Region:Middle East

Author(s):Rebecca

Product Code:KRAD2712

Pages:91

Published On:November 2025

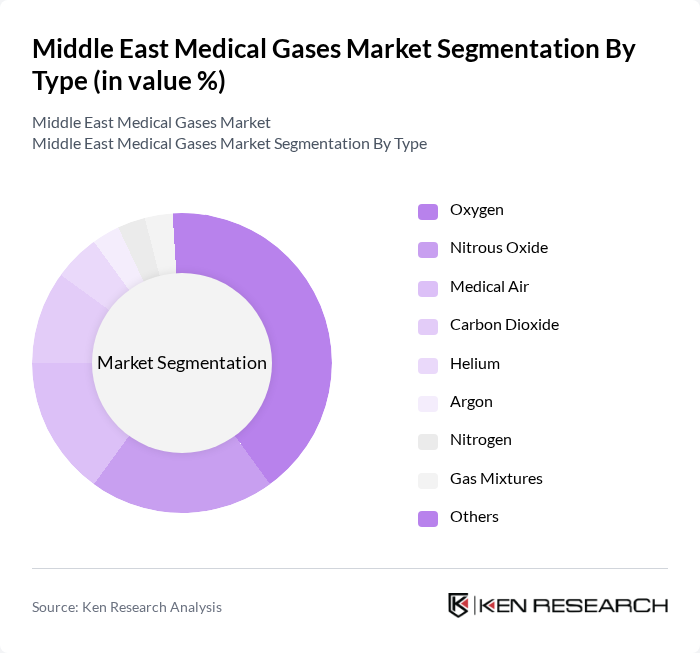

By Type:The market is segmented into various types of medical gases, including Oxygen, Nitrous Oxide, Medical Air, Carbon Dioxide, Helium, Argon, Nitrogen, Gas Mixtures (e.g., Heliox, Carbogen, Anaerobic/Aerobic Mixtures), and Others. Among these, Oxygen is the leading sub-segment due to its critical role in respiratory therapy and anesthesia. The increasing number of patients with respiratory diseases and the growing demand for oxygen therapy in home healthcare settings are driving this segment's growth. Nitrous Oxide and Medical Air also hold significant shares, primarily used in surgical procedures and anesthesia. The medical oxygen segment is projected to dominate the market with the largest share, reflecting its essential role in surgical procedures, respiratory illnesses, and emergency care .

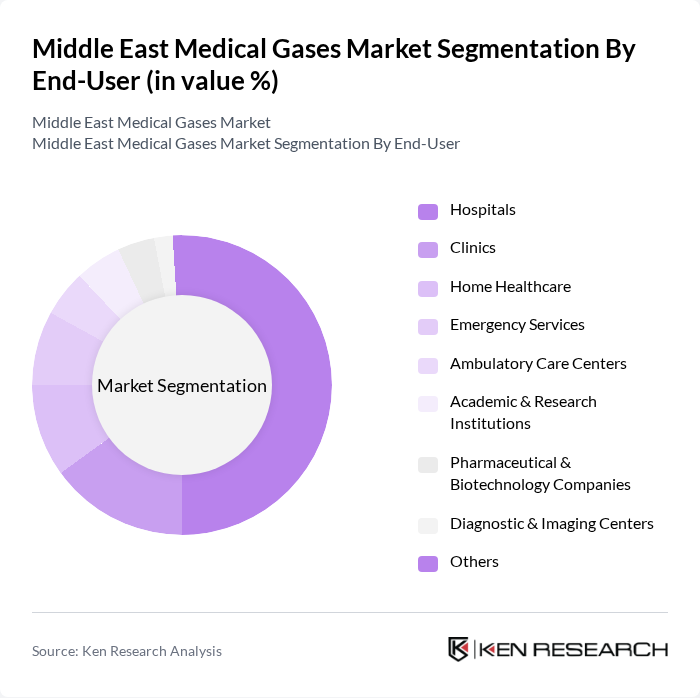

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Emergency Services, Ambulatory Care Centers, Academic & Research Institutions, Pharmaceutical & Biotechnology Companies, Diagnostic & Imaging Centers, and Others. Hospitals are the dominant end-user segment, driven by the high demand for medical gases in critical care units and surgical departments. The increasing number of hospitals and the expansion of healthcare facilities in the region are contributing to the growth of this segment. Home healthcare is also gaining traction, as more patients prefer receiving care in their homes, leading to a rise in the demand for portable medical gases. The hospital segment is projected to account for the largest share in the end-user segment, reflecting high patient footfall, surgical volume, and emergency care reliance .

The Middle East Medical Gases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Liquide, Linde Healthcare, Air Products and Chemicals, Inc., Gulf Cryo, National Gas Company (NGC Oman), Emirates Gas, Buzwair Industrial Gases Factories, Matheson Tri-Gas, Atlas Copco, African Oxygen Limited (Afrox), Messer Group, Praxair, Airgas, Universal Industrial Gases, Cryogenic Industries contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East medical gases market is poised for substantial growth, driven by increasing healthcare demands and technological advancements. As healthcare infrastructure expands, particularly in emerging markets, the adoption of innovative gas delivery systems will enhance operational efficiency. Additionally, the rising prevalence of chronic diseases will further fuel demand for medical gases. Stakeholders must navigate regulatory challenges while capitalizing on these trends to ensure sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Oxygen Nitrous Oxide Medical Air Carbon Dioxide Helium Argon Nitrogen Gas Mixtures (e.g., Heliox, Carbogen, Anaerobic/Aerobic Mixtures) Others |

| By End-User | Hospitals Clinics Home Healthcare Emergency Services Ambulatory Care Centers Academic & Research Institutions Pharmaceutical & Biotechnology Companies Diagnostic & Imaging Centers Others |

| By Application | Anesthesia Respiratory Therapy Surgical Procedures Diagnostic Procedures Pharmaceutical Manufacturing & Research Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Kuwait, Qatar, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Others |

| By Storage Type | Cylinders Bulk Storage Liquid Storage Others |

| By Regulatory Compliance | ISO Standards National Health Regulations Environmental Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Healthcare Facility Administrators | 70 | Facility Managers, Operations Directors |

| Medical Gas Suppliers | 50 | Sales Managers, Product Specialists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Healthcare Professionals | 90 | Doctors, Nurses, Anesthetists |

The Middle East Medical Gases Market is valued at approximately USD 1.44 billion, driven by the increasing prevalence of chronic diseases, healthcare infrastructure expansion, and rising demand for medical gases in therapeutic applications.