Region:Asia

Author(s):Dev

Product Code:KRAD5186

Pages:90

Published On:December 2025

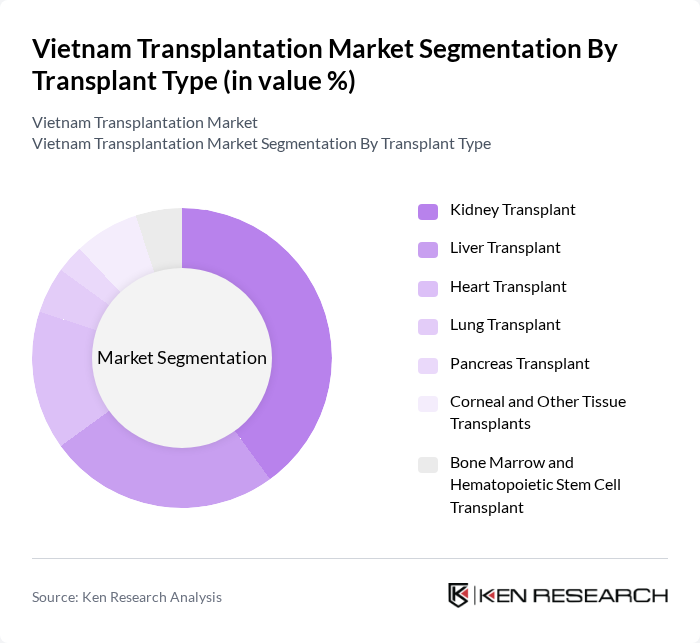

By Transplant Type:This segmentation includes various types of transplants, each catering to different medical needs. The subsegments are Kidney Transplant, Liver Transplant, Heart Transplant, Lung Transplant, Pancreas Transplant, Corneal and Other Tissue Transplants, and Bone Marrow and Hematopoietic Stem Cell Transplant. Among these, the Kidney Transplant segment is the most prominent, reflecting the high prevalence of chronic kidney disease and end-stage renal disease and the large number of patients on long-term dialysis. Vietnam performs over 1,000 organ transplants annually, with kidney procedures accounting for the largest share, while liver, heart, and lung transplants are also performed at major centers. The growing awareness of organ and tissue donation, continuous improvements in surgical techniques, anesthesiology, and perioperative care, and the expansion of transplant programs beyond Hanoi and Ho Chi Minh City have all contributed to the rise in kidney and liver transplants as well as corneal and hematopoietic stem cell procedures.

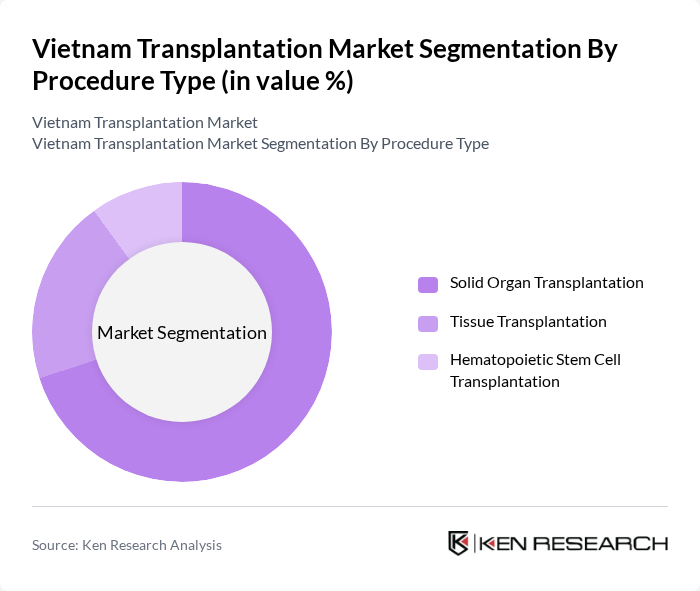

By Procedure Type:This segmentation includes Solid Organ Transplantation, Tissue Transplantation, and Hematopoietic Stem Cell Transplantation. Solid Organ Transplantation is the leading procedure type, driven by the high demand for kidney and liver transplants as the country has mastered complex organ transplant techniques and built a nationwide transplant network across more than 20 hospitals. The increasing incidence of organ failure due to diabetes, hypertension, hepatitis, and cardiopulmonary diseases, together with earlier diagnosis and better referral pathways, are significant factors contributing to the growth of this segment. Tissue Transplantation is also gaining traction, particularly corneal grafts and other tissue procedures, supported by growing public registration for post-mortem donation and the establishment of hospital-based advocacy and coordination units. Hematopoietic stem cell transplantation is expanding gradually at major oncology and hematology centers as indications broaden and supportive care capacity improves.

The Vietnam Transplantation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viet Duc University Hospital (Hanoi), Cho Ray Hospital (Ho Chi Minh City), Bach Mai Hospital (Hanoi), 108 Military Central Hospital (Hanoi), 103 Military Hospital – Vietnam Military Medical University, Hue Central Hospital, University Medical Center Ho Chi Minh City, Vinmec Healthcare System, FV Hospital (Ho Chi Minh City), An Sinh Hospital (Ho Chi Minh City), Tam Duc Heart Hospital (Ho Chi Minh City), Binh Dan Hospital (Ho Chi Minh City), Ho Chi Minh City University of Medicine and Pharmacy Hospital, Hanoi Medical University Hospital, Can Tho Central General Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam transplantation market appears promising, driven by ongoing advancements in medical technology and increasing public awareness. As the government continues to invest in healthcare infrastructure, the number of transplant centers is expected to rise, improving access to services. Additionally, the integration of telemedicine for post-operative care is likely to enhance patient management, while AI-driven donor-recipient matching systems may streamline the transplantation process, ultimately improving outcomes and patient satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Transplant Type | Kidney Transplant Liver Transplant Heart Transplant Lung Transplant Pancreas Transplant Corneal and Other Tissue Transplants Bone Marrow and Hematopoietic Stem Cell Transplant |

| By Procedure Type | Solid Organ Transplantation Tissue Transplantation Hematopoietic Stem Cell Transplantation |

| By Donor Type | Living Donor Deceased (Cadaveric) Donor Expanded Criteria Donor / High-Risk Donor |

| By End-User | Tertiary Public Hospitals University and Military Hospitals Private Multispecialty Hospitals Specialized Transplant Centers |

| By Payer / Funding Source | National Health Insurance (Health Insurance Fund) Other Government & Social Security Schemes Private Health Insurance Out-of-Pocket Payments International Aid, Charity & NGO Funding |

| By Geography | Northern Vietnam (incl. Hanoi) Central Vietnam (incl. Hue and Da Nang) Southern Vietnam (incl. Ho Chi Minh City) Key Urban Transplant Hubs vs. Provincial Hospitals |

| By Stage of Transplant Care | Pre-Transplant Evaluation and Work-Up Transplant Surgery Immediate Post-Operative Care (Inpatient) Long-Term Post-Transplant Follow-Up & Immunosuppression Management |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organ Procurement Organizations | 45 | Procurement Coordinators, Medical Directors |

| Transplant Centers | 40 | Surgeons, Transplant Nurses |

| Patient Experience Surveys | 150 | Transplant Recipients, Family Members |

| Healthcare Policy Experts | 40 | Health Economists, Policy Advisors |

| Public Awareness Campaigns | 45 | NGO Representatives, Community Health Workers |

The Vietnam Transplantation Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increased healthcare investments, awareness of organ donation, and advancements in transplant technologies.