Region:Asia

Author(s):Shubham

Product Code:KRAC4322

Pages:100

Published On:October 2025

Technology Market.png)

By Frequency Band:

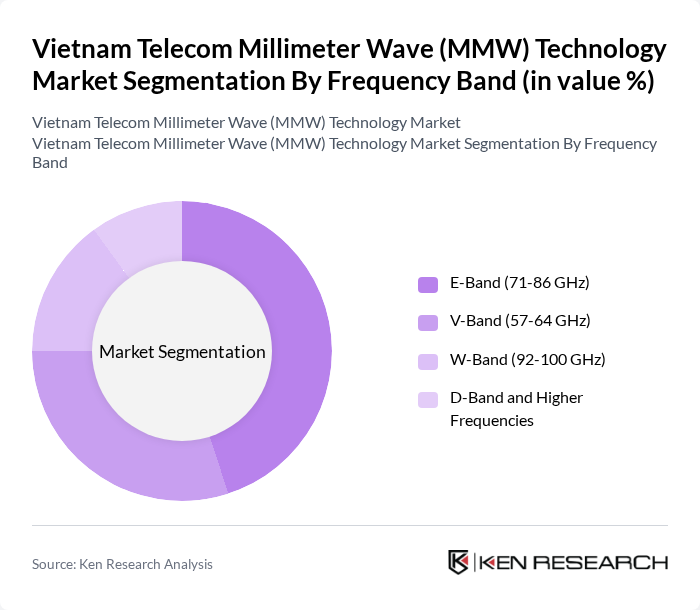

The frequency band segmentation of the Vietnam Telecom Millimeter Wave Technology Market includes E-Band (71-86 GHz), V-Band (57-64 GHz), W-Band (92-100 GHz), and D-Band and Higher Frequencies. Among these, the E-Band is currently dominating the market due to its high capacity and ability to support high-speed data transmission, which is essential for 5G applications. The increasing demand for bandwidth-intensive applications, such as video streaming and online gaming, has led to a surge in the adoption of E-Band technology. The V-Band is also gaining traction, particularly for fixed wireless access solutions, while the W-Band and D-Band are emerging as viable options for future applications.

By Application:

The application segmentation of the Vietnam Telecom Millimeter Wave Technology Market includes 5G Mobile Broadband, Fixed Wireless Access (FWA), Backhaul and Fronthaul, Smart Cities and IoT, Satellite Communication, and Autonomous Vehicles and Transportation. The 5G Mobile Broadband application is leading the market, driven by the increasing demand for high-speed internet and the need for low-latency communication. The rapid deployment of 5G networks across urban areas has significantly boosted the adoption of MMW technology for mobile broadband services. Fixed Wireless Access is also gaining popularity as an alternative to traditional wired connections, especially in rural areas where infrastructure is limited. Additionally, mmWave technology is increasingly being leveraged for augmented reality, virtual reality, and ultra-high-definition video streaming applications.

The Vietnam Telecom Millimeter Wave (MMW) Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group, Vietnam Posts and Telecommunications Group (VNPT), FPT Telecom, MobiFone, CMC Telecom, Saigon Cable Television (SCTV), HPT Vietnam, NetNam, Viettel Network, VTC Digital, Bkav Corporation, VinaPhone, Qualcomm Technologies Inc., Nokia Corporation, and Ericsson contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam Telecom MMW technology market appears promising, driven by ongoing investments in infrastructure and the government's commitment to digital transformation. As 5G networks expand, the demand for high-speed internet will continue to rise, creating opportunities for MMW technology adoption. Additionally, the increasing focus on smart city projects and IoT applications will further stimulate growth, positioning Vietnam as a regional leader in telecommunications innovation and technology deployment.

| Segment | Sub-Segments |

|---|---|

| By Frequency Band | E-Band (71-86 GHz) V-Band (57-64 GHz) W-Band (92-100 GHz) D-Band and Higher Frequencies |

| By Application | G Mobile Broadband Fixed Wireless Access (FWA) Backhaul and Fronthaul Smart Cities and IoT Satellite Communication Autonomous Vehicles and Transportation |

| By End-User | Telecommunications Operators Enterprises and Corporations Government and Defense Healthcare Providers Manufacturing and Industrial |

| By Component Type | Antennas and Transceivers RF Semiconductors and ICs Integrated Modules and Systems Network Infrastructure Equipment |

| By Licensing Model | Licensed Spectrum Unlicensed Spectrum |

| By Deployment Type | Urban Deployment Rural and Remote Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Infrastructure Providers | 50 | Network Engineers, Technical Directors |

| Mobile Network Operators | 40 | Operations Managers, Strategy Analysts |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Technology Vendors | 45 | Product Managers, Sales Directors |

| Research Institutions | 45 | Academic Researchers, Industry Analysts |

The Vietnam Telecom Millimeter Wave (MMW) Technology Market is valued at approximately USD 1.1 billion, driven by the increasing demand for high-speed internet and the expansion of 5G networks across the country.