Region:Middle East

Author(s):Dev

Product Code:KRAC1279

Pages:88

Published On:October 2025

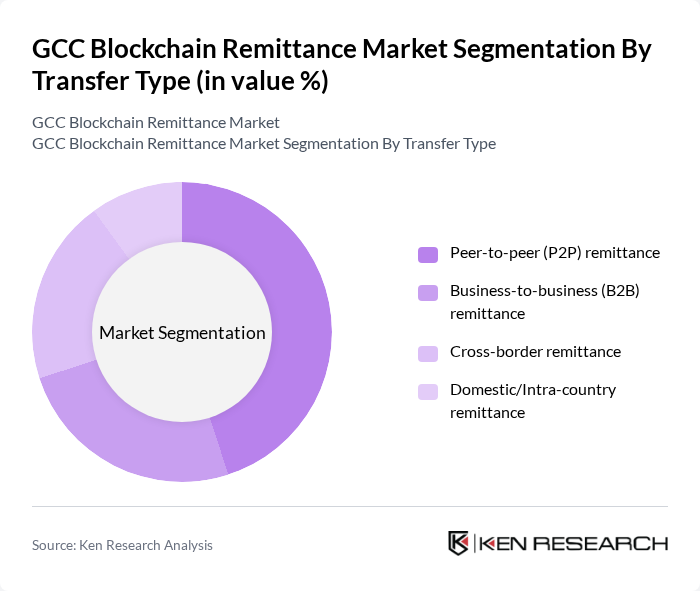

By Transfer Type:The transfer type segmentation includes various methods through which remittances are processed. The subsegments are Peer-to-peer (P2P) remittance, Business-to-business (B2B) remittance, Cross-border remittance, and Domestic/Intra-country remittance. Among these, the P2P remittance segment is currently leading the market due to the increasing number of individuals using blockchain technology for personal transactions. The convenience and lower fees associated with P2P transfers have made them a preferred choice for many users. Blockchain-powered P2P platforms now account for a growing share of remittance activity, with technological innovations such as smart contracts and mobile wallets further boosting adoption .

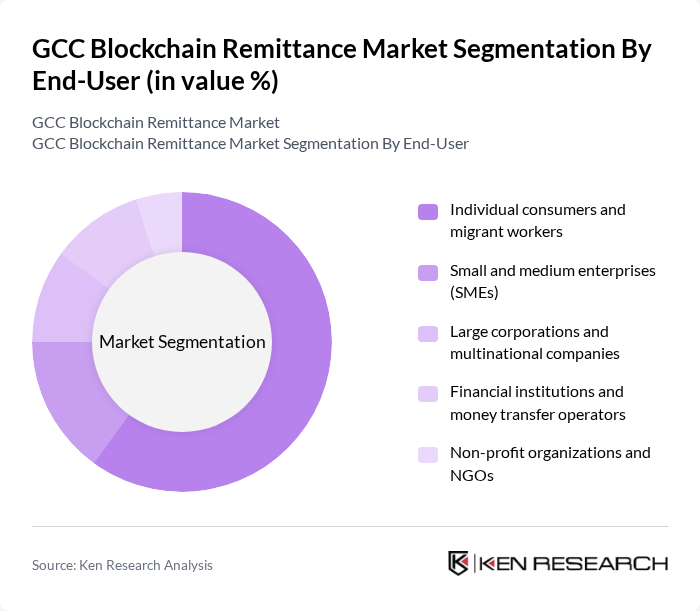

By End-User:The end-user segmentation encompasses various categories of users who utilize remittance services. This includes Individual consumers and migrant workers, Small and medium enterprises (SMEs), Large corporations and multinational companies, Financial institutions and money transfer operators, and Non-profit organizations and NGOs. The individual consumers and migrant workers segment is the most significant contributor to the market, driven by the high volume of remittances sent home by expatriates in the GCC region. The increasing use of mobile wallets and digital platforms among migrant workers is a key trend, supporting financial inclusion and ease of access .

The GCC Blockchain Remittance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ripple Labs Inc., Stellar Development Foundation, Emirates NBD, Qatar National Bank (QNB), Al Rajhi Bank, National Commercial Bank (NCB), Kuwait Finance House, BitOasis, Rain Financial, Binance, Paxful, LocalBitcoins, Circle Internet Financial Ltd., MoneyGram International Inc., Western Union Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC blockchain remittance market appears promising, driven by technological advancements and increasing digital literacy among users. As more individuals become familiar with blockchain's benefits, the adoption rate is expected to rise. Additionally, partnerships between blockchain companies and traditional financial institutions will likely enhance service offerings, making remittance processes more efficient. The focus on regulatory compliance will also foster a safer environment for users, encouraging further investment and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Transfer Type | Peer-to-peer (P2P) remittance Business-to-business (B2B) remittance Cross-border remittance Domestic/Intra-country remittance |

| By End-User | Individual consumers and migrant workers Small and medium enterprises (SMEs) Large corporations and multinational companies Financial institutions and money transfer operators Non-profit organizations and NGOs |

| By Technology/Platform Type | Public blockchain networks (Bitcoin, Ethereum) Private/permissioned blockchain Hybrid blockchain solutions Cryptocurrency-based platforms (Ripple, Stellar) Stablecoin payment systems |

| By Payment Method | Mobile wallet transfers Bank account transfers Cryptocurrency direct payments Cash pickup integration Multi-signature wallets |

| By Transaction Size | Micro-remittances (below USD 100) Small transactions (USD 100-500) Medium transactions (USD 500-2,000) Large transactions (above USD 2,000) |

| By Corridor/Geographic Route | GCC to South Asia (India, Pakistan, Bangladesh, Philippines) GCC to Africa (Egypt, Sudan, Ethiopia) GCC to Southeast Asia (Indonesia, Thailand, Vietnam) Intra-GCC transfers GCC to other regions (Europe, Americas) |

| By Application/Use Case | Personal remittances and family support Business payments and trade finance Investment and diaspora bonds Payroll and salary disbursements Emergency and humanitarian transfers |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Users | 120 | Expatriates, Frequent Senders |

| Fintech Executives | 60 | CEOs, Product Managers |

| Regulatory Authorities | 40 | Policy Makers, Compliance Officers |

| Blockchain Developers | 50 | Software Engineers, Project Leads |

| Remittance Service Providers | 45 | Operations Managers, Business Development Heads |

The GCC Blockchain Remittance Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of blockchain technology for remittance services, which offer lower transaction costs and faster processing times compared to traditional methods.