safety regulations and the need to protect workers from potential hazards in production environments.

The Vietnam Industrial Protective Clothing Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Vietnam Co., Ltd., Honeywell Vietnam (Honeywell Safety Products), DuPont Vietnam LLC, Ansell Vietnam Co., Ltd., Lakeland Industries, Inc., Delta Plus Vietnam Co., Ltd., Uvex Safety Group (regional representation in Vietnam), Portwest Vietnam, Cintas Corporation (regional / multinational accounts), Protective Industrial Products (PIP) – Asia Pacific, Radians, Inc., Ergodyne, Khai Hoan JSC (local protective gloves and workwear manufacturer), B?o An Safety Equipment Co., Ltd., Nam Anh Protective Clothing Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam industrial protective clothing market is poised for significant transformation, driven by evolving safety regulations and increased awareness among workers. As the manufacturing and construction sectors continue to expand, the demand for high-quality protective gear will rise. Innovations in materials and technology will further enhance product offerings, while e-commerce platforms will facilitate broader access. By future, the market is expected to witness a shift towards sustainable practices, with eco-friendly materials becoming a focal point for manufacturers and consumers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Flame-resistant and arc-flash protective clothing Chemical- and liquid-splash-resistant clothing High-visibility and reflective workwear Thermal and heat-resistant clothing Cut- and abrasion-resistant clothing Cleanroom and contamination-control garments Disposable protective coveralls and gowns Others |

| By End-User | Manufacturing (electronics, automotive, general industry) Construction and infrastructure Oil, gas, and petrochemicals Power, utilities, and mining Healthcare, pharmaceuticals, and laboratories Food processing and beverages Defense, firefighting, and public safety Others |

| By Material | Cotton and cotton blends Polyester and poly-cotton blends Aramid fibers (e.g., Nomex, Kevlar) High-performance fibers (PBI, UHMWPE, etc.) Coated and laminated fabrics (PVC, PU, etc.) Nonwoven and disposable materials Others |

| By Distribution Channel | Direct B2B contracts and tenders Industrial distributors and dealers Specialized safety equipment stores Online B2B platforms and marketplaces Retail and other channels |

| By Region | Northern Vietnam (including Hanoi and surrounding industrial zones) Central Vietnam (industrial and port clusters) Southern Vietnam (including Ho Chi Minh City and key industrial parks) |

| By Application | Protection against thermal and flame hazards Protection against chemicals and hazardous liquids Protection against mechanical and cut hazards Biological and contamination protection High-visibility and traffic safety Multi-risk and integrated protection Others |

| By Policy Support | National occupational safety and health (OSH) regulations Industry-specific safety standards and guidelines Incentives for localization and manufacturing investment Public procurement and government-led safety programs Training and capacity-building initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector | 120 | Safety Managers, Production Supervisors |

| Construction Industry | 90 | Site Managers, Health and Safety Officers |

| Oil and Gas Sector | 60 | Procurement Specialists, Safety Engineers |

| Healthcare Facilities | 70 | Infection Control Managers, Procurement Officers |

| Logistics and Warehousing | 80 | Warehouse Managers, Safety Compliance Officers |

The Vietnam industrial protective clothing market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased workplace safety regulations and rising industrial activities across various sectors.