Vietnam Sports Equipment and Lifestyle Apparel Market Overview

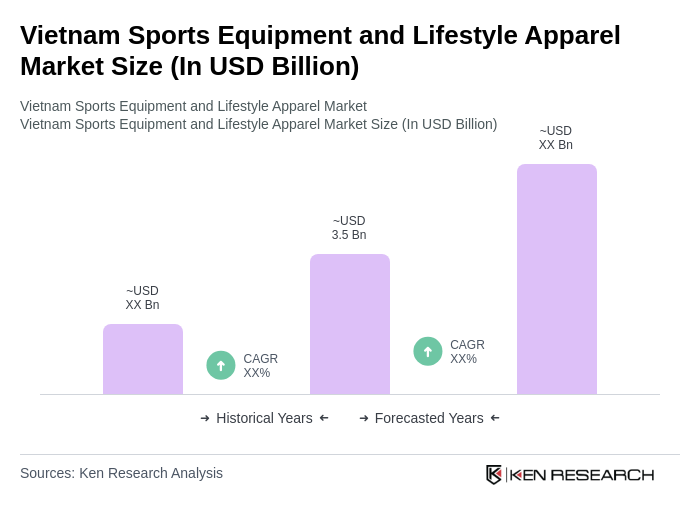

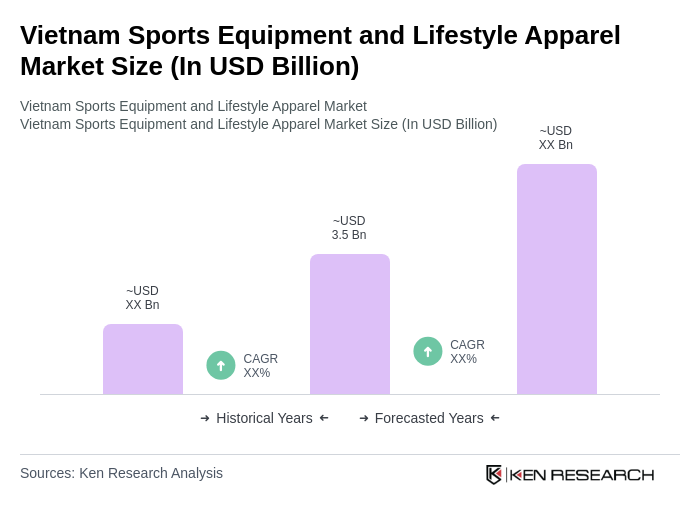

- The Vietnam Sports Equipment and Lifestyle Apparel Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in disposable income, and the growing popularity of sports and fitness activities. The market has seen a significant uptick in demand for both sports equipment and lifestyle apparel, reflecting a shift towards active living.

- Key cities such as Ho Chi Minh City and Hanoi dominate the market due to their large populations, urbanization, and economic development. These cities serve as major retail hubs, attracting both local and international brands, which enhances competition and variety for consumers. The concentration of fitness centers, sports events, and educational institutions in these urban areas further fuels market growth.

- In 2023, the Vietnamese government implemented a policy aimed at promoting sports and physical activities among the youth. This initiative includes funding for sports facilities and programs in schools, with an allocation of USD 200 million to enhance infrastructure and accessibility. The goal is to foster a culture of fitness and well-being, which is expected to positively impact the sports equipment and lifestyle apparel market.

Vietnam Sports Equipment and Lifestyle Apparel Market Segmentation

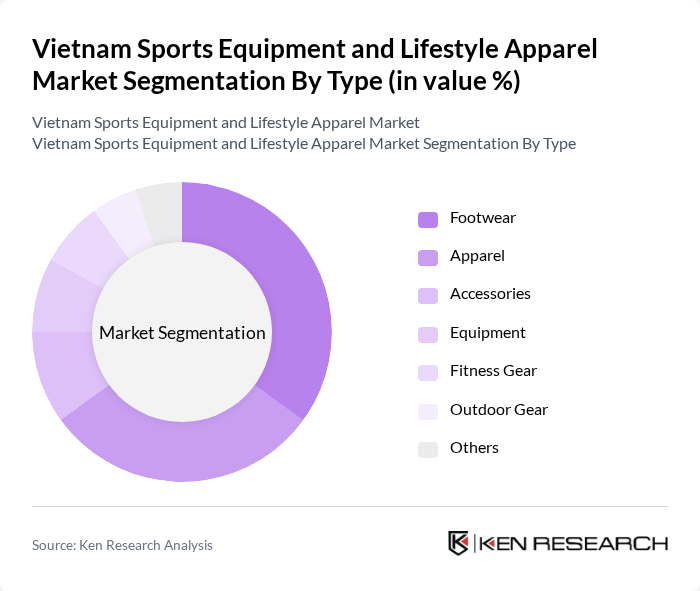

By Type:The market is segmented into various types, including Footwear, Apparel, Accessories, Equipment, Fitness Gear, Outdoor Gear, and Others. Among these, Footwear and Apparel are the leading segments, driven by consumer preferences for stylish and functional products. The increasing trend of athleisure has also contributed to the growth of Apparel, as consumers seek versatile clothing that can be worn for both sports and casual outings.

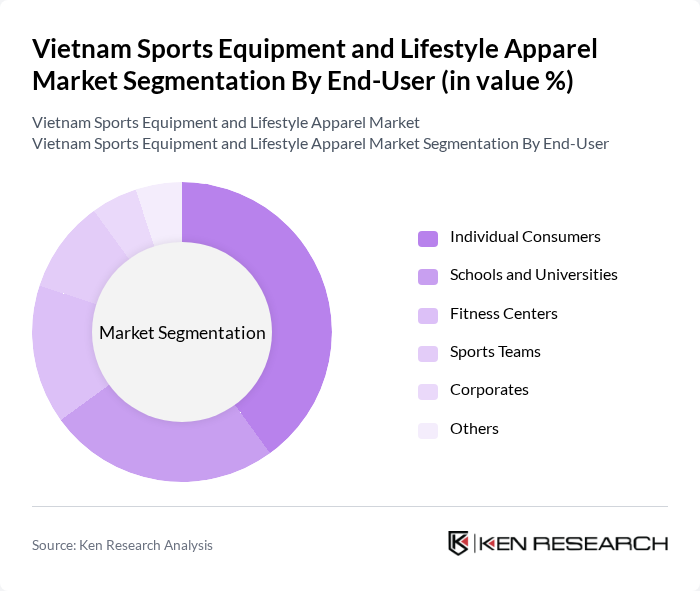

By End-User:The market is categorized into Individual Consumers, Schools and Universities, Fitness Centers, Sports Teams, Corporates, and Others. Individual Consumers represent the largest segment, driven by the increasing trend of personal fitness and wellness. Schools and Universities also contribute significantly, as educational institutions are increasingly investing in sports programs and facilities.

Vietnam Sports Equipment and Lifestyle Apparel Market Competitive Landscape

The Vietnam Sports Equipment and Lifestyle Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Li-Ning Company Limited, Decathlon S.A., The North Face, Inc., Columbia Sportswear Company, Skechers USA, Inc., New Balance Athletics, Inc., Asics Corporation, Mizuno Corporation, Anta Sports Products Limited, H&M Hennes & Mauritz AB, Lululemon Athletica Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Sports Equipment and Lifestyle Apparel Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Vietnamese population is increasingly prioritizing health, with 60% of adults engaging in regular physical activity as of now. This trend is supported by the government's health initiatives, which aim to reduce obesity rates, projected to reach 25% in the near future. The rise in health awareness is driving demand for sports equipment and lifestyle apparel, with the market expected to benefit from this growing consumer focus on fitness and well-being.

- Rising Disposable Income:Vietnam's GDP per capita is projected to reach approximately $4,800 in the near future, reflecting a significant increase in disposable income. This economic growth enables consumers to spend more on sports equipment and lifestyle apparel, with a 15% increase in spending on leisure activities noted in recent reports. As disposable income rises, consumers are more inclined to invest in quality sports products, further stimulating market growth.

- Growth of Fitness Culture:The fitness culture in Vietnam is rapidly evolving, with over 1,200 new gyms and fitness centers opening in urban areas in the near future. This expansion is indicative of a broader societal shift towards active lifestyles, with participation in sports and fitness activities increasing by 20% annually. As more individuals engage in fitness, the demand for specialized sports equipment and fashionable lifestyle apparel is expected to rise significantly.

Market Challenges

- Intense Competition:The sports equipment and lifestyle apparel market in Vietnam is characterized by intense competition, with over 200 brands vying for market share. Major international players dominate, making it challenging for local brands to establish a foothold. This competitive landscape pressures pricing strategies and marketing efforts, as companies must differentiate themselves to attract consumers in a crowded marketplace.

- Supply Chain Disruptions:The ongoing global supply chain disruptions have significantly impacted the availability of raw materials for sports equipment and apparel. In the near future, delays in shipping and increased freight costs are expected to rise by 30%, affecting production timelines and inventory levels. These disruptions hinder manufacturers' ability to meet consumer demand, potentially leading to lost sales and diminished market presence.

Vietnam Sports Equipment and Lifestyle Apparel Market Future Outlook

The Vietnam sports equipment and lifestyle apparel market is poised for continued growth, driven by increasing health consciousness and rising disposable incomes. As urbanization accelerates, more consumers are expected to engage in fitness activities, further boosting demand for innovative and stylish products. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and convenience in purchasing sports-related items.

Market Opportunities

- Emerging Sports Trends:The rise of niche sports, such as e-sports and adventure sports, presents significant opportunities for brands to develop specialized equipment and apparel. With an estimated 12 million participants in e-sports in the near future, targeting this demographic can lead to substantial market growth and brand loyalty.

- Sustainable Product Development:As consumers become more environmentally conscious, there is a growing demand for sustainable sports equipment and apparel. Companies that invest in eco-friendly materials and production processes can capture a significant share of the market, appealing to the 75% of consumers who prioritize sustainability in their purchasing decisions.