Region:Asia

Author(s):Rebecca

Product Code:KRAA9387

Pages:88

Published On:November 2025

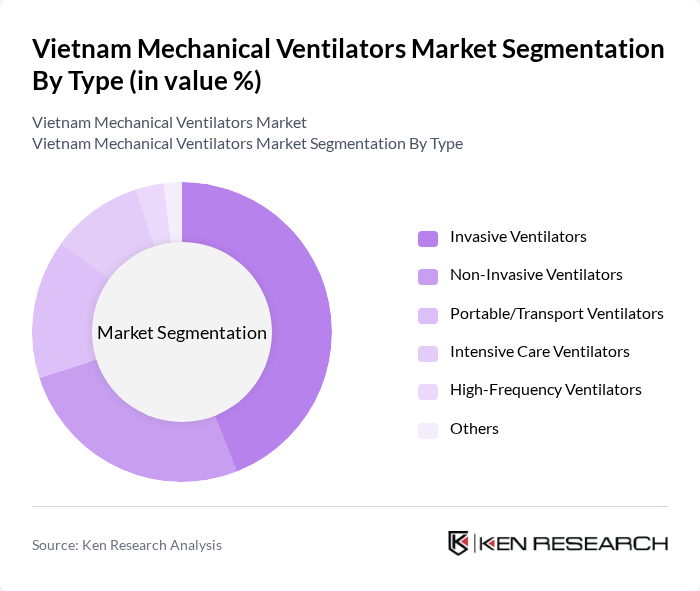

By Type:The market is segmented into various types of mechanical ventilators, including Invasive Ventilators, Non-Invasive Ventilators, Portable/Transport Ventilators, Intensive Care Ventilators, High-Frequency Ventilators, and Others. Among these, Invasive Ventilators are the most widely used due to their effectiveness in critical care settings, particularly for patients with severe respiratory failure. The demand for Non-Invasive Ventilators is also growing, driven by the increasing preference for less invasive treatment options and advancements in patient comfort and safety. The Portable/Transport Ventilators segment is gaining traction as well, especially in emergency medical services and home care scenarios, supported by the development of compact, battery-operated models .

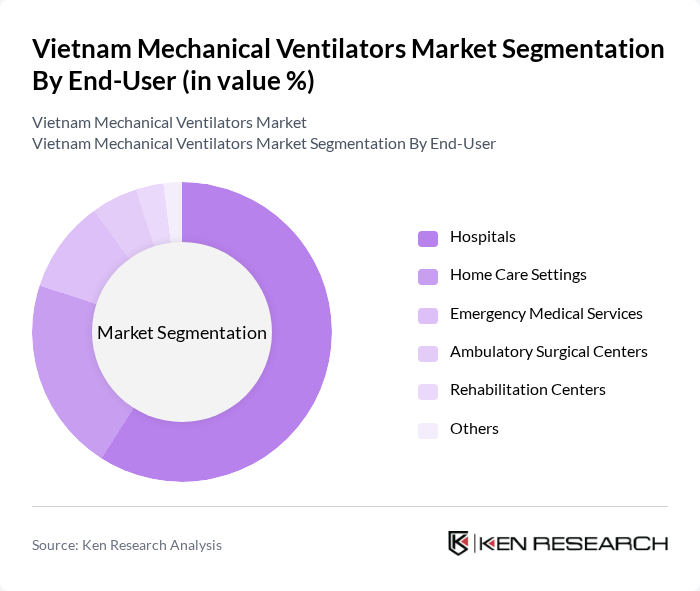

By End-User:The end-user segmentation includes Hospitals, Home Care Settings, Emergency Medical Services, Ambulatory Surgical Centers, Rehabilitation Centers, and Others. Hospitals are the primary end-users of mechanical ventilators, accounting for a significant share of the market due to their need for advanced respiratory support in critical care units. The Home Care Settings segment is also expanding as more patients prefer receiving care at home, leading to increased demand for portable and non-invasive ventilators. Emergency Medical Services are increasingly adopting transport ventilators for pre-hospital and inter-facility patient transfers, reflecting the broader trend toward mobile and decentralized respiratory care .

The Vietnam Mechanical Ventilators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Medtronic, GE Healthcare, Drägerwerk AG, ResMed, Hamilton Medical, Nihon Kohden Corporation, Smiths Medical, Vyaire Medical, Getinge Group, Mindray Medical International, Fisher & Paykel Healthcare, Air Liquide Medical Systems, Löwenstein Medical, Aeonmed Group contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam mechanical ventilators market is poised for significant transformation, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in ventilator technology is expected to enhance patient outcomes and operational efficiency. Additionally, the shift towards home healthcare solutions will likely expand the market, as more patients seek portable and user-friendly ventilators. These trends indicate a promising future for the industry, with a focus on improving accessibility and quality of care for respiratory patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Invasive Ventilators Non-Invasive Ventilators Portable/Transport Ventilators Intensive Care Ventilators High-Frequency Ventilators Others |

| By End-User | Hospitals Home Care Settings Emergency Medical Services Ambulatory Surgical Centers Rehabilitation Centers Others |

| By Application | Critical Care (ICU) Anesthesia Neonatal/Pediatric Care Emergency Care Pulmonary Diseases Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Technology | Mechanical Ventilation Bi-level Positive Airway Pressure (BiPAP) Continuous Positive Airway Pressure (CPAP) Advanced Mechanical Ventilators Others |

| By Patient Type | Adult Patients Pediatric Patients Neonatal/Infant Patients Geriatric Patients Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Medical Equipment Buyers |

| Respiratory Therapy Units | 70 | Respiratory Therapists, Clinical Managers |

| Home Care Providers | 50 | Home Care Coordinators, Patient Care Managers |

| Medical Device Distributors | 60 | Sales Representatives, Distribution Managers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Affairs Specialists |

The Vietnam Mechanical Ventilators Market is valued at approximately USD 140 million, driven by the increasing prevalence of respiratory diseases, a growing geriatric population, and the expansion of healthcare infrastructure, particularly highlighted during the COVID-19 pandemic.