Region:Africa

Author(s):Geetanshi

Product Code:KRAA1970

Pages:83

Published On:August 2025

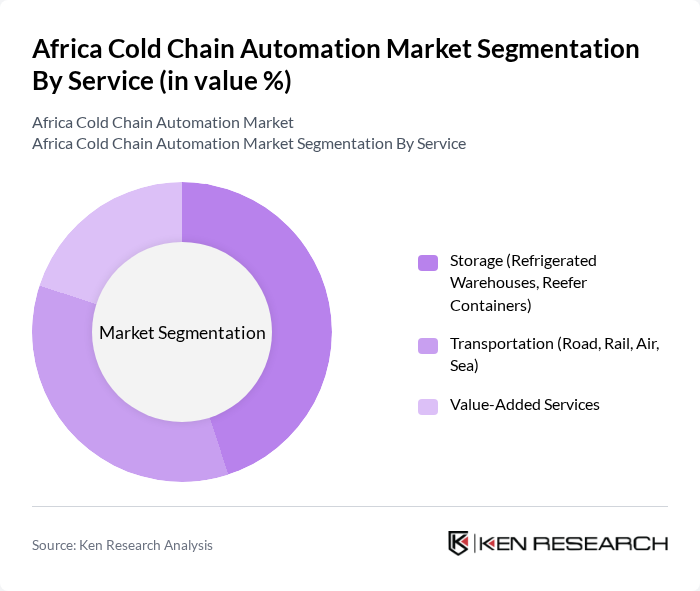

By Service:The service segment includes various sub-segments such as Storage (Refrigerated Warehouses, Reefer Containers), Transportation (Road, Rail, Air, Sea), and Value-Added Services. Thestoragesub-segment is currently leading the market due to the increasing need for efficient storage solutions that can maintain the quality of perishable goods. The rise in e-commerce and online grocery shopping has further fueled the demand for refrigerated warehouses and reefer containers, making them essential for businesses aiming to reduce spoilage and enhance customer satisfaction. Automation and real-time monitoring technologies are increasingly integrated into storage solutions to improve efficiency and traceability .

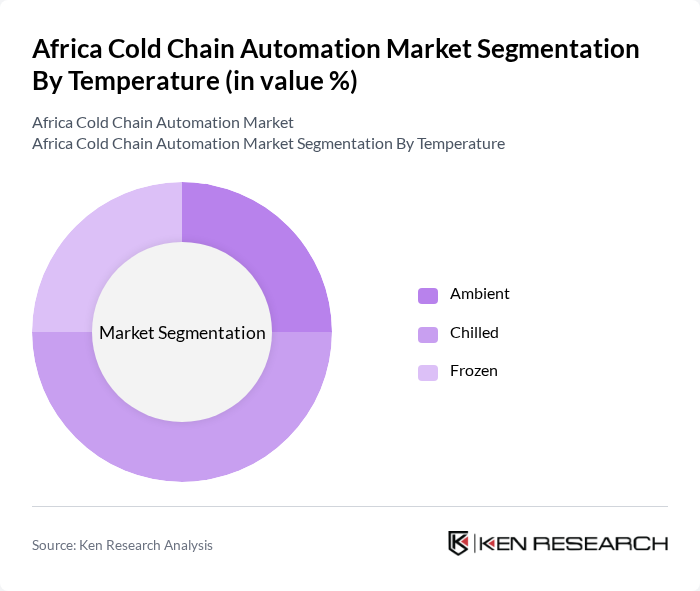

By Temperature:The temperature segment encompasses Ambient, Chilled, and Frozen categories. Thechilledsub-segment is currently dominating the market, driven by the increasing consumption of fresh produce and dairy products. As consumers become more health-conscious, the demand for chilled storage and transportation solutions has surged, leading to a significant rise in investments in cold chain infrastructure to meet these needs. The adoption of IoT-enabled temperature monitoring and automation is further enhancing the reliability of chilled logistics .

The Africa Cold Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as CCS Logistics, Imperial Logistics, DHL Supply Chain, Kuehne + Nagel, UPS Supply Chain Solutions, Nippon Express, United Cold Storage, Transcold Logistics, Cold Storage Solutions Kenya, Freshmark (Shoprite Group), Barloworld Logistics, Bolloré Logistics, Yamato Transport Co., Ltd., Cold Solutions East Africa, and Cold Chain Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain automation market in Africa appears promising, driven by technological advancements and increasing consumer awareness of food safety. As automation technologies become more affordable and accessible, businesses are likely to invest in these solutions to enhance efficiency. Additionally, the growing emphasis on sustainability will encourage the adoption of eco-friendly practices within the cold chain, further supporting market growth. Collaborative efforts between governments and private sectors will also play a crucial role in overcoming existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Service | Storage (Refrigerated Warehouses, Reefer Containers) Transportation (Road, Rail, Air, Sea) Value-Added Services |

| By Temperature | Ambient Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meats and Fish Processed Food Products Pharma, Life Sciences, and Chemicals Other Applications |

| By Geography | Nigeria South Africa Egypt Kenya Ethiopia Morocco Ghana Algeria Tanzania Ivory Coast |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 120 | Supply Chain Managers, Quality Assurance Managers |

| Pharmaceutical Cold Chain Management | 90 | Logistics Managers, Compliance Officers |

| Agricultural Produce Distribution | 100 | Farmers, Export Managers |

| Retail Cold Storage Solutions | 60 | Operations Managers, Store Managers |

| Technology Providers in Cold Chain | 50 | Product Managers, Sales Managers |

The Africa Cold Chain Automation Market is valued at approximately USD 11.8 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, as well as the need for efficient supply chain solutions to minimize spoilage and waste.