Region:Asia

Author(s):Shubham

Product Code:KRAB6625

Pages:91

Published On:October 2025

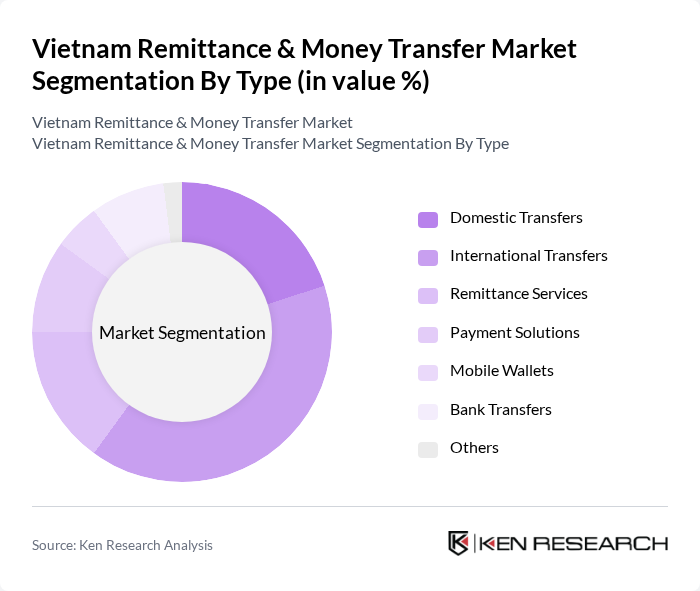

By Type:The market is segmented into various types, including Domestic Transfers, International Transfers, Remittance Services, Payment Solutions, Mobile Wallets, Bank Transfers, and Others. Among these, International Transfers are the most significant due to the high volume of remittances sent back home by Vietnamese workers abroad. The increasing reliance on digital platforms for these transactions has further propelled this segment's growth.

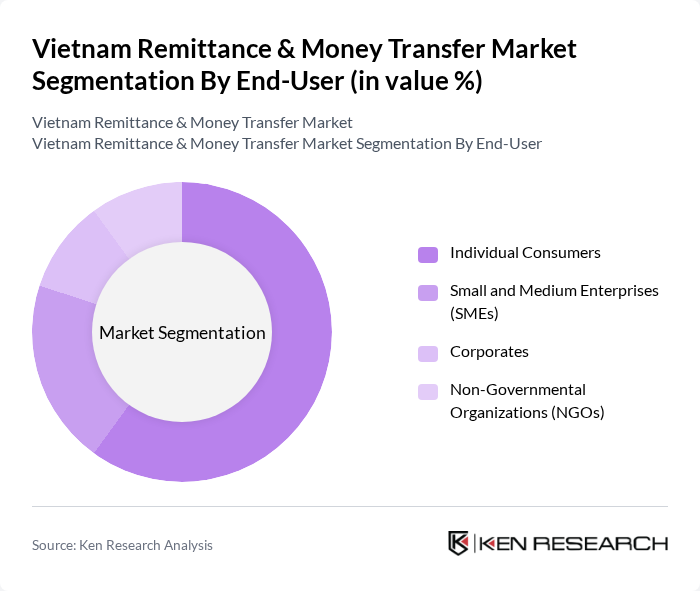

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Non-Governmental Organizations (NGOs). Individual Consumers dominate the market, driven by the need for personal remittances and financial support from family members working abroad. The increasing adoption of mobile wallets and online platforms has made it easier for individuals to send and receive money.

The Vietnam Remittance & Money Transfer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Viettel Money, MoMo, Payoo, Sacombank, Agribank, BIDV, TPBank, Vietcombank, ZaloPay, Remitly, TransferWise, WorldRemit, Xoom contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam remittance and money transfer market is poised for significant growth, driven by increasing digitalization and a focus on financial inclusion. As more Vietnamese workers seek employment abroad, remittance inflows are expected to rise, bolstered by technological advancements in payment systems. Additionally, government initiatives aimed at enhancing financial literacy will likely empower more individuals to utilize formal remittance channels. Overall, the market is set to evolve, with a strong emphasis on customer experience and innovative service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transfers International Transfers Remittance Services Payment Solutions Mobile Wallets Bank Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Non-Governmental Organizations (NGOs) |

| By Payment Method | Cash Payments Bank Transfers Mobile Payments Online Transfers |

| By Service Provider | Banks Non-Bank Financial Institutions Money Transfer Operators Digital Payment Platforms |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | One-Time Transfers Regular Transfers Occasional Transfers |

| By Geographic Reach | Urban Areas Rural Areas International Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vietnamese Expatriates in the US | 150 | Workers, Students, Family Members |

| Local Recipients of Remittances | 100 | Household Heads, Financial Managers |

| Money Transfer Service Providers | 80 | Operations Managers, Business Development Executives |

| Regulatory Authorities | 50 | Policy Makers, Compliance Officers |

| Financial Institutions Offering Remittance Services | 70 | Bank Managers, Financial Analysts |

The Vietnam Remittance & Money Transfer Market is valued at approximately USD 18 billion, driven by the increasing number of Vietnamese expatriates and the demand for efficient money transfer services, particularly through digital payment solutions.