Region:Asia

Author(s):Geetanshi

Product Code:KRAA2002

Pages:85

Published On:August 2025

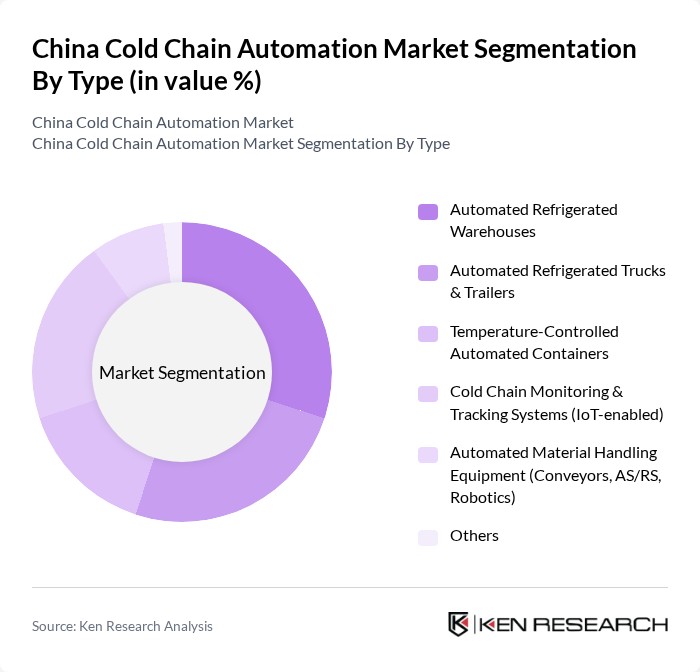

By Type:The segmentation by type covers the full spectrum of cold chain automation solutions. Primary subsegments include Automated Refrigerated Warehouses, Automated Refrigerated Trucks & Trailers, Temperature-Controlled Automated Containers, Cold Chain Monitoring & Tracking Systems (IoT-enabled), Automated Material Handling Equipment (such as conveyors, AS/RS, and robotics), and Others. Each subsegment is essential for improving operational efficiency, reducing manual intervention, and ensuring product integrity throughout the supply chain .

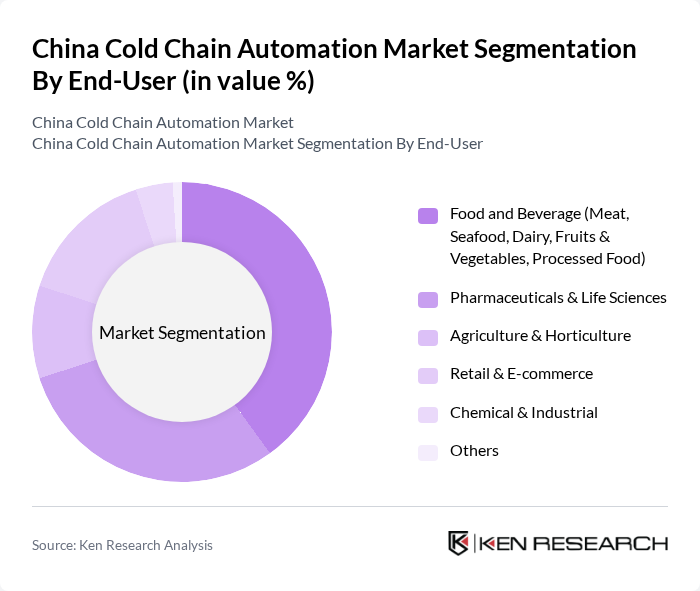

By End-User:The end-user segmentation reflects the diverse industries utilizing cold chain automation. The main subsegments are Food and Beverage (including meat, seafood, dairy, fruits & vegetables, and processed food), Pharmaceuticals & Life Sciences, Agriculture & Horticulture, Retail & E-commerce, Chemical & Industrial, and Others. Each sector has distinct requirements for temperature control, traceability, and logistics, driving demand for specialized cold chain solutions .

The China Cold Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haier Biomedical, JD Logistics, Alibaba Group, ZTO Express, SF Express, YTO Express, Sinotrans Limited, China National Pharmaceutical Group (Sinopharm), Newland E-Commerce Technology, Beijing Shunxin Agriculture, China Cold Chain Logistics Co., Ltd., Xiamen Xiangyu Co., Ltd., Shanghai Jiahua Cold Chain Co., Ltd., Shenzhen Huitong Logistics Co., Ltd., Beijing Huayuan Cold Chain Logistics Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China cold chain automation market appears promising, driven by increasing investments in technology and infrastructure. As consumer demand for fresh and safe food continues to rise, companies are expected to adopt more sophisticated automation solutions. Additionally, the integration of IoT and AI technologies will enhance operational efficiencies and real-time monitoring capabilities. These advancements will likely lead to improved supply chain transparency and reduced food waste, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Refrigerated Warehouses Automated Refrigerated Trucks & Trailers Temperature-Controlled Automated Containers Cold Chain Monitoring & Tracking Systems (IoT-enabled) Automated Material Handling Equipment (Conveyors, AS/RS, Robotics) Others |

| By End-User | Food and Beverage (Meat, Seafood, Dairy, Fruits & Vegetables, Processed Food) Pharmaceuticals & Life Sciences Agriculture & Horticulture Retail & E-commerce Chemical & Industrial Others |

| By Distribution Mode | Direct Distribution (Manufacturer to End-User) Third-Party Logistics (3PL) Providers E-commerce Fulfillment Platforms Others |

| By Application | Food Storage & Processing Pharmaceutical Storage & Distribution Retail Display & Last-Mile Delivery Agricultural Produce Handling Others |

| By Component | Automated Refrigeration Equipment IoT & Sensor Devices Warehouse Automation Software Automated Material Handling Systems Others |

| By Sales Channel | Direct Sales Distributors/Dealers Online Platforms Others |

| By Policy Support | Government Subsidies Tax Incentives Grants & Special Funds Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Storage | 60 | Logistics Coordinators, Compliance Officers |

| Retail Cold Chain Operations | 50 | Operations Managers, Inventory Control Specialists |

| Technology Providers in Cold Chain | 40 | Product Managers, Business Development Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The China Cold Chain Automation Market is valued at approximately USD 20 billion, driven by the increasing demand for temperature-sensitive products in sectors such as food, pharmaceuticals, and biotechnology, along with advancements in logistics and technology.