Region:Asia

Author(s):Shubham

Product Code:KRAA0775

Pages:100

Published On:August 2025

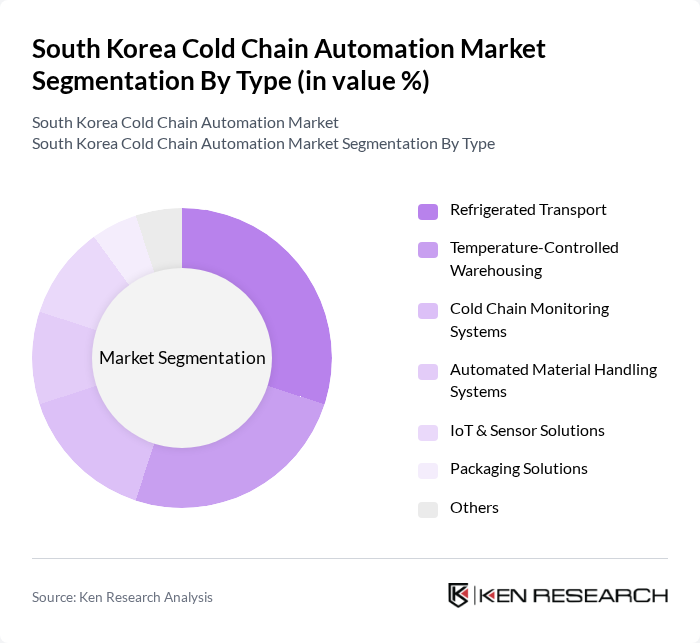

By Type:The market is segmented into Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Systems, Automated Material Handling Systems, IoT & Sensor Solutions, Packaging Solutions, and Others. Each of these segments plays a crucial role in ensuring the integrity, traceability, and efficiency of the cold chain process. Refrigerated transport and temperature-controlled warehousing are particularly critical due to the rapid rise in e-commerce grocery and pharmaceutical distribution, while cold chain monitoring systems and IoT solutions are increasingly adopted for real-time temperature tracking and compliance .

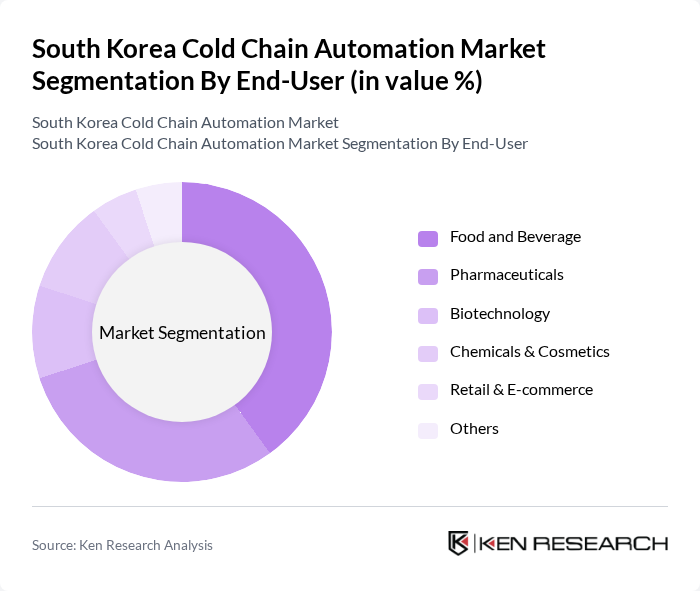

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Biotechnology, Chemicals & Cosmetics, Retail & E-commerce, and Others. Each sector has unique requirements for cold chain solutions, influencing the demand for specific automation technologies. Food and beverage lead due to the surge in fresh and frozen food consumption, while pharmaceuticals and biotechnology are rapidly growing segments driven by the need for temperature-sensitive drug and vaccine logistics .

The South Korea Cold Chain Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Lotte Global Logistics, Hyundai Glovis, Korea Cold Chain System (KCCS), Dongbu Express, S.Logistics, Samsung C&T Corporation, Hanon Systems, GS Global, DB Schenker Korea, Kuehne + Nagel Korea, Nippon Express Korea, Daewoo Logistics, Hanjin Transportation, and DSV Panalpina Korea contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea cold chain automation market is poised for significant transformation, driven by technological advancements and increasing consumer expectations. The integration of artificial intelligence and IoT technologies is expected to enhance real-time monitoring and predictive analytics, improving supply chain efficiency. Additionally, sustainability initiatives will likely shape future investments, as companies seek to reduce their carbon footprint. As the market evolves, collaboration among stakeholders will be crucial to overcoming existing challenges and capitalizing on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Systems Automated Material Handling Systems IoT & Sensor Solutions Packaging Solutions Others |

| By End-User | Food and Beverage (including meal kits, seafood, processed foods) Pharmaceuticals (including vaccines, biologics, clinical trial logistics) Biotechnology Chemicals & Cosmetics Retail & E-commerce Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Fulfillment Platforms Others |

| By Component | Refrigeration Equipment Monitoring Devices & Data Loggers Warehouse Automation Systems (conveyors, AS/RS, robotics) Software Solutions (WMS, TMS, IoT platforms) Others |

| By Application | Food Storage Pharmaceutical Storage & Distribution Transportation Inventory Management Others |

| By Sales Channel | Online Sales Offline Sales Distributors Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Operations Directors |

| Pharmaceutical Cold Storage | 80 | Logistics Coordinators, Quality Assurance Managers |

| Retail Cold Chain Solutions | 60 | Retail Operations Managers, Procurement Specialists |

| Technology Providers in Cold Chain | 50 | Product Development Managers, Sales Executives |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The South Korea Cold Chain Automation Market is valued at approximately USD 3.6 billion, reflecting significant growth driven by the demand for efficient logistics solutions in the food and pharmaceutical sectors.