Region:Africa

Author(s):Geetanshi

Product Code:KRAA0253

Pages:88

Published On:August 2025

By Service Type:The service type segmentation includes various subsegments such as Cold Storage/Warehousing Facilities, Refrigerated Transportation, and Value-Added Services (e.g., packaging, labeling, inventory management). Among these, Cold Storage/Warehousing Facilities dominate the market due to the increasing need for efficient storage solutions for perishable goods. The rise in e-commerce, the demand for fresh produce, and the expansion of the horticulture and dairy sectors have led to significant investments in cold storage infrastructure, making it a critical component of the cold chain .

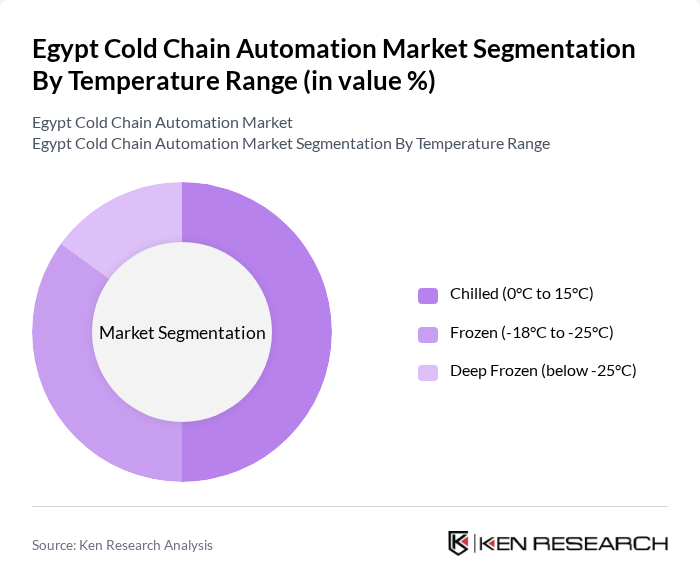

By Temperature Range:The temperature range segmentation includes Chilled (0°C to 15°C), Frozen (-18°C to -25°C), and Deep Frozen (below -25°C). The Chilled segment is currently leading the market, driven by the high demand for fresh fruits, vegetables, and dairy products. As consumer preferences shift towards healthier options, the need for chilled storage solutions has surged, making it a vital area of focus for cold chain operators .

The Egypt Cold Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logistica, Arab Company for Food Industries and Cooling (ACFIC), Custom Storage Company (CSC), Green Line Logistics, Multi Fruit Egypt, Cairo Cool, EgyCold, Fresh Cold Stores, Delta Logistics, Misr Refrigeration and Air Conditioning Company, United Group for Cold Stores, El Sewedy Logistics, Nile Cold Chain Solutions, Transmar, Medtrans contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Egypt cold chain automation market appears promising, driven by technological advancements and increasing consumer awareness regarding food safety. As the government continues to invest in infrastructure and regulatory frameworks, businesses are likely to adopt innovative solutions such as IoT and AI to enhance operational efficiency. Additionally, the growing trend of sustainability will push companies to implement energy-efficient practices, further transforming the cold chain landscape in Egypt in future.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Cold Storage/Warehousing Facilities Refrigerated Transportation Value-Added Services (e.g., packaging, labeling, inventory management) |

| By Temperature Range | Chilled (0°C to 15°C) Frozen (-18°C to -25°C) Deep Frozen (below -25°C) |

| By Application | Fruits and Vegetables Dairy Products and Frozen Desserts Pharmaceuticals and Life Sciences Processed Foods Meat, Fish, and Seafood |

| By Technology | Automated Storage and Retrieval Systems (AS/RS) IoT-Enabled Monitoring and Tracking Advanced Refrigeration Technologies (e.g., blast freezing) Data Analytics and Supply Chain Optimization Blockchain for Supply Chain Transparency |

| By End-User Industry | Food and Beverage Pharmaceuticals Agriculture Retail Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Companies | 60 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Providers | 50 | Operations Directors, Quality Assurance Managers |

| Retail Cold Storage Facilities | 40 | Warehouse Supervisors, Inventory Managers |

| Transport Logistics Firms | 50 | Fleet Managers, Compliance Officers |

| Technology Providers for Cold Chain Solutions | 40 | Product Managers, Business Development Executives |

The Egypt Cold Chain Automation Market is valued at approximately USD 495 million, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the expansion of e-commerce.